S-1: General form of registration statement for all companies including face-amount certificate companies

Published on September 9, 2011

Table of Contents

As filed with the Securities and Exchange Commission on September 9, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RESTORATION HARDWARE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5712 | 45-3052669 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

15 Koch Road, Suite J

Corte Madera, CA 94925

(415) 924-1005

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

Gary G. Friedman

Chairman and Co-Chief Executive Officer

Carlos E. Alberini

Co-Chief Executive Officer

15 Koch Road, Suite J

Corte Madera, CA 94925

(415) 924-1005

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Stewart L. McDowell, Esq. Steven R. Shoemate, Esq. Gibson Dunn & Crutcher, LLP 555 Mission Street San Francisco, CA 94105 Tel: (415) 393-8200 Fax: (415) 986-5309 |

Gavin B. Grover, Esq. John M. Rafferty, Esq. Andrew D. Thorpe, Esq. Morrison & Foerster LLP 425 Market Street San Francisco, CA 94105 Tel: (415) 268-7000 Fax: (415) 268-7522 |

Sharon R. Flanagan, Esq. Bradley S. Fenner, Esq. Connie P. Wu, Esq. Sidley Austin LLP 555 California Street San Francisco, CA 94104 Tel: (415) 772-1200 Fax: (415) 772-7400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||

| Common Stock, $0.0001 par value |

$150,000,000 | $17,415 | ||

|

|

||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes offering price of shares that the underwriters have the option to purchase. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated September 9, 2011.

Shares

Common Stock

This is Restoration Hardware Holdings, Inc.s initial public offering.

We are selling shares of our common stock and the selling stockholders identified in this prospectus are selling shares of our common stock. We will not receive any of the proceeds from the sale of shares to be offered by the selling stockholders.

We expect the public offering price to be between $ and $ . Since June 2008 and prior to this offering, there has been no public market for the shares. After pricing this offering, we expect that the shares will trade on the under the symbol .

Investing in our common stock involves risks that are described in the Risk Factors section beginning on page 14 of this prospectus.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

The underwriters may also purchase up to an additional shares from the selling stockholders, at the public offering price, less the underwriting discount.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2011.

Joint Book-Running Managers

| BofA Merrill Lynch | Goldman, Sachs & Co. |

The date of this prospectus is , 2011.

Table of Contents

| Page | ||||

| ii | ||||

| 1 | ||||

| 14 | ||||

| 35 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| Selected Historical Consolidated Financial and Operating Data |

42 | |||

| Managements Discussion and Analysis of Financial Condition and Results of Operations |

47 | |||

| 77 | ||||

| 94 | ||||

| 101 | ||||

| 120 | ||||

| 122 | ||||

| 127 | ||||

| 129 | ||||

| 132 | ||||

| Material U.S. Federal Income Tax Considerations to Non-U.S. Holders |

134 | |||

| 138 | ||||

| 145 | ||||

| 145 | ||||

| 146 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize be delivered to you. Neither we nor the selling stockholders or underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

We use a 52 53 week fiscal year ending on the Saturday closest to January 31. Fiscal years are identified in this prospectus according to the calendar year prior to the calendar year in which they end. For example, references to 2010, fiscal 2010 or similar references refer to the fiscal year ended January 29, 2011.

All of the outstanding capital stock of Restoration Hardware, Inc. was acquired on June 16, 2008, by Home Holdings, LLC, which we refer to in this prospectus as the Acquisition. Home Holdings equity interests are held primarily by (i) CP Home Holdings, LLC, an investment entity managed by funds affiliated with Catterton Management Company, LLC, (ii) Tower Three Home LLC, an investment fund managed by Tower Three Partners, LLC, and (iii) funds affiliated with Glenhill Capital. In this prospectus, we refer to CP Home Holdings, LLC and its affiliated funds as Catterton, we refer to Tower Three Home LLC and its affiliated funds as Tower Three and we refer to Glenhill Capital and its affiliated funds as Glenhill. As a result of the Acquisition, a new basis of accounting was created beginning June 17, 2008. In this prospectus, the periods prior to the Acquisition are referred to as the Predecessor periods and the periods after the Acquisition are referred to as the Successor periods. The Predecessor periods presented in this prospectus for 2008 include the period from February 3, 2008 through June 16, 2008, reflecting approximately 19 weeks of operations, and the Successor periods presented in this prospectus for 2008 include the period from June 17, 2008 through January 31, 2009, reflecting approximately 33 weeks of operations. Due to the Acquisition, the financial statements presented in this prospectus for the Successor periods are not comparable to those of the Predecessor periods.

In the section entitled Managements Discussion and Analysis of Financial Condition and Results of Operations, we have presented pro forma consolidated financial data for the 52-week period ended January 31, 2009, which gives effect to the Acquisition as if such transaction had occurred on February 3, 2008, and which we refer to as pro forma 2008, in addition to the Predecessor and Successor periods for 2008. We believe that presenting the discussion and analysis of the results of operations in this manner promotes the overall usefulness of the comparison given the complexities involved with comparing two significantly different periods.

In this prospectus, when we refer to retail assortment square footage, we mean the square footage of the largest retail assortment in any one store in a particular market. Generally, retail assortment square footage is the selling square footage of our largest store in a particular market and does not include the selling square footage of any other store in that market because the product assortment in the smaller stores will generally be redundant with products shown in the largest store. In this prospectus, when we refer to store level cash contribution margin, we mean store net revenues less product costs and cash operating costs related to store operations, divided by store net revenues.

ii

Table of Contents

This summary highlights some of the information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. You should read the following summary together with the entire prospectus carefully, including Risk Factors, Managements Discussion and Analysis of Financial Condition and Results of Operations, the more detailed information regarding our Company and the common stock being sold in this offering, as well as our consolidated financial statements and the related notes appearing elsewhere in this prospectus, before deciding to invest in our common stock. Some of the statements in this prospectus constitute forward-looking statements. See Forward-Looking Statements and Market Data.

Except where the context otherwise requires or where otherwise indicated, the terms Restoration Hardware, we, us, our, our Company and our business refer, prior to the Reorganization discussed below, to Restoration Hardware, Inc. and, after the Reorganization, to Restoration Hardware Holdings, Inc., in each case together with its consolidated subsidiaries, including Restoration Hardware, Inc., as a combined entity. The term Restoration Hardware Holdings refers to Restoration Hardware Holdings, Inc. and the term Home Holdings refers to Home Holdings, LLC, and, in each case, not to any of their subsidiaries.

Our Company

We believe Restoration Hardware is one of the fastest growing and most innovative luxury brands in the home furnishings marketplace. We believe our brand stands alone and is redefining this highly fragmented and growing market. Restoration Hardware is positioned as a lifestyle brand and design authority, offering dominant assortments across a growing number of categories, including furniture, lighting, textiles, bathware, décor, outdoor and garden, as well as baby and child products. We operate as a curator of the finest historical design the world has to offer. Our collections of timeless, updated classics and reproductions are presented consistently across our sales channels in sophisticated and unique lifestyle settings that we believe are on par with world-class interior designers. Our culture of innovation, superior product development capabilities, integrated multi-channel infrastructure and significant scale enable us to offer what we believe is an unmatched combination of design, quality and value.

Our business is fully integrated across our multiple channels of distribution, consisting of our stores, catalogs and websites. As of July 30, 2011, we operated 87 retail stores and 10 outlet stores throughout the United States and Canada. In fiscal 2010, we distributed approximately 46.5 million catalogs, and our websites logged over 12.1 million unique visits.

We have recently experienced strong growth in sales and profitability, including:

| | For the twelve months ended July 30, 2011, we grew our net revenues 26% to $862.3 million over the prior twelve month period, increased our Adjusted EBITDA 90% to $59.9 million and increased our net income by $16.5 million to a net income of $4.4 million. Our stores net revenues, comparable store sales and direct net revenues grew by 17%, 17% and 38%, respectively. |

| | In the first half of fiscal 2011, we grew our net revenues 27% to $420.4 million over the comparable period in fiscal 2010, increased our Adjusted EBITDA 209% to $27.7 million and increased our net income by $12.4 million to a net income of $1.1 million. Our stores net revenues, comparable store sales and direct net revenues grew by 21%, 20% and 36%, respectively. |

1

Table of Contents

| | In fiscal 2010, we grew our net revenues 24% to $772.8 million over fiscal 2009, increased our Adjusted EBITDA 134% to $41.1 million and decreased our net loss by $20.6 million to a net loss of $8.1 million. Our stores net revenues, comparable store sales and direct net revenues grew by 15%, 19% and 37%, respectively. |

See Prospectus SummarySummary Historical Consolidated Financial and Operating Data for a discussion of Adjusted EBITDA and a reconciliation of the differences between Adjusted EBITDA and net income (loss).

Our Competitive Strengths

Market-Redefining Luxury Brand. We believe Restoration Hardware stands alone as a leading luxury brand and is redefining the highly fragmented home furnishings market by offering an unmatched combination of design, quality and value. We believe we are disrupting the competitive landscape by attracting affluent consumers from designer showrooms and high-end boutiques with our compelling value proposition, as well as aspirational consumers trading up to our more sophisticated aesthetic relative to what can be found in department stores and other home furnishings retailers. In a market characterized by smaller, independent competitors, we believe our luxury positioning, superior quality and significant scale position us to continue to rapidly grow our market share.

Culture of Innovation. Innovation is at the core of what we do. We are dedicated to offering products that push established boundaries and influence the manner in which our customers envision their homes. The scope of our innovation is demonstrated company-wide, including in our product development platform, our stores, our direct channels and our infrastructure. We believe our ability to successfully innovate and introduce new products enables us to gain market share, adapt our business to emerging trends and stay relevant with our customers.

Superior Product Development Capabilities. We have architected a proprietary product development platform that is fully integrated from ideation to presentation. We have established a cross-functional organization centered on product leadership, with teams that collaborate across functions and that work closely with our network of artisan partners who act as an extension of our product development team. Our product development platform and significant scale have enabled us to introduce an increasing number of new products with each collection and dramatically shorten our product lead times while allowing us to deliver differentiated products to our customers at a great value.

Multi-Channel Go-To-Market Strategy. We pursue a market-based rather than a channel-based sales strategy and allocate resources by market to maximize our return on invested capital. Our strategy is to size our stores and assortments to the potential of the market area that each location serves, while leveraging our direct channels to maximize reach and allow customers to access our complete product offering. Our channels are fully integrated and complement each other, with our stores acting as showrooms for our brand while our catalogs and websites act as virtual extensions of our stores. This approach is designed to enhance our customer experience, generate greater sales, increase our market share and deliver higher returns on invested capital.

Fully Integrated Infrastructure. Our infrastructure is integrated across our multiple channels, providing three key advantages: (i) strong direct sourcing capabilities and direct vendor relationships; (ii) centrally managed inventory across our channels to drive working capital efficiency and to optimize our product availability; and (iii) a reconfigured distribution network and new order management, warehouse management and point-of-sale systems that have reduced our product return rates and improved customer service levels. Our systems platform also includes business intelligence reporting capabilities that provide multi-channel information to enable us to make timely and informed decisions. We believe our infrastructure provides us with a sophisticated operating platform and significant capabilities to support our future growth.

2

Table of Contents

High Performance, Values-Driven Organization Led by Accomplished Team. We have built a high performance organization driven by a company-wide commitment to our core values of People, Quality, Service and Innovation. Our leadership team, led by our Co-Chief Executive Officers, Gary Friedman and Carlos Alberini, has over 100 years of specialty home experience and significant expertise across all of our core functions, including brand management, product development, sourcing, supply chain, merchandising, finance and operations. With over 24 years of experience in executive roles in the specialty home industry, Mr. Friedman is recognized as a creative force and design leader. Prior to joining us in 2001, Mr. Friedman spent 13 years at Williams Sonoma, Inc. in various executive roles, most recently as President and Chief Operating Officer. Mr. Alberini is a highly respected financial and operational leader in the retail sector, having most recently served as President and Chief Operating Officer of Guess? from 2000 until 2010, when he joined us as Co-Chief Executive Officer. We believe our leadership team, including the complementary skills of Mr. Friedman and Mr. Alberini, is a key driver of our success and positions us to execute our long term growth strategy.

Our Growth Strategy

Increase Market Share by Expanding Existing and Entering New Product Categories. We participate in the highly fragmented, $143 billion U.S. home furnishings market, and our net revenues currently represent less than 1% of this market. We believe there is a substantial opportunity to continue to increase our market share as more consumers are exposed to our growing merchandise assortment and as introductions of new products and categories allow existing customers to add to their collections. We apply our unique design aesthetic and superior product development capabilities to bring a differentiated perspective to both existing and new product categories. Over the past few years we have successfully expanded our offering in all of our categories. We also have a successful record of new category introductions, and plan to continue introducing select new product categories, such as Tabletop in 2012, where we can offer a dominant assortment consistent with our brand positioning in other product categories.

Expand Our Retail Assortment Square Footage. We plan to increase our retail assortment square footage by opening full line Design Galleries in key metropolitan markets, expanding select existing Galleries and opening Galleries in new markets. Our experience has proven that when we display a product in our stores, we sell substantially greater quantities of that product across all of our channels. Most of our existing Galleries display under 50% of our current merchandise assortment. We see a significant growth opportunity with our full line Design Galleries, in which we can showcase approximately 80% of our current product assortment in a highly differentiated retail setting. These stores will have approximately 15,000 20,000 square feet of interior selling space and 4,000 7,000 square feet of outdoor selling space. This larger store format provides an opportunity to increase sales, consolidate markets, reduce operating costs and enhance return on capital. Following the opening of our first full line Design Gallery in Los Angeles, we are opening a full line Design Gallery in Houston in the Fall of 2011, followed by planned full line Design Galleries in Greenwich, Connecticut; Boston; New York City; Scottsdale; Orange County, California; Atlanta; Chicago and Dallas over the next few years. We have identified over 35 markets in which we plan to open full line Design Galleries.

Grow our Direct-to-Consumer Business. We will grow our direct business by expanding our catalog page count and circulation, reaching new households with our catalogs and implementing our e-commerce marketing initiatives. As with our stores, we have found when we display a product in our catalogs, we experience increased sales of that product across all of our channels. In our Spring 2011 Home catalog, we significantly increased the average page count and circulated pages, and reached approximately 20% more households than in Spring 2010 while reducing the number of catalog mailings in that season. This strategy contributed to a 36% increase in net revenues for our direct business in the first six months of fiscal 2011 compared to the same period in the prior year. Based on the success of our Spring 2011 Home catalog, we increased the page count of our recently released Fall 2011 Home catalog to over 600 pages, which now displays over 90% of our current product assortment. We plan to circulate this catalog to more than double the number of households we reached with our

3

Table of Contents

Spring 2011 catalog. In the aggregate, we plan to increase circulated pages by more than 40% in 2011 and by more than 30% in 2012. We are also investing in enhanced marketing initiatives for our e-commerce business, which we believe will result in greater website traffic and sales.

Increase Operating Margins. We have the opportunity to improve our operating margins by leveraging occupancy costs and operating expenses, and by expanding our merchandise margins. We believe that our real estate strategy will allow us to better leverage our fixed occupancy costs by consolidating multiple Galleries into single full line Design Galleries, opening locations outside of malls that tend to have lower lease costs per square foot, reducing non-selling backroom space and closing unproductive stores. We have a well-developed, scalable infrastructure that is positioned to support our revenue growth without a proportionate increase in operating expenses. We believe we can further increase our merchandise margins by: (i) continuing to benefit from our direct sourcing initiatives; (ii) optimizing product pricing and utilizing more targeted promotions; and (iii) using new merchandise planning systems to manage inventory more efficiently across all of our channels.

Pursue International Expansion. We plan to strategically expand our business in select countries outside of the United States and Canada over the next several years. We believe that our luxury brand, product innovation, and unique aesthetic will have strong international appeal.

Evolution of Our Business

When Gary Friedman joined us as Chief Executive Officer in 2001, we began to reposition Restoration Hardware from a nostalgic, discovery-items business to a leading home furnishings brand. Starting in 2008 when we were taken private by investment funds affiliated with Catterton, Tower Three and Glenhill, we significantly accelerated the transformation of our brand and the development of our multi-channel business model and infrastructure. Over the last ten years, we built a new company as we:

| | Elevated our brand positioning; |

| | Enhanced our product development process; |

| | Refined our go-to-market strategy; |

| | Reconceptualized our stores and developed our full line Design Gallery format; |

| | Built a new supply chain and systems infrastructure; and |

| | Strengthened our management team. |

We believe these initiatives have contributed to our recent strong performance and increased profitability, and position us for sustained growth and profitability.

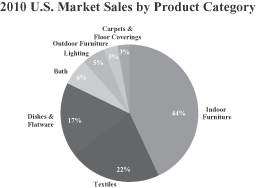

Our Market

We participate in the large and growing domestic housewares and home furnishings market. Based on third-party research, this market generated $143 billion in retail sales in 2010 and is projected to grow at a compound annual growth rate of 3% 4% between 2011 and 2015. Our net revenues currently represent less than 1% of this market, providing us with a substantial opportunity to gain market share.

According to Euromonitor International, a market research and analysis firm, the housewares and home furnishings market is highly fragmented. The top 20 companies comprised only 30% of the total market in 2008, with the largest player representing less than 3% of the total market. As a result of the weakening housing market and economic downturn in 2007, many home furnishings retailers were forced to close stores, dramatically scale back operations or lower prices. This disruption created an opportunity for us. We believe we are well positioned to gain market share in the current competitive environment as a result of our unmatched combination of design, quality and value.

4

Table of Contents

We target high income households that drive a disproportionate share of spending in the home furnishings market. According to third-party research, the higher income consumer group represents approximately 31% of the U.S. population but comprises 50% of the total housewares and home furnishings market sales. We believe that these consumers are highly attractive as they tend to be less impacted by an economic downturn and return to spending more quickly in an economic recovery.

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider the following risks, including the risks discussed in the section entitled Risk Factors, before investing in our common stock:

We are undertaking a large number of business initiatives at the same time and if these new initiatives are not successful, they may have a negative impact on our operating results. Growth in our business may not be sustained and may not generate a corresponding improvement in our results of operations. If we fail to successfully anticipate consumer preferences and demand, and manage our inventory commensurate with demand, our results of operations may be adversely affected. Our performance and our growth strategy depend on our ability to purchase our merchandise in sufficient quantities at competitive prices, and any disruptions we experience in our ability to obtain our products in a timely fashion or in the quantities required could have a material adverse effect on our business. We may not have adequate remedies with our vendors for defective merchandise, which could damage our reputation and brand image and harm our business. Changes in consumer spending or the housing market may significantly harm our revenue and results of operations. If we lose key personnel or are unable to hire additional qualified personnel, our business may be harmed. Our operations have significant liquidity and capital requirements and depend on the availability of adequate financing on reasonable terms and if we are unable to borrow significant capital, it could have a significant negative effect on our business.

Reorganization

Restoration Hardware Holdings was incorporated as a Delaware corporation on August 18, 2011, by our sole stockholder, Home Holdings, for the purpose of acquiring all of the stock of Home Holdings wholly owned subsidiary, Restoration Hardware, Inc. Restoration Hardware Holdings will acquire all of the outstanding shares of Restoration Hardware, Inc. prior to the effectiveness of this offering. Outstanding units under the 2008 Home Holdings equity compensation plan, which we refer to as our Team Resto Ownership Plan, will be converted in connection with this offering into our common stock on a for basis, and the vesting status of the Home Holdings units will carry over to our common stock, with unvested shares constituting restricted stock. In this prospectus, we refer to these transactions as the Reorganization.

Principal Equity Holders

Home Holdings equity interests are held primarily by funds affiliated with Catterton, Tower Three and Glenhill. In this prospectus, we refer to Catterton, Tower Three and Glenhill as our Principal Equity Holders.

Home Holdings will remain in place after the completion of this offering and will continue to be the single largest holder of our common stock. Interests of Catterton, Tower Three and Glenhill in our Company will continue to be held indirectly through their ownership interests in Home Holdings.

5

Table of Contents

Catterton. Catterton is a leading private equity firm with an exclusive focus on providing equity capital in support of small to middle-market consumer companies that are positioned for attractive growth. Since its founding in 1989, Catterton has invested in approximately 80 companies and led equity investments totaling over $3.3 billion. Presently, Catterton is actively managing more than $2.5 billion of equity capital focused on all sectors of the consumer industry: food, beverage, retail, restaurants, consumer products, consumer services and media and marketing services. Cattertons combination of investment capital, strategic operating skills and industry network has enabled it to become a highly sought after firm within this industry.

Tower Three. Tower Three is an operationally-focused private equity fund formed to create a concentrated portfolio of investments in U.S.-based middle-market businesses. Tower Threes professionals are experienced with operational management, financial restructuring, private equity and credit markets. With long-term committed capital from major institutional investors, Tower Three has the flexibility to participate in a variety of transactions.

Glenhill. Glenhill is a privately owned investment partnership that invests primarily in public equity markets internationally. Founded in 2001, Glenhill is led by Glenn J. Krevlin, who has served as the managing member of Krevlin Advisors, LLC, an investment management firm, which is the general partner of Glenhill.

6

Table of Contents

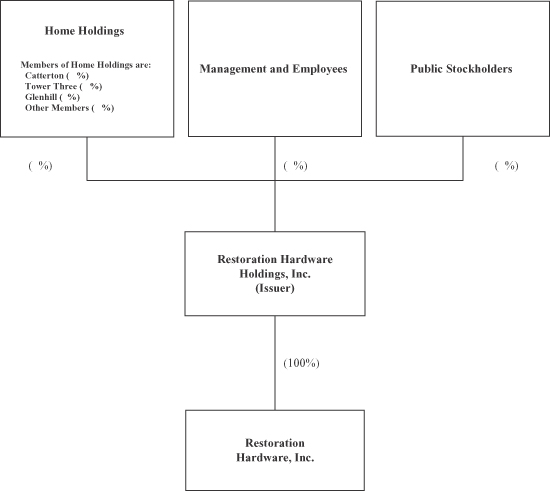

The following chart sets forth our anticipated ownership structure as of the completion of this offering assuming no exercise by the underwriters of their option to purchase additional shares:

Corporate and Other Information

Restoration Hardware Holdings, Inc., the issuer of the common stock in this offering, is a Delaware corporation. Our corporate headquarters are located at 15 Koch Road, Suite J, Corte Madera, CA 94925. Our telephone number is (415) 924-1005. Our principal website address is www.restorationhardware.com. We also operate a website for our Baby & Child brand at www.rhbabyandchild.com. The information on any of our websites is not deemed to be incorporated in this prospectus or to be part of this prospectus.

This prospectus includes our trademarks, such as Restoration Hardware and Restoration Hardware Baby & Child, which are protected under applicable intellectual property laws and are the property of Restoration Hardware. This prospectus also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

7

Table of Contents

The Offering

| Total common stock offered |

shares |

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

shares |

| Common stock to be outstanding immediately after this offering |

shares |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting the underwriting discount and estimated offering expenses, will be approximately $ million, assuming the shares are offered at $ per share (the midpoint of the estimated price range set forth on the cover of this prospectus). |

| We will not receive any proceeds from the sale of shares by the selling stockholders. |

| We intend to use the net proceeds from the sale of common stock by us in this offering to repay all or a portion of the outstanding amounts under the Restoration Hardware, Inc. revolving line of credit, for general corporate purposes, including working capital and capital expenditures, and to pay other fees and expenses incurred in connection with this offering, including payments to Catterton, Tower Three and Glenhill pursuant to the terms of the management services agreement we have entered into with them. See Use of Proceeds. |

| Principal stockholders |

Upon completion of this offering, Home Holdings will own approximately shares, or %, of our outstanding common stock. Of that amount, Catterton will beneficially own approximately shares, or %, of our outstanding common stock, Tower Three will beneficially own approximately shares, or %, of our outstanding common stock, and Glenhill will beneficially own approximately shares, or %, of our outstanding common stock. |

| We are a controlled company within the meaning of the listing rules, and therefore will be exempt from certain of the corporate governance listing requirements of the . See ManagementCorporate Governance. |

| Dividend policy |

We currently intend to retain all available funds and any future earnings for use in the operation of our business, and therefore we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of directors and will depend upon our results of operations, financial condition, capital requirements and other factors that our board of directors deems relevant. We are a holding company, and substantially all of our operations are carried out by our subsidiary, Restoration Hardware, Inc., and its subsidiaries. Restoration |

8

Table of Contents

| Hardware, Inc.s ability to pay dividends to us is limited by its line of credit, which may in turn limit our ability to pay dividends on our common stock. Our ability to pay dividends may also be restricted by the terms of any future credit agreement or any future debt or preferred securities of ours or of our subsidiaries. See Dividend Policy. |

| Conflicts of interest |

As described under Use of Proceeds, Bank of America, N.A., an affiliate of Merrill Lynch, Pierce, Fenner & Smith Incorporated, an underwriter in this offering, is a lender under the Restoration Hardware, Inc. revolving line of credit and may receive more than five percent of the net proceeds of this offering. Thus, Merrill Lynch, Pierce, Fenner & Smith Incorporated may be deemed to have a conflict of interest under the applicable provisions of Rule 5121 of the Conduct Rules of the Financial Industry Regulatory Authority, Inc., or FINRA. Accordingly, this offering will be made in compliance with the applicable provisions of Rules 5110 and 5121 of the Conduct Rules regarding the underwriting of securities of a company with a member that has a conflict of interest within the meaning of those rules. Goldman, Sachs & Co. has agreed to serve as a qualified independent underwriter as defined by FINRA and performed due diligence investigations and reviewed and participated in the preparation of the registration statement of which this prospectus forms a part. No underwriter with a conflict of interest will execute sales in discretionary accounts without the prior written specific approval of the customers. See UnderwritingConflicts of Interest. |

| Risk factors |

Investing in our common stock involves a high degree of risk. See Risk Factors beginning on page 14 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed symbol for trading on |

|

Unless otherwise indicated, all information in this prospectus relating to the number of shares of our common stock to be outstanding immediately after this offering:

| | excludes unvested restricted shares of our common stock that will be issued to our executive officers and other employees and consultants under the Restoration Hardware 2011 Equity Replacement Plan, which we refer to as the Replacement Plan, as replacement grants for awards previously issued pursuant to the Team Resto Ownership Plan; |

| | excludes options to purchase shares of our common stock, each with an exercise price equal to the initial public offering price, that we expect to grant in connection with this offering under the Restoration Hardware 2011 Stock Incentive Plan, which we refer to as our 2011 Plan; |

| | excludes additional shares of common stock reserved for future grants under our 2011 Plan; |

| | assumes an initial public offering price of $ per share (the midpoint of the estimated price range set forth on the cover of this prospectus); and |

| | assumes no exercise by the underwriters of their option to purchase up to additional shares from the selling stockholders. |

9

Table of Contents

Summary Historical Consolidated Financial and Operating Data

The following tables present Restoration Hardware, Inc.s summary historical consolidated financial and operating data as of the dates and for the periods indicated. Restoration Hardware Holdings was formed as a Delaware corporation on August 18, 2011. Restoration Hardware Holdings will acquire all of the outstanding shares of capital stock of Restoration Hardware, Inc. prior to the effectiveness of this offering in connection with the Reorganization, and will therefore control Restoration Hardware, Inc. Restoration Hardware Holdings has not engaged in any business or other activities except in connection with its formation and the Reorganization. Accordingly, all financial and other information herein relating to periods prior to the completion of the Reorganization is that of Restoration Hardware, Inc.

All of the outstanding capital stock of Restoration Hardware, Inc. was acquired on June 16, 2008, by Home Holdings, which we refer to in this prospectus as the Acquisition. As a result of the Acquisition, a new basis of accounting was created beginning June 17, 2008. The periods prior to the Acquisition are referred to as the Predecessor periods and the periods after the Acquisition are referred to as the Successor periods in this prospectus. The Predecessor periods presented in this prospectus include the period from February 3, 2008, through June 16, 2008, reflecting approximately 19 weeks of operations, and the Successor periods presented in this prospectus include the period from June 17, 2008, through January 31, 2009, reflecting approximately 33 weeks of operations. Due to the Acquisition, the financial statements for the Successor periods are not comparable to those of the Predecessor periods presented in this prospectus.

The summary consolidated financial data for the periods ended June 16, 2008, and January 31, 2009, and for the fiscal years ended January 30, 2010, and January 29, 2011, were derived from Restoration Hardware, Inc.s consolidated financial statements included elsewhere in this prospectus.

The summary consolidated financial data for the six months ended July 31, 2010, and July 30, 2011, and as of July 30, 2011, were derived from Restoration Hardware, Inc.s unaudited consolidated interim financial statements included elsewhere in this prospectus. The unaudited consolidated interim financial statements were prepared on a basis consistent with that used in preparing our audited consolidated financial statements and include all adjustments, consisting of normal and recurring items, that we consider necessary for a fair presentation of our financial position and results of operations for the unaudited periods. The unaudited financial information for the twelve months ended July 31, 2010, has been derived by adding our financial information for the year ended January 30, 2010, to the financial information for the six months ended July 31, 2010, and subtracting the financial information for the six months ended August 1, 2009. The unaudited financial information for the twelve months ended July 30, 2011, has been derived by adding our financial information for the year ended January 29, 2011, to the financial information for the six months ended July 30, 2011, and subtracting the financial information for the six months ended July 31, 2010.

Restoration Hardware, Inc.s historical results are not necessarily indicative of future operating results, and interim results for the six months ended July 30, 2011, are not projections for the results to be expected for the fiscal year ending January 28, 2012. The summary historical consolidated data presented below should be read in conjunction with the sections entitled Risk Factors, Selected Historical Consolidated Financial and Operating Data and Managements Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements and the related notes thereto and other financial data included elsewhere in this prospectus.

10

Table of Contents

| Predecessor |

|

Successor | ||||||||||||||||||||||||||||||||

| Period from February 3, 2008 Through June 16, 2008 |

Period from June 17, 2008, Through January 31, 2009 |

Year Ended | Six Months Ended | Last Twelve Months Ended (1) |

||||||||||||||||||||||||||||||

| January 30, 2010 |

January 29, 2011 |

July 31, 2010 |

July 30, 2011 |

July 31, 2010 |

July 30, 2011 |

|||||||||||||||||||||||||||||

| (dollars in thousands, excluding per share and per square foot data) | ||||||||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||||||||

| Net revenues |

$ | 195,437 | $ | 498,581 | $ | 625,685 | $ | 772,752 | $ | 330,854 | $ | 420,383 | $ | 686,787 | $ | 862,281 | ||||||||||||||||||

| Cost of goods sold |

140,088 | 308,448 | 412,629 | 501,132 | 214,084 | 265,953 | 447,762 | 553,001 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Gross profit |

55,349 | 190,133 | 213,056 | 271,620 | 116,770 | 154,430 | 239,025 | 309,280 | ||||||||||||||||||||||||||

| Selling, general and administrative expenses |

75,396 | 213,011 | 238,889 | 275,859 | 126,453 | 150,619 | 248,603 | 300,025 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income (loss) from operations |

(20,047 | ) | (22,878 | ) | (25,833 | ) | (4,239 | ) | (9,683 | ) | 3,811 | (9,578 | ) | 9,255 | ||||||||||||||||||||

| Interest expense |

(2,731 | ) | (4,907 | ) | (3,241 | ) | (3,150 | ) | (1,579 | ) | (1,888 | ) | (3,087 | ) | (3,459 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income (loss) before income taxes |

(22,778 | ) | (27,785 | ) | (29,074 | ) | (7,389 | ) | (11,262 | ) | 1,923 | (12,665 | ) | 5,796 | ||||||||||||||||||||

| Income tax expense (benefit) |

508 | (201 | ) | (423 | ) | 685 | 41 | 783 | (584 | ) | 1,427 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income (loss) |

$ | (23,286 | ) | $ | (27,584 | ) | $ | (28,651 | ) | $ | (8,074 | ) | $ | (11,303 | ) | $ | 1,140 | $ | (12,081 | ) | $ | 4,369 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Basic and diluted net income (loss) per share |

$ | (0.60 | ) | $ | (275,840 | ) | $ | (286,510 | ) | $ | (80,740 | ) | $ | (113,030 | ) | $ | 11,400 | $ | (120,810 | ) | $ | 43,690 | ||||||||||||

| Basic and diluted average number of shares outstanding |

38,969,000 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | ||||||||||||||||||||||||||

| Pro forma net income (loss) per share (2): |

||||||||||||||||||||||||||||||||||

| Basic |

$ | $ | ||||||||||||||||||||||||||||||||

| Diluted |

$ | $ | ||||||||||||||||||||||||||||||||

| Pro forma average number of shares outstanding (2): |

||||||||||||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||||||||||||

| Diluted |

||||||||||||||||||||||||||||||||||

| Other Financial and Operating Data: |

||||||||||||||||||||||||||||||||||

| Growth in net revenues: |

||||||||||||||||||||||||||||||||||

| Stores (3) |

| | (6 | )% | 15 | % | 17 | % | 21 | % | 6 | % | 17 | % | ||||||||||||||||||||

| Direct |

| | (15 | )% | 37 | % | 31 | % | 36 | % | 10 | % | 38 | % | ||||||||||||||||||||

| Total |

| | (10 | )% | 24 | % | 23 | % | 27 | % | 7 | % | 26 | % | ||||||||||||||||||||

| Retail (4): |

||||||||||||||||||||||||||||||||||

| Comparable store sales change (5) |

(12 | )% | (8 | )% | (7 | )% | 19 | % | 26 | % | 20 | % | 10 | % | 17 | % | ||||||||||||||||||

| Retail stores open at end of period |

100 | 99 | 95 | 91 | 96 | 87 | 96 | 87 | ||||||||||||||||||||||||||

| Average gross square footage (in thousands) (6) |

1,072 | 1,060 | 1,042 | 1,014 | 1,019 | 946 | 1,024 | 977 | ||||||||||||||||||||||||||

| Average selling square footage (in thousands) (6) |

677 | 671 | 660 | 641 | 645 | 599 | 648 | 619 | ||||||||||||||||||||||||||

| Retail sales per selling square foot (7) |

$ | 147 | $ | 406 | $ | 525 | $ | 635 | $ | 277 | $ | 351 | $ | 584 | $ | 710 | ||||||||||||||||||

| Direct: |

||||||||||||||||||||||||||||||||||

| Catalogs circulated (in thousands) (8) |

13,771 | 26,831 | 31,336 | 46,507 | 18,893 | 12,768 | 38,266 | 40,382 | ||||||||||||||||||||||||||

| Catalog pages circulated (in millions) (8) |

2,168 | 3,507 | 4,418 | 6,260 | 2,823 | 3,293 | 5,560 | 6,730 | ||||||||||||||||||||||||||

| Direct as a percentage of net revenues (9) |

43 | % | 41 | % | 39 | % | 43 | % | 42 | % | 45 | % | 41 | % | 45 | % | ||||||||||||||||||

| Capital expenditures |

$ | 3,821 | $ | 13,428 | $ | 2,024 | $ | 39,907 | $ | 14,181 | $ | 12,168 | $ | 15,670 | $ | 37,894 | ||||||||||||||||||

| Adjusted EBITDA (10) |

$ | (8,219 | ) | $ | 4,386 | $ | 17,596 | $ | 41,097 | $ | 8,994 | $ | 27,747 | $ | 31,516 | $ | 59,850 | |||||||||||||||||

11

Table of Contents

| As of July 30, 2011 | ||||||||

| Actual | Pro Forma As Adjusted (11) |

|||||||

| (in thousands) | ||||||||

| Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 9,139 | $ | |||||

| Working capital (excluding cash and cash equivalents) (12) |

136,765 | |||||||

| Total assets |

565,529 | |||||||

| Line of credit |

136,609 | |||||||

| Total debt (including current portion) (13) |

146,492 | |||||||

| Total stockholders equity |

218,354 | |||||||

| (1) | The unaudited financial information for the twelve months ended July 31, 2010, has been derived by adding our financial information for the year ended January 30, 2010, to the financial information for the six months ended July 31, 2010, and subtracting the financial information for the six months ended August 1, 2009. The unaudited financial information for the twelve months ended July 30, 2011, has been derived by adding our financial information for the year ended January 29, 2011, to the financial information for the six months ended July 30, 2011, and subtracting the financial information for the six months ended July 31, 2010. |

| (2) | Pro forma net income (loss) per share gives effect to (i) the Reorganization, (ii) the issuance of shares of common stock in this offering and (iii) the application of a portion of the estimated net proceeds from the sale of common stock by us in this offering to repay a portion of the outstanding amounts under Restoration Hardware, Inc.s revolving line of credit as if the offering and those transactions had occurred on January 31, 2010. This assumes net proceeds of this offering of $ million, assuming the shares are offered at $ per share, the midpoint of the estimated price range set forth on the cover of this prospectus, after deducting the underwriting discount and estimated offering expenses. |

| (3) | Store data represent retail stores plus outlet stores. |

| (4) | Retail data have been calculated based upon retail stores, including our Baby & Child Gallery, and excludes outlet stores. |

| (5) | Comparable store sales have been calculated based upon retail stores that were open at least fourteen full months as of the end of the reporting period and did not change square footage by more than 20% between periods. Comparable store net revenues exclude revenues from outlet stores. |

| (6) | Average square footage (gross or selling, as applicable) is calculated for each quarter by taking the total applicable square footage at the beginning of the quarter plus the total applicable square footage at the end of the quarter and dividing by two. Average square footage for periods of six, nine and twelve months is calculated by averaging the average square footage for the quarters within such periods. |

Average square footage (gross or selling, as applicable) for the 2008 Predecessor period is calculated by adding the average applicable square footage for the first quarter of the year ended January 31, 2009, and for the period May 4, 2008, through June 16, 2008, and dividing by two. Average square footage (gross or selling, as applicable) for the period May 4, 2008, through June 16, 2008, is calculated by taking the total applicable square footage at the beginning of the period plus the total applicable square footage at the end of the period and dividing by two.

Average square footage (gross or selling, as applicable) for the 2008 Successor period is calculated by adding the average square footage for three periods, being the period June 17, 2008, through August 2, 2008, the third quarter of the year ending January 31, 2009, and the fourth quarter of the year ended January 31, 2009, and dividing by three. Average square footage (gross or selling, as applicable) for the period June 17, 2008, through August 2, 2008, is calculated by taking the total applicable square footage at the beginning of the period plus the total applicable square footage at the end of the period and dividing by two.

| (7) | Retail sales per selling square foot is calculated by dividing total net revenues for all retail stores, comparable and non-comparable, by the average selling square footage for the period. |

| (8) | The catalogs and catalog pages circulated from period to period do not take into account different page sizes per catalog distributed. Page sizes and page counts vary for different catalog mailings and we sometimes mail different versions of a catalog at the same time. Accordingly, period to period comparisons of catalogs circulated and catalog pages circulated do not take these variations into account. In fiscal 2010, we mailed a larger number of catalogs that contained fewer pages and in some cases significantly smaller page sizes than in prior periods. In the first six months of fiscal 2011, we mailed fewer catalogs that contained a significant increase in number of pages as compared to the first six months of fiscal 2010. |

| (9) | Direct revenues include sales through our catalogs and websites. |

| (10) | A reconciliation of net income (loss) under accounting principles generally accepted in the United States (GAAP) to EBITDA and Adjusted EBITDA is set forth below in Selected Historical Consolidated Financial and Operating Data. |

EBITDA and Adjusted EBITDA have been presented in this prospectus and are supplemental measures of financial performance that are not required by, or presented in accordance with, GAAP. We have presented Adjusted EBITDA for the Predecessor periods consistently with the Successor periods to present such adjustments on a comparable basis for those periods. EBITDA is defined as consolidated net income (loss) before depreciation and amortization, interest expense and provision for income taxes. Adjusted EBITDA is calculated in accordance with and is the basis of our Management Incentive Program (or MIP) as described further under Executive CompensationCompensation Discussion and Analysis, and reflects further adjustments to EBITDA to eliminate the impact of certain items, including non-cash or other items that we do not consider representative of our

12

Table of Contents

ongoing operating performance as discussed in more detail in the section entitled Selected Historical Consolidated Financial and Operating Data.

EBITDA and Adjusted EBITDA are included in this prospectus because they are key metrics used by management, our board of directors, and our Principal Equity Holders to assess our financial performance, and Adjusted EBITDA is used in connection with determining incentive compensation under our MIP. Additionally, EBITDA is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We use Adjusted EBITDA, alongside other GAAP measures such as gross profit, operating income (loss) and net income (loss), to measure profitability, to make budgeting decisions, and to compare our performance against that of other peer companies. We believe that Adjusted EBITDA provides useful information facilitating operating performance comparisons from period to period and company to company.

EBITDA and Adjusted EBITDA are not GAAP measures of our financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance, cash flows from operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP and they should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for managements discretionary use, as they do not consider certain cash requirements such as tax payments and debt service requirements and certain other cash costs that may recur in the future. EBITDA and Adjusted EBITDA contain certain other limitations, including the failure to reflect our cash expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized, and exclude certain unusual charges that may recur in the future. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed to imply that our future results will be unaffected by any such adjustments. Management compensates for these limitations by relying primarily on our GAAP results and by using EBITDA and Adjusted EBITDA only supplementally. Our measures of EBITDA and Adjusted EBITDA are not necessarily comparable to other similarly titled captions of other companies due to different methods of calculation.

| (11) | Pro Forma as Adjusted amounts give effect to (i) the Reorganization, (ii) the issuance of shares of common stock in this offering, (iii) the application of $ million of estimated net proceeds of this offering to repay a portion of the outstanding amounts under the revolving line of credit, (iv) the use of $ million of the estimated net proceeds to pay other fees and expenses incurred in connection with this offering, including management fees of $ to Catterton, Tower Three and Glenhill pursuant to the terms of the management services agreement with them, (v) $ non cash impact to accumulated deficit for stock based compensation charges related to the shares of restricted stock that become vested upon this offering, plus (vi) additional cash payments of $ to former employees that are due as a result of this stock offering. A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover of this prospectus, would increase (decrease) the pro forma as adjusted amount of cash and cash equivalents by approximately $ million, total assets by approximately $ million, line of credit by approximately $ million, total debt (including current portion) by approximately $ million and total stockholders equity by approximately $ million, assuming the number of shares offered by us, as set forth on the cover of this prospectus, remains the same and after deducting the underwriting discount and estimated offering expenses. |

| (12) | Working capital is defined as current assets, excluding cash and cash equivalents, less current liabilities, excluding the current portion of long-term debt. |

| (13) | Total debt (including current portion) includes amounts outstanding under the line of credit and capital lease obligations. |

13

Table of Contents

This offering and an investment in our common stock involve a high degree of risk. You should carefully consider the risks and uncertainties described below, together with the risks and uncertainties described elsewhere in this prospectus, including our consolidated financial statements and the related notes contained elsewhere in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks or uncertainties actually occurs, our business, financial condition, results of operations, cash flow and prospects could be materially and adversely affected. As a result, the price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

We are undertaking a large number of business initiatives at the same time and if these new initiatives are not successful, they may have a negative impact on our operating results.

We are in the process of an ongoing major transformation of our business characterized by a period of rapid growth and a large number of new business initiatives. For example, we recently developed a new full line Design Gallery format which involves larger store square footage. We plan to open full line Design Galleries in select major metropolitan markets and we expect to close a number of our older stores and replace them with the new full line Design Gallery format. We are currently contemplating other new product lines and extensions, as well as expanding sales to other channels and international markets. In addition, we are continuing a number of new initiatives in other areas of our business, including product sourcing and distribution and management information systems. For example, we recently eliminated the use of third party buying agents in most foreign locations. In addition, we have recently significantly expanded the page counts of our catalogs, increased the number of households receiving our catalogs and reduced the number of catalog mailings.

The number of current business initiatives could strain our financial, operational and management resources. In addition, these initiatives may not be successful. For example, if customers do not respond favorably to our new full line Design Gallery format or our larger Source Book catalogs over time, our financial results may be adversely affected. All of the foregoing risks may be compounded during the current or any future economic downturn. If we are not successful in managing our current growth and the large number of new initiatives that are underway, we might experience an adverse impact on our financial performance and results of operations. In addition, if we fail to achieve the intended results of our current business initiatives, or if the implementation of these initiatives is delayed or abandoned, diverts managements attention or resources from other aspects of our business, or costs more than anticipated, we may experience inadequate return on investment for some of our business initiatives, which would have a negative effect on our operating results.

Growth in our business may not be sustained and may not generate a corresponding improvement in our results of operations.

We may not be able to maintain or improve the levels of growth that we have experienced in the recent past. For example, although our net revenue for the first six months of fiscal 2011 grew by approximately 27% over the same period of fiscal 2010, there can be no assurance that we can achieve these levels of growth in the future.

In addition, we have also recently experienced strong comparable store sales. Comparable store sales increased 20% during the first six months of fiscal 2011 as compared to the same period of fiscal 2010, and comparable store sales increased 19% during fiscal 2010 compared to fiscal 2009. If our future comparable store sales fail to meet market expectations or decline, the price of our common stock could decline. Various factors affect comparable store sales, including the number, size and location of stores we open, close, remodel or expand in any period, the overall economic and general retail sales environment, consumer preferences and demand, our ability to efficiently source and distribute products, changes in our product offerings, competition,

14

Table of Contents

current local and global economic conditions, changes in catalog circulation and the success of marketing programs. These factors may cause our comparable store sales results to be materially lower than recent periods and our expectations, which could harm our results of operations and result in a decline in the price of our common stock.

Although we have recently experienced sales growth as a result of a number of new business initiatives, this sales growth may not continue and the level of our sales could return to prior levels if customer response to our product offerings is not sustained. Many factors can influence customer response to our product offerings and store formats including responses from our competitors who may introduce similar products or merchandise formats. In addition, sales levels for particular merchandise or product categories may not continue over time if customer demand levels are not sustained. The level of customer response to new store formats including our full line Design Galleries may vary in different markets and store locations. Similarly, the level of customer response to our new Source Book may vary in different markets. In addition, there can be no assurance that we will be able to migrate customer demand successfully when we choose to close a store in a particular location in favor of a new full line Design Gallery in the same or an adjacent market location. While our objective is to retain a high percentage of customer demand from store locations that we closed during fiscal 2010, there can be no assurance that we will retain a high percentage of sales from stores closed in the future or that we will continue to retain a high percentage of sales from stores previously closed.

In addition, continued increased activity in our business could result in material changes in our operating costs, including increased merchandise inventory costs and costs for paper and postage associated with the mailing and shipping of catalogs and products. We cannot assure you that we will succeed in offsetting these expenses with increased efficiency or that cost increases associated with our business will not have an adverse effect on our financial results.

If we fail to successfully anticipate consumer preferences and demand, and manage our inventory commensurate with demand, our results of operations may be adversely affected.

Our success depends in large part on our ability to originate and define home product trends, as well as to anticipate, gauge and react to changing consumer demands in a timely manner. Our products must appeal to a range of consumers whose preferences cannot always be predicted with certainty. We cannot assure you that we will be able to continue to develop products that customers positively respond to or that we will successfully meet consumer demands in the future. Any failure on our part to anticipate, identify or respond effectively to consumer preferences and demand could adversely affect sales of our products. If this occurs, our sales may decline significantly, and we may be required to mark down certain products to sell the resulting excess inventory or to sell such inventory through our outlet stores, either of which could have a material adverse effect on our financial condition and results of operations.

In addition, we must manage our merchandise in stock and inventory levels to track consumer demand. Much of our merchandise requires that we provide vendors with significant ordering lead time, frequently before market factors are known. In addition, the seasonal nature of our products requires us to carry a significant amount of inventory prior to peak selling seasons. If we are not able to anticipate consumer demand for our different product offerings, or successfully manage inventory levels for products that are in demand, we may experience:

| | back orders, order cancellations and lost sales for products that are in high demand for which we did not stock adequate inventory; and |

| | overstock inventory levels for products that have lower consumer demand, requiring us to take markdowns or other steps to sell slower moving merchandise. |

As a result of these and other factors, we are vulnerable to demand and pricing shifts and to misjudgments in the selection and timing of merchandise purchases.

15

Table of Contents

Our performance and growth strategy depends on our ability to purchase our merchandise in sufficient quantities at competitive prices, including our products that are produced by artisans and specialty vendors, and any disruptions we experience in our ability to obtain our products in a timely fashion or in the quantities required could have a material adverse effect on our business.

We do not own or operate any manufacturing facilities. We instead purchase all of our merchandise from a large number of vendors, many of which are the sole sources for particular products. Our growth strategy includes expanding the amount of products we sell, and our performance depends on our ability to purchase our merchandise in sufficient quantities at competitive prices. However, many of our key products are produced by artisans, specialty vendors and other vendors that may have limited production capacity. In addition, some of our vendors are small and undercapitalized firms. A number of our vendors, particularly our artisan vendors, may have limited resources, production capacities and operating histories. As a result, the capacity of some of our vendors to meet our supply requirements has been, and may in the future be, constrained at various times and our vendors may be susceptible to production difficulties or other factors that negatively affect the quantity or quality of their production during future periods. A disruption in the ability of our significant vendors to access liquidity could also cause serious disruptions or an overall deterioration of their businesses which could lead to a significant reduction in their ability to manufacture or ship products to us.

In addition, any difficulties that we experience in our ability to obtain products in sufficient quality and quantity from our vendors could have a material adverse effect on our business. In fiscal 2010, we purchased approximately 84% of our merchandise from vendors that are located abroad. Our ability to obtain desired merchandise in sufficient quantities could be impaired by events that adversely affect our vendors or the locations in which they operate, such as difficulties or problems associated with our vendors operations, business, finances, labor, importation of products, costs, production, insurance and reputation. Failure of vendors to produce adequate quantities of merchandise in a timely manner has resulted in back orders and lower revenue in certain periods of our business operation including during fiscal 2010. While we believe our vendors have increased their capacity to meet our demand and have addressed the issues encountered in fiscal 2010, we cannot assure you that our vendors will be able to produce adequate quantities of merchandise in a timely manner in the future.

We also do not have long-term contracts or other contractual assurances of continued supply, pricing or access to new products with our vendors, and generally we transact business with our vendors on an order by order basis. Therefore, any vendor could discontinue selling to us at any time. Any disruptions we experience in our ability to obtain our products in a timely fashion or in the quantities required could have a material adverse effect on our business.

We may not be able to locate and develop relationships with a sufficient number of new vendors, which could lead to product shortages and customer backorders, which could harm our business.

In the event that one or more of our vendors is unable to meet our quantity or quality demands, we may not be able to identify new vendors in a timely fashion, or at all. Even if we do identify such new vendors, we may not be able to develop relationships with them quickly enough to replace any discontinued vendors without experiencing product shortages and customer backorders. In addition, we cannot assure you that any new vendor with which we contract, particularly any new vendor abroad, would not be subject to the same or similar quality and quantity risks.

We do not have exclusive relationships with many of our vendors, and there is a risk that our vendors may sell similar or identical products to our competitors, which could harm our business.

Our arrangements with our vendors are generally not exclusive. As a result, most of our vendors might be able to sell similar or identical products to certain of our competitors, some of whom purchase products in significantly greater volume, or enter into arrangements with suppliers that could impair our ability to sell their products, including by requiring suppliers to enter into exclusive arrangements, which could limit our access to

16

Table of Contents

such arrangements or products. Our vendors could also initiate or expand sales of their products through their own stores or through the Internet to the retail market and therefore compete with us directly or sell their products through outlet centers or discount stores, increasing the competitive pricing pressure we face.

We may not have adequate remedies with our vendors for defective merchandise, which could damage our reputation and brand image and harm our business.

If products that we purchase from vendors are damaged or prove to be defective, we may not be able to return products to these vendors and obtain refunds of our purchase price or obtain other indemnification from them. Our vendors limited capacities may result in a vendors inability to replace any defective merchandise in a timely manner. In addition, our vendors limited capitalization or liquidity may mean that a vendor that has supplied defective merchandise will not be able to refund the purchase price to us or pay us any penalties or damages.

In addition, our vendors may not adhere to our quality control standards, and we might not identify the deficiency before merchandise ships to our stores or customers. Our vendors failure to manufacture or import quality merchandise in a timely and effective manner could damage our reputation and brand image, and could lead to an increase in customer litigation against us and a corresponding increase in our routine and non-routine litigation costs. Further, any merchandise that does not meet our quality standards or other government requirements could become subject to a recall, which could damage our reputation and brand image and harm our business.

Changes in consumer spending or the housing market may significantly harm our revenue and results of operations.

Our business depends on consumer demand for our products and, consequently, is sensitive to a number of factors that influence consumer spending, including, among other things, the general state of the economy, capital and credit markets, consumer confidence, general business conditions, the availability and cost of consumer credit, conditions in the retail home furnishings sector, the level of consumer debt, interest rates, level of taxes affecting consumers, housing prices, new construction and other activity in the housing sector and the state of the mortgage industry and other aspects of consumer credit tied to housing, including the availability and pricing of mortgage refinancings and home equity lines of credit. We believe that a number of these factors have had, and may continue to have, an adverse impact on our business and results, and these factors may make it difficult for us to accurately predict our operating and financial results for future periods.

For example, the general economic uncertainty over the last several quarters has led to decreased discretionary spending. The economic environment, together with other factors in the financial markets, have contributed to a prolonged slump in the housing market. Our business is dependent upon home purchases and remodelings. The slowdown in the housing sector has affected the level of home purchases and remodelings and we anticipate this slowdown may continue for the foreseeable future. All of these factors have adversely affected the level of consumer spending on home furnishings and we believe these factors have caused reduction in consumer demand for our product offerings. In addition, prolonged periods of reduced consumer confidence and continuation of adverse economic conditions may adversely affect consumer demand for discretionary items and luxury retail products and may drive our customers to seek lower cost alternatives to our product offerings. Our sales results were adversely affected in 2007, 2008 and 2009 due at least in part to macroeconomic factors affecting housing, as well as the economic recession and decreased consumer spending in North America. The future of the North American economy is uncertain and there can be no assurance that the recent trends in economic recovery will be sustained or that the housing market will recover.

Reduced consumer confidence and spending may also limit our ability to increase prices or sustain price increases and may require increased levels of selling and promotional expenses. We may be required to launch cost-cutting initiatives to reduce operating costs, and these initiatives may not be successful in reducing costs significantly or may impair our ability to operate effectively.

17

Table of Contents

If we lose key personnel or are unable to hire additional qualified personnel, our business may be harmed.