DEF 14A: Definitive proxy statements

Published on May 18, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

RH

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

RH

15 Koch Road, Suite K

Corte Madera, CA 94925

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

to be held on:

June 27, 2017

10:30 a.m. Pacific Time

Dear Stockholder:

You are cordially invited to attend our 2017 Annual Meeting of Stockholders, which will be held at 10:30 a.m. (Pacific Time) on June 27, 2017, at the Companys headquarters located at 15 Koch Road, Corte Madera, CA 94925.

We are holding the Annual Meeting for the following purposes, which are more fully described in the proxy statement:

| 1. | To elect the three nominees named in the proxy statement to our board of directors; |

| 2. | To vote, on an advisory basis, on our named executive officer compensation; |

| 3. | To re-approve our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Internal Revenue Code of 1986, as amended (the Code); |

| 4. | To approve our Cash Incentive Bonus Plan for purposes of Section 162(m)(4)(C) of the Code; |

| 5. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending February 3, 2018; and |

| 6. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Only stockholders of record as of the close of business on April 28, 2017 are entitled to notice and to vote at the Annual Meeting or any postponement or adjournment thereof. A list of stockholders entitled to vote will be available for inspection at our offices for ten days prior to the Annual Meeting. If you would like to view this stockholder list, please contact Investor Relations at (415) 945-4998.

Each share of stock that you own represents one vote, and your vote as a stockholder of RH is very important. For questions regarding your stock ownership, you may contact Investor Relations at (415) 945-4998 or, if you are a registered holder, our transfer agent, Computershare Investor Services, by email through their website at www.computershare.com/contactus or by phone at (800) 962-4284 (within the U.S. and Canada) or (781) 575-3120 (outside the U.S. and Canada).

The Board of Directors has approved the proposals described in the accompanying proxy statement and recommends that you vote FOR the election of all nominees for director in Proposal 1, FOR the approval of compensation of our named executive officers in Proposal 2, FOR the re-approval of our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code in Proposal 3, FOR the approval of our Cash Incentive Bonus Plan for purposes of Section 162(m)(4)(C) of the Code in Proposal 4 and FOR the ratification of the appointment of PricewaterhouseCoopers LLP in Proposal 5.

BY ORDER OF THE BOARD OF DIRECTORS

Gary Friedman

Chairman and Chief Executive Officer

Corte Madera, California

May 18, 2017

YOUR VOTE IS IMPORTANT

Instructions for submitting your proxy are provided in the Notice of Internet Availability of Proxy Materials, the Proxy Statement and your proxy card. It is important that your shares be represented and voted at the Annual Meeting. Please submit your proxy through the Internet, by telephone, or by completing the enclosed proxy card and returning it in the enclosed envelope. You may revoke your proxy at any time prior to its exercise at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholder Meeting to be Held on June 27, 2017:

| The Companys 2017 Notice and Proxy Statement, its fiscal 2016 Annual Report on Form 10-K and its proxy card are available for review online at www.proxyvote.com |

RH

2017 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

Information about Solicitation and Voting

The accompanying proxy is solicited on behalf of the board of directors of RH (the Company) for use at the Companys 2017 Annual Meeting of Stockholders (the Annual Meeting) to be held at the Companys headquarters located at 15 Koch Road, Corte Madera, CA 94925 on June 27, 2017, at 10:30 a.m. (Pacific Time), and any adjournment or postponement thereof.

On or about May 18, 2017, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2017 Notice and Proxy Statement and our fiscal 2016 Annual Report on Form 10-K (the 2016 Annual Report) via the Internet and vote online. The Notice of Internet Availability of Proxy Materials also contains instructions on how you can receive a paper copy of the proxy materials. Our 2016 Annual Report, Notice of Internet Availability of Proxy Materials and our proxy card are first being made available online on or about May 18, 2017.

About the Annual Meeting

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will vote upon the five proposals described in this proxy statement.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission, or the SEC, instead of mailing a printed copy of our proxy materials to all stockholders entitled to vote at the Annual Meeting, we are furnishing the proxy materials to our stockholders over the Internet. Accordingly, on or about May 18, 2017, the Company will mail a Notice of Internet Availability of Proxy Materials (the Notice) to the Companys stockholders, other than those who previously requested electronic or paper delivery. If you received a Notice by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice will instruct you as to how you may access and review the proxy materials and submit your vote on the Internet or by telephone. If you received a Notice by mail and would like to receive a printed copy of the proxy materials, please follow the instructions for requesting such materials included in the Notice. On the date of mailing of the Notice, all stockholders will have the ability to access all of our proxy materials on a website referred to in the Notice. These proxy materials will be available free of charge. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the cost of the physical printing and mailing of materials.

What proposals are scheduled to be voted on at the Annual Meeting?

Stockholders will be asked to vote on five proposals. The proposals are:

| 1. | The election to our board of directors of the three nominees named in this proxy statement; |

| 2. | An advisory vote on our named executive officer compensation; |

| 3. | Re-approval of our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code; |

| 4. | Approval of our Cash Incentive Bonus Plan for purposes of Section 162(m)(4)(C) of the Code; and |

| 5. | The ratification of the appointment of PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for the fiscal year ending February 3, 2018 (fiscal 2017). |

1

What is the recommendation of the board of directors on each of the proposals scheduled to be voted on at the Annual Meeting?

The board of directors recommends that you vote:

| | FOR each of the nominees to the board of directors (Proposal 1); |

| | FOR the advisory vote on named executive officer compensation (Proposal 2); |

| | FOR the re-approval of our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code (Proposal 3); |

| | FOR approval of our Cash Incentive Bonus Plan for purposes of Section 162(m)(4)(C) of the Code (Proposal 4); and |

| | FOR the ratification of the appointment of PwC as our independent registered public accounting firm for fiscal 2017 (Proposal 5). |

Could other matters be decided at the Annual Meeting?

Our Bylaws require that we receive advance notice of any proposal to be brought before the Annual Meeting by stockholders of the Company, and we have not received notice of any such proposals. If any other matter were to come before the Annual Meeting, the proxy holders appointed by our board of directors will have the discretion to vote on those matters for you.

Who can vote at the Annual Meeting?

Stockholders as of the record date for the Annual Meeting, April 28, 2017, are entitled to vote at the Annual Meeting. At the close of business on the record date, there were 33,075,569 shares of the Companys common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 28, 2017, your shares were registered directly in your name with our transfer agent, Computershare Investor Services, then you are considered the stockholder of record with respect to those shares.

As a stockholder of record, you may vote at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote over the Internet or by telephone, or, if you request paper proxy materials, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee

If on April 28, 2017, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

How do I vote?

If you are a stockholder of record, you may:

| | vote in personwe will provide a ballot to stockholders who attend the Annual Meeting and wish to vote in person; |

2

| | vote by mailif you request a paper proxy card, simply complete, sign and date the enclosed proxy card, then follow the instructions on the card; or |

| | vote via the Internet or via telephonefollow the instructions on the Notice of Internet Availability or proxy card and have the Notice or proxy card available when you access the internet website or place your telephone call. |

Votes submitted via the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on June 26, 2017. Submitting your proxy, whether via the Internet, by telephone or by mail if you requested a paper proxy card, will not affect your right to vote at the Annual Meeting should you decide to attend the meeting.

If you are not a stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted. You may still attend the Annual Meeting if you have already voted by proxy.

What if I return my proxy card directly to the Company, but do not provide voting instructions?

If a signed proxy card is returned to us without any indication of how your shares should be voted on a particular proposal at the meeting, your shares will be voted in accordance with the recommendations of our board of directors stated above. For example, if you return a signed proxy card with no indication of your vote on any of the proposals, your votes will be cast FOR the election of the three director nominees named in this proxy statement, FOR the approval, on an advisory basis, of the compensation of our named executive officers, FOR the re-approval of our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code, FOR approval of our Cash Incentive Bonus Plan for purposes of Section 162(m)(4)(C) of the Code and FOR the ratification of the appointment of PwC as our independent registered public accounting firm for fiscal 2017.

If you hold your shares in street name and do not vote, and your broker does not have discretionary power to vote your shares, your shares may constitute broker non-votes (as described below) and may not be counted in determining the number of shares necessary for approval of a proposal. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting. Voting results will be tabulated and certified by the inspector of elections appointed for the meeting.

What is the quorum requirement for the Annual Meeting?

A majority of our outstanding shares as of the record date must be present at the meeting in order to hold the meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the meeting if you are present and vote in person at the meeting or if you have properly submitted a proxy.

How are abstentions and broker non-votes treated?

Abstentions (i.e., shares present at the meeting and voted abstain) are counted for purposes of determining whether a quorum is present, and have no effect on the election of directors (Proposal 1), on the advisory vote to approve our named executive officer compensation (Proposal 2) or on the ratification of appointment of auditors (Proposal 5). For the purpose of determining whether the stockholders have re-approved our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code (Proposal 3) and approved our Cash Incentive Bonus Plan for purposes of Section 162(m)(4)(C) of the Code (Proposal 4), abstentions are counted as votes cast under the rules of the New York Stock Exchange (NYSE) and have the same effect as an against vote.

Broker non-votes occur when shares held by a broker for a beneficial owner are not voted because (i) the broker did not receive voting instructions from the beneficial owner, and (ii) the broker lacked discretionary authority to vote the shares. Broker non-votes are counted for purposes of determining whether a quorum is present. Note that if you are a beneficial

3

holder and do not provide specific voting instructions to your broker, the broker that holds your shares will not be authorized to vote on the election of directors (Proposal 1), to vote on an advisory basis to approve our named executive officer compensation (Proposal 2), to vote to re-approve our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code (Proposal 3) or to vote to approve our Cash Incentive Bonus Plan for purposes of Section 162(m)(4)(C) of the Code (Proposal 4). Ratification of the appointment of auditors (Proposal 5) is considered to be a routine matter and, accordingly, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 5, brokers will be permitted to exercise their discretionary authority to vote for the ratification of the appointment of auditors. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Annual Meeting.

What is the vote required for each proposal?

The votes required to approve each proposal are as follows:

| | Proposal 1. Stockholders choices for Proposal 1 (Election of Directors) are limited to for and withhold. A plurality of the shares of common stock voting in person or by proxy is required to elect each of the three nominees for director under Proposal 1. Under plurality voting, the three nominees receiving the largest number of votes cast (votes FOR) will be elected. Because the election of directors under Proposal 1 is considered to be a non-routine matter under the rules of the NYSE, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 1, brokers will not be permitted to exercise their voting authority and uninstructed shares may constitute broker non-votes. Abstentions and broker non-votes will have no effect on the outcome of Proposal 1 because the election of directors is based on the votes actually cast. |

| | Proposal 2. The affirmative vote of a majority of votes cast, whether in person or by proxy, is required to approve, on an advisory basis, the compensation of our named executive officers described under Proposal 2 (Advisory Vote to Approve Executive Compensation). Because the advisory vote under Proposal 2 is considered to be a non-routine matter under the rules of the NYSE, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 2, brokers will not be permitted to exercise their voting authority and uninstructed shares may constitute broker non- votes. Abstentions and broker non-votes will have no effect on the outcome of Proposal 2 because the advisory vote is based on the votes actually cast. |

| | Proposal 3. The affirmative vote of a majority of votes cast, whether in person or by proxy, is required to re-approve our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code under Proposal 3 (Re-Approval of the 2012 Stock Incentive Plan for Purposes of Section 162(m)(4)(C) of the Code). Because re-approval of our 2012 Stock Incentive Plan under Proposal 3 is considered to be a non-routine matter under the rules of the NYSE, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 3, brokers will not be permitted to exercise their voting authority and uninstructed shares may constitute broker non-votes. Broker non-votes will have no effect on the outcome of Proposal 3 because the vote is based on the votes actually cast. Under the rules of the NYSE, abstentions are counted as votes cast for Proposal 3, and therefore abstentions will have the same effect as a vote against Proposal 3. |

| | Proposal 4. The affirmative vote of a majority of votes cast, whether in person or by proxy, is required to approve our Cash Incentive Bonus Plan for purposes of Section 162(m)(4)(C) of the Code under Proposal 4 (Approval of the Cash Incentive Bonus Plan for Purposes of Section 162(m)(4)(C) of the Code). Because approval of our Cash Incentive Bonus Plan under Proposal 4 is considered to be a non-routine matter under the rules of the NYSE, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 4, brokers will not be permitted to exercise their voting authority and uninstructed shares may constitute broker non-votes. Broker non-votes will have no effect on the outcome of Proposal 4 because the vote is based on the votes actually cast. Under the rules of the NYSE, abstentions are counted as votes cast for Proposal 4, and therefore abstentions will have the same effect as a vote against Proposal 4. |

| | Proposal 5. The affirmative vote of a majority of votes cast, whether in person or by proxy, is required to ratify the selection of the independent registered public accounting firm for fiscal 2017 under Proposal 5 (Ratification of Appointment of Auditors). Proposal 5 is considered to be a routine matter and, accordingly, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 5, brokers |

4

| will be permitted to exercise their discretionary authority to vote for the ratification of the appointment of auditors. Abstentions and broker non-votes will have no effect on the outcome of Proposal 5 because the ratification of appointment of auditors is based on the votes actually cast. |

How can I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to use the Internet to:

| | View the Companys proxy materials for the Annual Meeting; and |

| | Instruct the Company to send future proxy materials to you by email. |

The Companys proxy materials are also available at ir.rh.com. This website address is included for reference only. The information contained on the Companys website is not incorporated by reference into this proxy statement.

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

Who is paying for this proxy solicitation?

The Company is paying the costs of the solicitation of proxies. Proxies may be solicited on behalf of the Company by our directors, officers, employees or agents in person or by telephone, facsimile or other electronic means. We will also reimburse brokerage firms and other custodians, nominees and fiduciaries, upon request, for their reasonable expenses incurred in sending proxies and proxy materials to beneficial owners of our common stock. We have retained the services of Alliance Advisors LLC (Alliance) to assist in the solicitation of proxies for a fee of approximately $26,000 plus reasonable out-of-pocket expenses. We may engage Alliance for additional solicitation work and incur fees greater than $26,000, depending on a variety of factors, including preliminary voting results and recommendations from Institutional Shareholder Services.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

How can I change my vote after submitting my proxy?

A stockholder who has given a proxy may revoke it at any time before it is exercised at the meeting by:

| | delivering to the Corporate Secretary of the Company (by any means, including facsimile) a written notice stating that the proxy is revoked; |

| | signing and delivering a proxy bearing a later date; |

| | voting again over the Internet or by telephone; or |

| | attending and voting at the Annual Meeting (although attendance at the meeting will not, by itself, revoke a proxy). |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Where can I find the voting results?

The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the Annual Meeting.

5

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors currently consists of nine directors, three of whom, as the Class II directors, have been nominated and are standing for election at the Annual Meeting.

Unless proxy cards are otherwise marked or a broker non-vote occurs, the persons named as proxies will vote all proxies FOR the election of each nominee named in this proxy statement. Proxies submitted to the Company cannot be voted at the Annual Meeting for nominees other than those nominees named in this proxy statement. However, if any director nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee designated by our board of directors. Alternatively, our board of directors may reduce the size of our board of directors.

Each nominee has consented to serve as a director if elected, and our board of directors does not believe that any nominee will be unwilling or unable to serve if elected as a director. Each director will hold office until the expiration of the three-year term and until his or her successor has been duly elected and qualified or until his or her earlier resignation or removal.

Nominees for Director

Our board of directors has nominated the nominees listed below to serve as Class II directors for the term beginning at the Annual Meeting and ending at our 2020 annual meeting.

There are no familial or special relationships between any director nominee or executive officer and any other director nominee or executive officer. There are no arrangements or understandings between any director nominee or executive officer and any other person pursuant to which he or she has been or will be selected as our director and/or executive officer.

The names of each nominee for director, their ages as of April 28, 2017, and other information about each nominee are shown below.

| Nominee |

Age |

Director Since |

||||||

| Hilary Krane |

53 | 2016 | ||||||

| Katie Mitic |

47 | 2013 | ||||||

| Ali Rowghani |

44 | 2015 | ||||||

Hilary Krane has served on our board of directors since her appointment in June 2016. She currently serves as the Executive Vice President, Chief Administrative Officer and General Counsel of NIKE, Inc., a position she has held since 2013. From 2011 to 2013, she served as the Vice President, General Counsel and Corporate Affairs of NIKE, Inc. From April 2010 under responsibilities expanded in 2011, she served as Vice President and General Counsel of NIKE, Inc. Prior to joining NIKE, Inc., Ms. Krane was General Counsel and Senior Vice President for Corporate Affairs at Levi Strauss & Co. from 2006 to 2010. From 1996 to 2006, she was a partner and assistant general counsel at PricewaterhouseCoopers LLP. Ms. Krane holds a Bachelor of Arts from Stanford University and a J.D. from the University of Chicago. Ms. Krane was selected to our board of directors because of her experience contributing to the growth and development of innovative and iconic global brands.

Katie Mitic has served on our board of directors since October 2013. Ms. Mitic is the Founder and Chief Executive Officer of Sitch, Inc., a consumer mobile start-up company formed in August 2012. From August 2010 to August 2012, Ms. Mitic served as Director of Platform & Mobile Marketing for Facebook, Inc., a social networking service. From June 2009 to July 2010, Ms. Mitic served as Senior Vice President, Product Marketing of Palm, Inc., a smartphone manufacturer. She also serves on the board of directors and the executive committee of Special Olympics International, and on the board of directors, compensation committee and as chair of the nominating and governance committee of eBay, Inc., a Nasdaq-listed global commerce company. Ms. Mitic holds a Bachelor of Arts in Economics from Stanford University and an M.B.A. degree from Harvard Business School. Ms. Mitic was selected to our board of directors because of her extensive experience as a leader and entrepreneur obtained from her experience with major global consumer-facing technology companies.

6

Ali Rowghani was appointed to our board of directors in January 2015. Mr. Rowghani has served in executive leadership positions at innovative growth companies, including Twitter, Inc. and Pixar Animation Studios, Inc. At Twitter, Mr. Rowghani was hired as the Companys first Chief Financial Officer in March 2010, and later served as Chief Operating Officer, with responsibility for business development, platform, media, product, and business analytics, from December 2012 to June 2014. Prior to Twitter, from June 2002 to February 2010, Mr. Rowghani served in various leadership roles at Pixar, including Chief Financial Officer and Senior Vice President, Strategic Planning, reporting to Pixar founder and President, Ed Catmull. Mr. Rowghani is currently the Chief Executive Officer of YCombinators Continuity Fund. Mr. Rowghani holds a Bachelor of Arts in International Relations and an M.B.A. from Stanford University. Mr. Rowghanis operational and financial leadership, coupled with his expertise in scaling innovative, high-growth companies, provides the board of directors with valuable operational and financial expertise.

THE BOARD RECOMMENDS A VOTE FOR ELECTION OF

EACH OF THE THREE NOMINATED DIRECTORS.

Class I Directors Continuing in Office Until the 2019 Annual Meeting

Eri Chaya, 43, has served as a member of our board of directors since November 2012. Ms. Chaya served as our Chief Creative Officer since April 2008 and, in May 2016, became Co-President, Chief Creative and Merchandising Officer. Before becoming our Chief Creative Officer, Ms. Chaya was our Vice President of Creative, beginning in July 2006. From February 2004 to June 2006, Ms. Chaya was a creative director at Goodby, Silverstein and Partners, an international advertising agency. From May 2000 to February 2004, Ms. Chaya was a creative director at Banana Republic, a clothing retailer. Ms. Chaya graduated from Art Center College of Design, one of the countrys preeminent design schools. Ms. Chaya was selected to our board of directors because of her extensive knowledge and experience in design, product development, brand development, marketing and advertising.

Mark Demilio, 61, has served as a member of our board of directors since September 2009 and currently serves as the boards Lead Independent Director. Mr. Demilio was a member of the board of directors of Cosi, Inc., a national restaurant chain, from April 2004 to May 2017, served on its audit committee, its compensation committee and its nominating and corporate governance committee, and served for a time as Chairman of the board of directors of Cosi and as the interim Chief Executive Officer of Cosi. Since September, 2015, Mr. Demilio has served as a member of the board of directors and Chairman of the audit committee of Schumacher Clinical Partners, a privately-held provider of emergency medicine and hospitalist services through physician staffing and management. From February 2014 through March 2016, Mr. Demilio served as a member of the board of directors and Chairman of the audit committee of The Paslin Company, a private company that designs, assembles and integrates robotic assembly lines for the automotive industry. From December 2000 until his retirement in October 2008, Mr. Demilio served as the Chief Financial Officer of Magellan Health Services, Inc., a Nasdaq-listed managed specialty healthcare company that managed the delivery of behavioral healthcare treatment services, specialty pharmaceuticals and radiology services. Mr. Demilio has also been the General Counsel for Magellan Health Service, the Chief Financial Officer and General Counsel of Youth Services International, Inc., an attorney specializing in corporate and securities law with the law firms of Miles & Stockbridge and Piper & Marbury, a financial analyst for CareFirst BlueCross BlueShield of Maryland and a certified public accountant with Arthur Andersen LLP. Mr. Demilio was selected to our board of directors because he possesses particular knowledge and experience in accounting, finance and capital structure, strategic planning and leadership of complex organizations and board practices of other major corporations.

Leonard Schlesinger, 64, was appointed to our board of directors in April 2014. Dr. Schlesinger has served as the Baker Foundation Professor of Business Administration at Harvard Business School, a role he returned to in July 2013 after having served as the President of Babson College from July 2008 until July 2013 and having held various positions at public and private companies. From 1999 to 2007, Dr. Schlesinger held various executive positions at Limited Brands, Inc. (now L Brands, Inc.), an NYSE-listed company, including Vice Chairman of the board of directors and Chief Operating Officer. While at Limited Brands, he was responsible for the operational and financial functions across the enterprise including Express, Limited Stores, Victorias Secret Beauty, Bath and Body Works, C.O. Bigelow, Henri Bendel and the White Barn Candle Company. Dr. Schlesinger also previously served as Executive Vice President and Chief Operating Officer at Au Bon Pain Co., Inc. and as a director of numerous public and private retail, consumer products and technology companies.

7

Dr. Schlesinger has also held leadership roles at leading MBA and executive education programs and other academic institutions, including twenty years at Harvard Business School where he served as the George Fisher Baker Jr. Professor of Business Administration. Dr. Schlesinger holds a Doctor of Business Administration from Harvard Business School, an M.B.A. from Columbia University and a Bachelor of Arts in American Civilization from Brown University. Dr. Schlesingers extensive experience at numerous private and public retail companies provides the board with valuable operational, financial and business expertise.

Class III Directors Continuing in Office Until the 2018 Annual Meeting

Gary Friedman, 59, is the Chairman and Chief Executive Officer of the Company and Founder of the RH brand as we know it today. From July 2013 to January 2014, Mr. Friedman served as Co-Chief Executive Officer with Mr. Alberini, and from October 2012 to July 2013, Mr. Friedman served as Chairman Emeritus, Creator and Curator on an advisory basis. Mr. Friedman served as our Chairman from May 2010 to October 2012 and as our Co-Chief Executive Officer from June 2010 to October 2012. He also served as our Chief Executive Officer from March 2001 to June 2010 and as our Chairman from March 2005 to June 2008. He served on our board of directors from March 2001 to October 2012. Prior to joining us, from 1988 to 2001, Mr. Friedman worked for Williams-Sonoma, Inc., a specialty retailer of products for the home, where he served in various capacities, including as President and Chief Operating Officer from May 2000 to March 2001, as Chief Merchandising Officer and President of Retail Stores from 1995 to 2000 and as Executive Vice President and President of the Williams-Sonoma and Pottery Barn brands from 1993 to 2001. Prior to joining Williams-Sonoma, Mr. Friedman spent eleven years with Gap, Inc., a specialty retailer, in various management positions. Mr. Friedman was selected to our board of directors because of his leadership in re-conceptualizing and developing the RH brand and business into the leading luxury home brand in the North American market, his deep and unmatched expertise in developing and rapidly growing many of the leading consumer brands in the home furnishings space, and his extensive knowledge of building and leading complex multi-branded and multi-channel organizations.

Carlos Alberini, 61, has served on our board of directors since June 2012. Mr. Alberini has served as the Chairman and Chief Executive Officer of Lucky Brand since February 2014. Mr. Alberini served as our Co-Chief Executive Officer from June 2010 through October 2012 and from July 2013 through January 2014, and he served as our sole Chief Executive Officer from October 2012 through July 2013. Mr. Alberini was President and Chief Operating Officer of Guess?, Inc., an NYSE-listed specialty retailer of apparel and accessories, from December 2000 to June 2010. From May 2006 to July 2006, Mr. Alberini served as Interim Chief Financial Officer of Guess. Mr. Alberini served as a member of the board of directors of Guess from December 2000 to September 2011. From October 1996 to December 2000, Mr. Alberini served as Senior Vice President and Chief Financial Officer of Footstar, Inc., a retailer of footwear. From May 1995 to October 1996, Mr. Alberini served as Vice President of Finance and Acting Chief Financial Officer of the Melville Corporation, a retail holding corporation. From 1987 to 1995, Mr. Alberini was with The Bon-Ton Stores, Inc., an operator of department stores, in various capacities, including Corporate Controller, Senior Vice President, Chief Financial Officer and Treasurer. Prior to that, Mr. Alberini served in various positions at PricewaterhouseCoopers LLP, an audit firm. Mr. Alberini was selected to our board of directors because he possesses particular knowledge and experience in retail and merchandising, branded consumer goods, accounting, financing and capital finance, board practices of other large retail companies and leadership of complex organizations.

Keith C. Belling, 59, has served on our board of directors since April 2016, and previously served as an advisor to the board of directors from May 2015 to April 2016. Mr. Belling is the co-founder, Chairman and former Chief Executive Officer of popchips, inc. (popchips) a leading better-for-you snack food business that launched in 2007. Mr. Belling has served as chairman of popchips since 2007 and served as popchips Chief Executive Officer from 2007 through 2012, leading the company to distribution of over 30,000 retail stores across North America and the United Kingdom. Mr. Belling has served as an advisor to several innovative consumer, real estate and technology companies. Mr. Belling also has founded other businesses, including e-commerce company Allbusiness.com, a leading small business portal, founded in 2008, where Mr. Belling formerly served as Chief Executive Officer and which was acquired by NBCi. Mr. Belling has been selected to our board of directors because of his experience as a founder, leader, and entrepreneur of several innovative consumer companies, as well as his background and experience in the real estate sector.

8

CORPORATE GOVERNANCE & DIRECTOR INDEPENDENCE

Corporate Governance Guidelines

Our Corporate Governance Guidelines generally specify the distribution of rights and responsibilities of our board of directors and detail the rules and procedures for making decisions on corporate affairs. In general, the stockholders elect our board of directors, which is responsible for the general governance of our Company, including selection and oversight of key management, and management is responsible for running our day-to-day operations.

Our Corporate Governance Guidelines are available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on Corporate Governance. The contents of our website are not incorporated by reference into this proxy statement and are not soliciting materials.

Code of Business Conduct and Code of Ethics

We have adopted a code of business conduct and code of ethics applicable to our principal executive, financial and accounting officers and all persons performing similar functions. Copies of these codes are available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on Corporate Governance. We expect that any amendments to either code, or any waiver of the requirements of either code, will be disclosed on our website or as required by applicable law or NYSE listing requirements.

Compensation Committee Interlocks and Insider Participation

No member of the compensation committee has served as one of our officers or employees at any time. None of our executive officers serves as a member of the compensation committee of any other company that has an executive officer serving as a member of our board of directors. None of our executive officers serves as a member of the board of directors of any other company that has an executive officer serving as a member of our compensation committee. None of our directors or executive officers are members of the same family.

Composition and Qualifications of our Board of Directors

Our board of directors consists of nine directors, including our Chairman and Chief Executive Officer. Our certificate of incorporation provides that, subject to any rights applicable to any then-outstanding preferred stock, our board of directors shall consist of such number of directors as determined from time to time by resolution adopted by a majority of the total number of authorized directors whether or not there exist any vacancies in previously authorized directorships. Subject to any rights applicable to any then-outstanding preferred stock, any additional directorships resulting from an increase in the number of directors may only be filled by the directors then in office, unless otherwise required by law or by a resolution passed by our board of directors. The term of office for each director will be until his or her successor is elected at our annual meeting or his or her death, resignation or removal, whichever is earliest to occur.

Our board of directors is divided into three classes, with each director serving a three-year term, and one class being elected at each years annual meeting of stockholders. Our directors by class are as follows:

Class I: Eri Chaya, Mark Demilio and Leonard Schlesinger, with a term expiring at the 2019 annual meeting.

Class II: Hilary Krane, Katie Mitic and Ali Rowghani, with a term expiring at the 2017 annual meeting.

Class III: Gary Friedman, Carlos Alberini and Keith Belling, with a term expiring at the 2018 annual meeting.

9

We believe our board of directors should be composed of individuals with sophistication and experience in many substantive areas that impact our business. We believe experience, qualifications, or skills in the following areas are most important: retail merchandising; marketing and advertising; furniture and consumer goods; sales and distribution; accounting, finance, and capital structure; strategic planning and leadership of complex organizations; legal/regulatory and government affairs; people management; and board practices of other major corporations. We believe that all our current board members possess the professional and personal qualifications necessary for board service, and have highlighted particularly noteworthy attributes for each board member in their individual biographies above and as summarized below.

|

|

|

|

| Committee Membership | Experience | |||||||||||||||||||||||||||||

| Name/ Current position |

Age | Director Since |

Independent | Audit | Comp. | Nominating & Corporate Governance |

Business Leadership |

Brand/Retail Experience |

Growth Company Experience |

Public Company Executive/ Director |

Investment/ Financial |

Legal | Risk Oversight/ Management |

|||||||||||||||||

| Gary Friedman RH Chairman & CEO | 59 | |

Mar. 2001 |

|

● | ● | ● | |||||||||||||||||||||||

| Carlos Alberini Chairman & CEO of Lucky Brand | 61 | |

Jun. 2012 |

|

● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Keith Belling Founder and Chairman of popchips, inc. | 59 | |

Apr. 2016 |

|

● | ● | ● | ● | ||||||||||||||||||||||

| Eri Chaya Co-President, Chief Creative and Merchandising Officer of the Company | 43 | |

Nov. 2012 |

|

● | |||||||||||||||||||||||||

| Mark Demilio Former Chairman of the Board of Cosi, Inc. | 61 |

|

Sep. 2009 |

|

● | ○ | ● | ○ | ● | ● | ● | ● | ● | |||||||||||||||||

| Hilary Krane EVP, CAO and General Counsel, NIKE, Inc. | 53 | |

Jun. 2016 |

|

● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Katie Mitic Founder & CEO of Sitch, Inc. | 47 | |

Oct. 2013 |

|

● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Ali Rowghani CEO, YCombinator Continuity Fund | 44 | |

Jan. 2015 |

|

● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||

| Leonard Schlesinger Professor of Business Administration, Harvard Business School | 64 |

|

Apr. 2014 |

|

● | ○ | ● | ● | ● | ● | ● | |||||||||||||||||||

| ○ Committee Chair ● Committee Member |

||||||||||||||||||||||||||||||

Board Leadership Structure; Lead Independent Director

Our Corporate Governance Guidelines provide that the roles of Chairman of our board of directors and Chief Executive Officer may be either separate or combined, and our board of directors exercises its discretion in combining or separating these positions as it deems appropriate. Our board of directors believes that the combination or separation of these positions should continue to be considered as part of our succession planning process. Currently, the roles are combined, with Mr. Friedman serving as Chief Executive Officer and Chairman of our board of directors.

10

In July 2013, the board of directors created the position of Lead Independent Director and adopted a Lead Independent Director Charter which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on Corporate Governance. The Lead Independent Director Charter provides that the Lead Independent Director shall serve in a lead capacity to coordinate the activities of the other non-employee directors, to help facilitate communication between the board of directors and management and perform such other duties and functions as directed by the board from time to time. The Lead Independent Director presides over executive sessions of non-management directors.

Mr. Demilio currently serves as our Lead Independent Director. We believe the appointment of Mr. Demilio as our Lead Independent Director is beneficial to the Company due to Mr. Demilios breadth of experience and ability to facilitate communication between management and the board of directors and devote significant time to the Company.

Our Corporate Governance Guidelines provide the flexibility for our board of directors to modify our leadership structure in the future as appropriate. We believe that our Company is well served by this flexible leadership structure.

Board Meetings

Our board of directors held a total of eight meetings during the fiscal year ended January 28, 2017 (fiscal 2016) and our independent directors met in regularly scheduled executive sessions presided over by our Lead Independent Director. During fiscal 2016, all of our incumbent directors attended at least 75% of the total meetings of the board and of the committees on which they served during the period for which they were a director or committee member.

Agendas and topics for board and committee meetings are developed through discussions among management and members of our board of directors and its committees. Information and data that are important to the issues to be considered are distributed in advance of each meeting. Board meetings and background materials focus on key strategic, operational, financial, governance and compliance matters applicable to us.

Committee Composition and Meetings

In fiscal 2016, the board had three standing committees: an audit committee; a compensation committee; and a nominating and corporate governance committee. All board committees are composed of independent directors. Committee membership and the number of meetings each committee held in fiscal 2016 are as follows:

| Committees | ||||||

| Directors |

Audit | Compensation |

Nominating & Corporate Governance |

|||

| Mark Demilio (1)(2) |

Chair | Member | Chair | |||

| Hilary Krane (3) |

Member | |||||

| Katie Mitic |

Member | |||||

| Ali Rowghani |

Member | |||||

| Leonard Schlesinger |

Chair | |||||

| Thomas Mottola (2) |

Former Member | Former Member | Former Chair | |||

| Number of Meetings in Fiscal 2016 |

5 | 7 | 2 (4) | |||

| (1) | Designated by the board as an audit committee financial expert. |

| (2) | Mr. Mottola served as Lead Independent Director until March 2016. Mr. Demilio is currently the boards Lead Independent Director. Mr. Mottola resigned from the board of directors effective June 20, 2016. |

| (3) | Ms. Krane joined the board of directors effective June 20, 2016. |

| (4) | Committee members also had two informal meetings in fiscal 2016. |

Our board of directors has delegated various responsibilities and authorities to its three different committees, as described below and in the committee charters. The board committees regularly report on their activities and actions to the full board of directors as they deem appropriate and as the board of directors may request. Each member of the audit committee, the compensation committee and the nominating and corporate governance committee was appointed by our board of directors, which reviews committee composition from time to time.

11

Audit Committee

The audit committee was established for the primary purpose of assisting the board of directors in overseeing the accounting and financial reporting processes of the Company and audits of its financial statements. The audit committee is responsible for, among other matters:

| | appointing, retaining, compensating, evaluating, terminating and overseeing our independent registered public accounting firm; |

| | delineating relationships between our independent registered public accounting firm and our Company consistent with the rules of the NYSE and request information from our independent registered public accounting firm and management to determine the presence or absence of a conflict of interest; |

| | reviewing with our independent registered public accounting firm the scope and results of their audit; |

| | approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

| | reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; |

| | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; and |

| | reviewing and approving related-person transactions. |

Our audit committee currently consists of Mr. Demilio, Ms. Krane and Ms. Mitic. Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the Exchange Act), and NYSE rules require us to have at least three audit committee members, all of whom are independent. Our board of directors has affirmatively determined that each of Mr. Demilio, Ms. Krane and Ms. Mitic meets the definition of independent director for purposes of serving on our audit committee under Rule 10A-3 of the Exchange Act and NYSE rules. In addition, our board of directors has determined that Mr. Demilio qualifies as an audit committee financial expert, as such term is defined in Item 407(d)(5) of Regulation S-K.

Our board of directors has adopted a written charter for the audit committee, which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on Corporate Governance. The audit committee conducts an annual self-evaluation of its performance, as set forth in its charter.

Compensation Committee

The compensation committee was established for the primary purpose of assisting the board of directors in discharging its responsibilities relating to the compensation of the Companys directors and executive officers, as further described in Compensation Discussion and AnalysisCompensation Committee Review of Compensation below. The compensation committee is responsible for, among other matters:

| | reviewing key employee compensation goals, policies, plans and programs; |

| | reviewing and approving the compensation of our directors, Chief Executive Officer and other executive officers; |

| | reviewing employment agreements and other similar arrangements between us and our executive officers; and |

| | appointing and overseeing any compensation consultants. |

Our compensation committee currently consists of Mr. Demilio and Dr. Schlesinger. Our board of directors has affirmatively determined that each member of the compensation committee meets applicable independence requirements for membership on a compensation committee in accordance with applicable rules of the NYSE.

12

Our board of directors adopted a written charter for the compensation committee, which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on Corporate Governance. The compensation committee conducts an annual self-evaluation of its performance, as set forth in its charter.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee was established for the primary purpose of assisting the board of directors in discharging its responsibilities relating to the election of directors. The nominating and corporate governance committee is responsible for, among other matters:

| | identifying individuals qualified to become members of our board of directors, consistent with criteria approved by our board of directors; |

| | overseeing the organization of our board of directors to discharge the boards duties and responsibilities properly and efficiently; and |

| | developing and recommending to our board of directors a set of corporate governance guidelines and principles. |

Our nominating and corporate governance committee currently consists of Messrs. Demilio and Rowghani. Our board of directors has affirmatively determined that each member of the nominating and corporate governance committee meets applicable independence requirements for membership on a nominating and corporate governance committee in accordance with applicable rules of the NYSE.

Our board of directors adopted a written charter for the nominating and corporate governance committee, which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on Corporate Governance. The nominating and corporate governance committee conducts an annual self-evaluation of its performance, as set forth in its charter.

Director Nominations; Communication with Directors

Criteria for Nomination to the Board

In accordance with its charter, the nominating and corporate governance committee will consider candidates submitted by the Companys stockholders, as well as candidates recommended by directors and management, for nomination to our board of directors. The nominating and corporate governance committee considers qualifications for the board of directors membership, which may include, among others:

(1) the highest personal and professional integrity,

(2) demonstrated exceptional ability and judgment,

(3) broad experience in business, finance or administration,

(4) familiarity with the Companys industry,

(5) ability to serve the long-term interests of the Companys stockholders,

(6) sufficient time available to devote to the affairs of the Company,

(7) ability to provide continuing service to promote stability and continuity in the boardroom and provide the benefit of familiarity and insight into the Companys affairs that directors would accumulate during their tenure,

(8) ability to help the board of directors work as a collective body, and

(9) experience, areas of expertise, as well as other factors relative to the overall composition of the board of directors.

The nominating and corporate governance committee further reviews and assesses the activities and associations of each candidate to ensure there is no legal impediment, conflict of interest, or other consideration that might hinder or prevent service on our board of directors. In making its selection, the nominating and corporate governance committee bears in mind that the foremost responsibility of a director of a company is to represent the interests of the stockholders as a whole.

13

Each directors individual biography set forth above includes the key individual attributes, experience and skills of each director that led to the conclusion that each director should continue to serve as a member of our board of directors at this time, as reflected in the summary above. We believe the range of tenures of our directors creates a synergy between institutional knowledge and new perspectives.

Stockholder Proposals for Nominees

In accordance with its charter, the nominating and corporate governance committee will consider potential nominees properly submitted by stockholders. Stockholders seeking to do so should provide the information set forth in the nominating and corporate governance committees charter regarding director nominations. The nominating and corporate governance committee will apply the same criteria for candidates proposed by stockholders as it does for candidates proposed by management or other directors.

To be considered for nomination by the nominating and corporate governance committee at next years annual meeting of stockholders, submissions by stockholders must be submitted in writing and must be received by the Corporate Secretary between January 18, 2018 and February 17, 2018 to ensure adequate time for meaningful consideration by the nominating and corporate governance committee. Each submission must include the following information:

| | the candidates name, age, business address and residence address; |

| | the candidates biographical information, including educational information, principal occupation or employment, past work experience (including all positions held during the past five years), personal references, and service on boards of directors or other material positions that the candidate currently holds or has held during the prior three years; |

| | the class and number of shares of the Company which are beneficially owned by the candidate; |

| | any potential conflicts of interest that might prevent or otherwise limit the candidate from service as an effective member; |

| | any other information pertinent to the qualification of the candidate; |

| | the name and record address of the stockholder making the recommendation; and |

| | the class and number of shares of the Company which are beneficially owned by such stockholder and the period of time such shares have been held, including whether such shares have been held in excess of one year prior to the date of the recommendation. |

Information regarding requirements that must be followed by a stockholder who wishes to make a stockholder nomination for election to our board of directors for next years annual meeting is described in this proxy statement under Additional InformationStockholder Proposals for the 2018 Annual Meeting.

Communicating with Members of the Board of Directors

Any stockholder or any other interested party who wishes to communicate directly with (i) our entire board of directors, (ii) the non-management directors as a group, or (iii) the Lead Independent Director, may do so by corresponding with the Lead Independent Director at the following address: Lead Independent Director, RH, Legal Dept., 15 Koch Road, Suite K, Bldg. D, Corte Madera, CA 94925, Attn: Corporate Secretary. All communications will be received, processed and then directed to the appropriate member(s) of our board other than, at the boards request, certain items unrelated to the boards duties, such as customer complaints, spam, junk mail, solicitations, employment inquires and similar items.

Stockholder Outreach Activities

We actively engage with major stockholders of the Company, which has been a practice of the Company since our initial public offering in 2012. In 2016, we launched a formal stockholder outreach program in order to solicit additional input from stockholders with respect to corporate governance and executive compensation practices. This stockholder outreach effort continued in 2017 and is designed to supplement the ongoing communications between our management and stockholders.

14

As part of the 2016 stockholder outreach campaign, we solicited the views of institutional investors that we believe represented approximately 94% of our issued and outstanding shares owned by institutional investors as of December 31, 2015, and had discussions with and received feedback from investors representing approximately 61% of such outstanding shares. In addition to the general feedback noted in the chart below, investors expressed appreciation of our outreach efforts and acknowledged our quick reaction and responsiveness to the results of our prior year annual meeting at which stockholders voted against our say-on-pay proposal. The results of the stockholder outreach campaign and the feedback we received were provided to our board of directors.

| What we heard in 2016 | What we did in 2016 and 2017 | |

| Stockholders requested that we include more tables and summary presentation of information within the compensation discussion and analysis portion of the proxy statement. | We reviewed our proxy statements from previous years and made improvements for the current year, including providing more information in tables and charts rather than within lengthy narrative form in order to make the presentation easier to read and more accessible to readers. | |

| Stockholders requested increased transparency into the why behind certain compensation decisions, such as the bonus metrics used in our Leadership Incentive Program, or LIP. | We increased the disclosure in our compensation discussion and analysis in order to explain the reasons we chose certain compensation metrics and to show how our program is aligned with stockholder interests. In particular, we have also provided detailed information concerning the structuring of the 2017 Stock Option Award that the compensation committee approved for grant to our Chairman and Chief Executive Officer. | |

| Stockholders requested additional disclosure to provide greater context for the level of our executive compensation programs in terms of comparison with industry metrics. | We provided additional information regarding the results of a comprehensive review of market compensation practices in fiscal 2015 performed by the independent compensation consultants working with our Compensation Committee. | |

| Stockholders requested additional disclosure regarding certain corporate governance practices. | We added additional details and information regarding certain of our corporate governance practices. |

As part of the 2017 stockholder outreach campaign, we solicited the views of institutional investors that we believe represented approximately 54.7% of our issued and outstanding shares owned by institutional investors as of December 31, 2016, and had discussions with and received feedback from investors representing approximately 39.9% of such outstanding shares. Inasmuch as we had contacts with a large number of our investors in our first annual stockholder outreach campaign during 2016, a number of our investors that had been previously contacted indicated there was not a need to have a second round of conversations in the current annual stockholder outreach campaign as their positions on the topics discussed had not changed in any significant way from the prior year conversations. In addition to the general feedback noted in the chart below, investors once again expressed appreciation of our outreach efforts. The results of the stockholder outreach campaign and the feedback we received were presented to our board of directors.

15

| What we heard in 2017 |

What we did in 2017

|

|

| We asked stockholders about the potential determination by the Board that Carlos Alberini now qualifies as an independent director following the three year anniversary of his departure from RH. Stockholders requested that any such determination be accompanied by detailed disclosure about the basis for Mr. Alberini being determined an independent director. Some investors noted the policies of independent governance services which indicate that a former chief executive officer should not be deemed fully independent in particular for the purposes of serving on any committees of the board of directors that are required to be comprised of independent members. | The Board made a determination that Mr. Alberini meets the independence tests of the NYSE and the SEC for purposes of the requirement that a majority of members on the Board should be independent. We provided detailed disclosure in this proxy statement regarding the basis for this determination. The Board also determined not to appoint Mr. Alberini to any of RHs committees of the board of directors that require directors be independent. | |

| Stockholders have expressed a general view that to the extent RH makes large equity awards to executives that are intended to serve as a long term equity incentive over a period of years, our disclosure should be very clear about the nature of such multi-year awards and the period that the award is intended to cover. | In those circumstances where we make a multi-year equity award to an executive officer, we intend to disclose more details concerning the multi-year nature of the award. We have followed a practice of making multi-year equity awards to our Chairman and Chief Executive Officer in several instances and we have provided substantial additional disclosure concerning those multi-year awards. In particular, we provided a multi-year equity award to him in the second fiscal quarter of 2013. In the second quarter of fiscal 2017, we granted him an additional multi-year equity award that is designed to serve for a four year period. We have enhanced the level of disclosure concerning these multi-year equity awards to our Chairman and Chief Executive Officer in our compensation discussion and analysis in order to explain the intent and details behind these large equity awards. | |

| Stockholders also expressed a preference that equity awards granted to the executive officers of RH in particular be tied to performance metrics rather than simple time based metrics based on continued service. | We structured the 2017 Stock Option Award (defined below) to Mr. Friedman to require substantial stock price appreciation from the price of our common stock on the date of grant in order for restrictions on the shares underlying the award to lapse. Investor feedback that we received indicates that share price performance is a key metric that investors believe aligns the incentives of executives with the objectives of investors. We determined that the 2017 Stock Option Award would be linked to price objectives of $100, $125 and $150 per share in equal increments as of the date of grant; these stock price targets represent increases of more than 100%, 150%, and 200%, respectively. We also required a four year service period for the Chief Executive Officer in order to assure that these price objectives would be measured on a sustained basis rather than at a single moment in time. | |

| We asked stockholders about re-approving our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code.

Some stockholders expressed support for re-approving the 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code, though some stockholders indicated that support for any such proposal might be dependent on the plan terms in effect at the time of the vote. |

We have included in this proxy statement a proposal to re-approve our 2012 Stock Incentive Plan for purposes of Section 162(m)(4)(C) of the Code, providing stockholders with the opportunity to express their views through a vote on this matter. |

Please refer to the Compensation Discussion and Analysis section of this proxy statement under Stockholder Engagement for more information regarding our stockholder outreach program. We plan to continue various stockholder communication and outreach programs in the future.

Board Independence

In accordance with our Corporate Governance Guidelines, the board of directors affirmatively determines that each independent director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) and meets the standards for independence as defined by applicable law and the rules of the NYSE.

Our board of directors undertook a review of the independence of our directors and considered whether any director has a material relationship with us that could compromise that directors ability to exercise independent judgment in carrying out that directors responsibilities. Our board of directors affirmatively determined that each of Mr. Alberini, Mr. Demilio, Ms. Krane, Ms. Mitic, Mr. Rowghani and Dr. Schlesinger is an independent director, as defined under the applicable rules of the NYSE and the SEC, and that the other members of the board are not independent. Further, the board of directors determined that each member of the board of directors audit committee, compensation committee and nominating and corporate governance committee satisfies independence standards applicable to each committee on which he or she serves.

16

The boards independence determination was based on information provided by our current directors. In particular, in making its determination that Mr. Alberini is an independent director, the board of directors considered that under the rules of the NYSE and the SEC, Mr. Alberini could be deemed independent for membership on the board of directors after February 2017 given that his prior service as the Companys Co-Chief Executive Officer and Chief Executive Officer had occurred more than three years prior to such date. In reaching its conclusion regarding the independence of Mr. Alberini, the board of directors further considered Mr. Alberinis position as the chief executive officer of Lucky Brands and other prior and existing relationships between the Company and Mr. Alberini. The board concluded that Mr. Alberinis full-time position as chief executive officer of another company distinguished his circumstances from that of a former chief executive officer who remains on the board of directors upon retirement as chief executive officer. Although the board of directors determined that Mr. Alberini is an independent director under the applicable rules of the NYSE and the SEC, the board of directors elected not to appoint Mr. Alberini to any of the committees of the Company that are required under applicable rules of the NYSE or SEC to be composed entirely of independent directors.

Boards Role in Risk Oversight

Our board of directors is responsible for overseeing our risk management process. Our board of directors focuses on our general risk management strategy, including the most significant risks facing us, and oversees the implementation of risk mitigation strategies by management. Our board of directors is also apprised by management of particular risk management matters in connection with the boards general oversight and approval of corporate matters and significant transactions. In addition, each of the board committees is responsible for risk management under its area of responsibility and consistent with its charter and such other responsibilities as may be delegated to them by the board of directors from time to time.

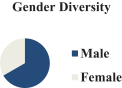

Board Diversity

Our board of directors strongly believes its effectiveness is enhanced by being comprised of individuals with diverse backgrounds, skills and experience that are relevant to the role of the board of directors and the needs of the business. Accordingly, the board regularly reviews the changing needs of the business and the skills and experience resident in its members, with the intention that the board will be periodically renewed as certain directors rotate off and new directors are recruited. The boards commitment to diversity and renewal will be tempered by the need to balance change with continuity and experience.

Our current board composition is highly diverse in the areas of gender, age, ethnicity and business experience. We believe that our commitment to diversity is demonstrated by the current membership of our board.

Director and Executive Stock Ownership Guidelines

We do not require that our directors maintain a minimum ownership interest in our Company. However, our Chairman and Chief Executive Officer, Mr. Friedman, has consistently maintained a significant equity ownership interest in the Company and beneficially owns approximately 16.7% of the Companys common stock which, as of April 28, 2017, was valued at approximately 88 times his annual base salary for fiscal 2016. Additionally, Ms. Chaya, our Co-President, Chief Creative and Merchandising Officer and director, holds stock and equity awards with a value, as of April 28, 2017, of approximately 10 times her annual base salary for fiscal 2016.

We encourage our directors and executive officers to maintain holdings in our stock and grant equity awards in order to promote equity ownership and financial alignment with investors. Additional information regarding the stockholdings of our other named executive officers is set forth in this proxy statement in the section entitled Security Ownership of Certain Beneficial Owners and Management.

Annual Meeting Attendance

We do not have a policy that requires our directors to attend the annual meeting of stockholders. Two directors attended the 2016 annual meeting.

17

COMPENSATION OF DIRECTORS

In fiscal 2016, we compensated the independent, non-employee members of our board of directors as follows:

| Annual cash retainer |

$120,000, paid quarterly in advance | |

| Lead Independent Director |

20,000 stock options granted upon appointment (1) | |

| Audit committee chairman |

$50,000, paid quarterly in advance | |

| Audit committee member |

$25,000, paid quarterly in advance | |

| Compensation committee chairman |

$35,000, paid quarterly in advance | |

| Compensation committee member |

$20,000, paid quarterly in advance | |

| Nominating & corporate governance committee chairman |

$25,000, paid quarterly in advance | |

| Nominating & corporate governance committee member |

$15,000, paid quarterly in advance | |

| Meeting attendance fees |

$2,500 per in-person meeting; $1,500 per telephonic meeting |

|

| Annual equity grant of restricted stock |

Aggregate value of $125,000 (2) | |

| (1) | The options vest in five equal installments over five years, subject to the individuals continuing service as the Lead Independent Director, such that the option shall become exercisable for 4,000 shares on the first anniversary of the date of the individuals appointment as Lead Independent Director and for an additional 4,000 shares upon each of the second, third, fourth and fifth anniversaries thereafter. |

| (2) | Based on the average closing price of our common stock on the date of grant, determined using the closing prices for the ten consecutive trading days prior to and inclusive of the date of grant, which shares vest in full on the one-year anniversary of the date of grant. Grants are made for service for the period between the annual meeting of stockholders for the fiscal year in which the grant was made and the annual meeting of stockholders for the following fiscal year. |

Annual equity grants described above are granted on the date of the annual meeting of stockholders each year.

Effective April 28, 2016, the Company began compensating all non-employee directors on the same basis as the Companys arrangement for compensating independent, non-employee directors as described above. Mr. Friedman and Ms. Chaya, as current Company employees, did not receive any compensation for board service for fiscal 2016, and former director Michael Chu, who resigned from the board of directors effective as of April 28, 2016, did not receive any compensation for board services for fiscal 2016. All directors receive reimbursement for reasonable out-of-pocket expenses incurred in connection with meetings of our board of directors.

The following table shows the compensation earned by all non-employee directors during fiscal 2016:

| Name |

Fees Earned |

Stock Awards (1) |

Total | |||||||||

| Carlos Alberini |

$ | 96,681 | $ | 146,478 | $ | 243,159 | ||||||

| Keith Belling (2) |

$ | 134,500 | $ | 130,670 | $ | 265,170 | ||||||

| Mark Demilio |

$ | 221,316 | $ | 130,670 | $ | 351,986 | ||||||

| Hilary Krane (3) |

$ | 92,832 | $ | 131,637 | $ | 224,469 | ||||||

| Katie Mitic |

$ | 156,000 | $ | 130,670 | $ | 286,670 | ||||||

| Ali Rowghani |

$ | 113,250 | $ | 130,670 | $ | 243,920 | ||||||

| Leonard Schlesinger |

$ | 171,000 | $ | 130,670 | $ | 301,670 | ||||||