EX-99.1

Published on December 11, 2015

Exhibit 99.1

Transcript of Investor Video Presentation by

Restoration Hardware Holdings, Inc. on December 10, 2015

Transcript of Gary Friedman - 3Q15 Video Presentation

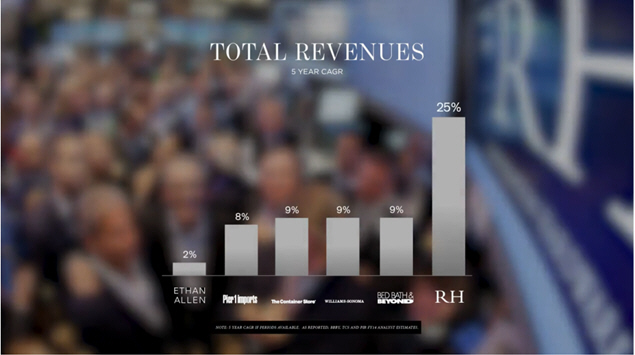

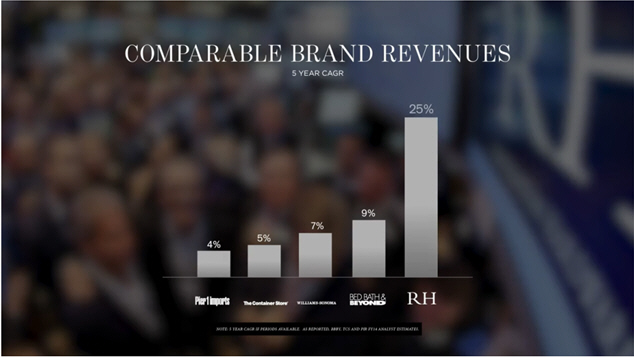

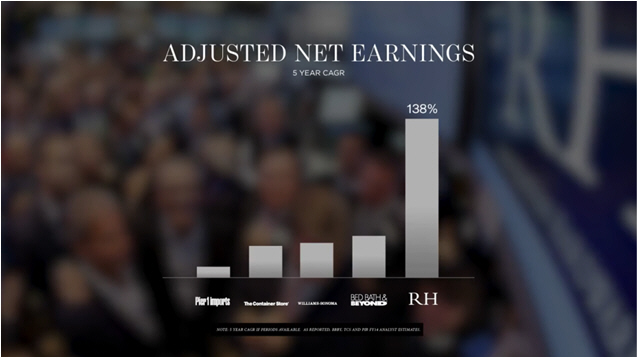

Since our public offering 3 years ago, weve outperformed our home furnishings peers by a wide margin. Over the past 5 years our compounded growth rates in total revenues, comparable brand revenues and adjusted net earnings demonstrate the power of our platform, and a culture of innovation that is widely referenced but rarely seen in our industry.

We continue to prove that our strategy of building larger stores and mailing bigger books while unconventional, has produced results that are equally so.

While nearly 50% of our revenues today are online, over 90% of our business is delivered direct to customers, as our fully integrated, multi-channel platform has proven to be a meaningful competitive advantage.

We believe blurring the lines between physical and digital, where our stores act as showrooms for our brand will be the winning model.

We also continue to believe, that when the dust settles, our strategy of what is arguably the most significant retail transformation in history, will prove to be the right one.

That the physical manifestation of an aspirational brand in an inspiring three dimensional environment, will prove to be more valuable than a one dimensional online store.

We are no longer alone in our thinking, as online only retailers are opening stores and learning about the power of physical with digital.

Just recently, Leslie Wexner, the Chairman and CEO of L Brands, speaking at his annual investor conference also passionately endorsed physical stores, telling the audience...This may not sound sexy, but...

SLIDE: Brick and mortar is way, way, way bigger than the Internet

I would also add, our reluctance to follow the crowd and make unproven marketing investments has also confounded many critics.

Weve found no correlation between the number of friends you have on Facebook, or followers on Twitter, Instagram or Pinterest, to sales or earnings growth.

In fact, it was recently pointed out that we ranked a lowly 71 out of 73 brands on the Digital IQ Index of Specialty Retailers. I would point out, however, that if you arranged the same list of retailers by earnings growth over the past 5 years we believe we would end up at the top, and not by a small margin.

We believe our performance is a result of saying no to the multiple interesting choices that our organization is constantly faced with so we can direct our energies into the few relevant ones.

Since our offering we have remained focused on two growth strategies that have enabled us to disrupt the luxury home furnishings marketplace, and continue to drive long term, sustainable growth.

Those two strategies are,

The expansion of our brand,

and...

The transformation of our retail stores...

Let me take a moment to update you on our recent progress... As it relates to the expansion of our brand, we are innovating and executing at an unprecedented pace.

We recently unveiled two new businesses, RH Modern, and RH Teen.

RH Modern was launched with a 540 page sourcebook, its own dedicated website, a significant retail presence inside our Next Generation Galleries, plus a freestanding gallery on Beverly Blvd in Los Angeles.

While still early, as the majority of RH Modern books arrived in home around the middle of November, the trends are very encouraging.

In the retail locations where RH Modern is now featured, we have early data that RH Modern is adding more than 40 points of incremental volume.

In Los Angeles where we opened our first freestanding location, RH Modern is trending to add over 60 points of incremental volume, with a $25 million dollar annual run rate, while our Melrose Gallery continues to comp positive only a few blocks away.

These early reads would indicate that RH Modern will drive significant incremental revenues and open up the RH brand to an entirely new market.

We expect RH Modern volumes to build as in-stocks improve, we continue to expand the assortment, and aggressively grow the retail footprint over the next several years.

For those of you who havent seen an RH Modern live, here is a short video of our new Beverly Blvd Gallery in Los Angeles.

(VIDEO)

RH Teen is off to a strong start, and also opens up our brand to a new, and we believe underserved market. RH Teen launched with its own 200 page Sourcebook, a dedicated website and a retail presence in our new Next Generation Galleries in Chicago, Denver, and Tampa.

We expect to continue expanding the RH Teen offer and increasing our retail footprint in concert with the rollout of RH Baby and Child.

Now let me turn your attention to the transformation of our retail stores.

First I would say, we could not be happier with the recent results.

Our new galleries that opened in Chicago, Denver, and Tampa are all exceeding our expectations.

Im also pleased to report that our first Next Generation Gallery that opened last year in Atlanta is comping up strongly now that the store has come up against its one year anniversary.

Thats despite the fact we have not yet added RH Modern or Teen. Both concepts are scheduled to be added to Atlanta in Q1 and will drive even higher sales increases.

Each of the new Galleries weve opened this year represents an important test for our brand.

In Chicago, we are testing our first truly freestanding gallery. The store is not in a typical retail district, in fact the closest retail store is 5 blocks away.

The Gallery is located in the 3Arts Club, a historic building adjacent to one of Chicagos most affluent residential neighborhoods, the famous gold coast.

We wanted to see if we could create a destination, that if successful, would open up the aperture of the real estate possibilities and provide leverage in negotiations as we prove ourselves to be a tenant that can energize a neighborhood or project and drive traffic.

We refer to The 3Arts Club, where we opened our first restaurant, The 3Arts Cafe, with Chicago restauranteur and chef Brendan Sodikoff, as our Field of Dreams and if we built something special, they would come.

Well, I am pleased to tell you that they have, as RH Chicago, is our best performing gallery to date.

In fact, this is a picture of what the line looks like to get a seat at The 3Arts Cafe on a typical weekend before we open our doors...

Weve articulated that our goal has always been to blur the lines between residential and retail, creating an environment that was more home than store.

The next logical evolution is to blur the lines between home and hospitality, creating an integrated experience that engages our guests and immerses them into the RH lifestyle.

Lets take a peek inside this restored and reimagined historic building, and show you what the commotion is all about...

In Denver, we partnered with the Taubman Company, to become the first specialty retailer in history to anchor a major regional shopping center, where a former Saks 5th Avenue was torn down and replaced with RH Denver, the gallery at Cherry Creek.

I want to thank Billy and Bobby Taubman for taking the risk and being the first developer to make a significant investment and bet on RH as a tenant that could not only attract the right clientele to the center, but also attract the right new tenants.

In Tampa, we also partnered with the Taubman Company and our plan was to test a next generation gallery in a secondary market.

Our objective was to build a slightly smaller and less expensive gallery that still presented the full offer of the brand, and met our return on investment targets.

Im pleased to tell you that so far, RH Tampa, the Gallery at International Plaza is achieving all of our objectives and is outperforming our expectations by a wide margin.

This gives us great confidence regarding the reach of our brand and the ability to profitably expand our retail footprint in smaller markets.

All of our new galleries opened this year, including RH Modern, should have a payback period of less than 18 months, and in some cases less than a year.

When we step back and consider the positive response of our two new businesses, the over performance of all of our new Galleries, and the exciting new product we have in the development pipeline for 2016 and beyond.

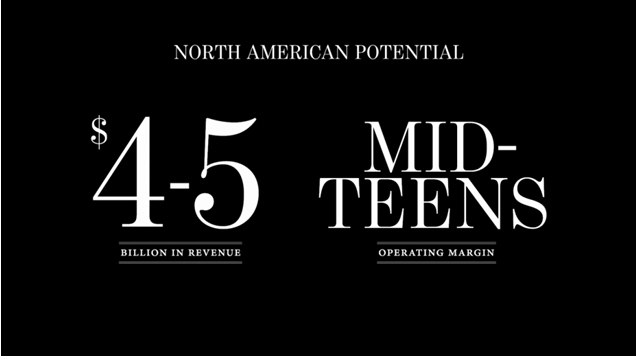

We could not be more confident about our long term goal of reaching $4-5 Billion in North American Revenues.

In closing, I would like to congratulate and thank our team and partners from around the world.

For us, this is much more than a company, this is our cause.

Its about much more than profits, its about purpose.

Its about much more than the value of the company, its about the values of our company.

As weve demonstrated our culture has a bias for innovation versus duplication, leadership versus follow-ship, and weve proven we have the courage to destroy todays reality to create tomorrows future.

As our shareholders, you can count on us to continue testing, learning, evolving, and growing in our quest to become one of the highest performing and most admired brands in the world.

By chasing our hopes and dreams, we hope to inspire others to chase theirs.

Transcript of Karen Boone - 3Q15 Video Presentation

The many innovations and transformative changes that we have made in evolving our business model are leading us down a clear path toward significant shareholder value creation.

We remain on track to reach $4 to $5 billion in revenue with a mid-teens operating margin once our North American real estate transformation is complete.

We expect the expansion of our operating margin to come from leverage of our occupancy, advertising and fixed corporate expenses, as well as improvement in our product and shipping margins.

We also see a clear, near-term path to becoming Free Cash Flow positive and continue to expect to reach this important goal within the next year.

We have been growing our business horizontally by expanding our product assortment and adding new businesses.

We believe it takes a year to properly optimize new investments.

We expect that as we accelerate square footage growth, and grow our business vertically, we will begin to increase inventory turns and significantly improve cash flow and working capital needs.

We also continue to make progress with our vendors to extend payment terms such that our payables increase as our businesses scale together.

We continue to generate strong returns on our invested capital and based on the further evolution and improvement in our real estate negotiations, believe those trends will continue to improve.

Let me now talk about our recent results

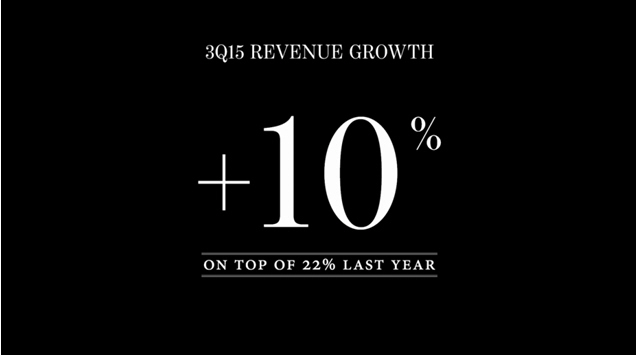

Revenues during the third quarter increased 10% on top of 22% last year.

As anticipated, we did experience a deceleration from the second quarter based on a shift in the timing of our new product introductions.

We had a significant reduction in the amount of newness introduced in our Core business given the launches of RH Modern and RH Teen later in the year.

We also had a significant reduction in circulated pages this year.

Both of these factors had an impact on our Q3 growth rate as we began to anniversary the build and acceleration of last years Spring Source Books.

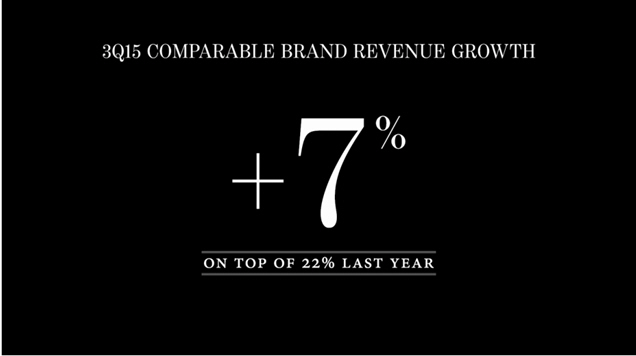

Comparable brand revenue growth was 7% in Q3 on top of 22% last year.

The delta between comparable brand revenue growth and net revenue growth was slightly wider during the quarter given the strong performance of our non-comp next generation Design Galleries, as well as Outlet warehouse sales held during the quarter.

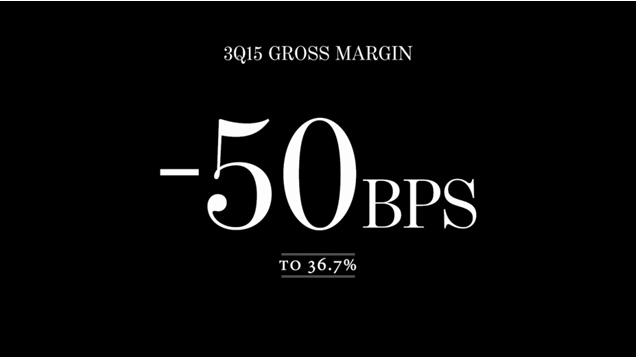

As anticipated, adjusted gross margin decreased 50 basis points to 36.7% driven by lower margin Outlet warehouse sales, higher shipping costs, and deleverage in supply chain occupancy related to our new DC in Northern California.

These decreases were partially offset by higher merchandise margins in our Core business and leverage in our fixed supply chain and retail occupancy costs.

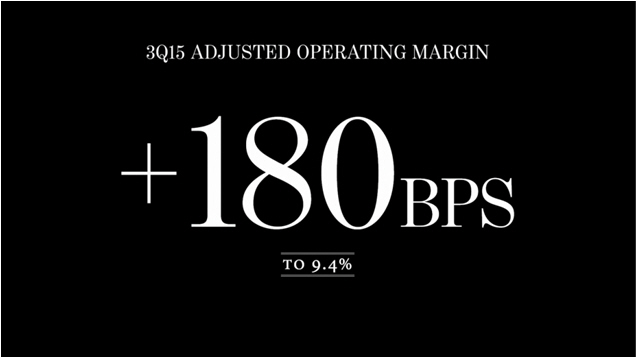

We continued to deliver solid earnings growth and operating margin expansion.

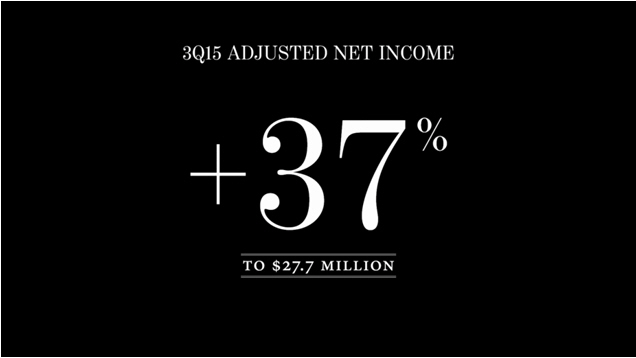

Adjusted operating margins expanded 180 basis points to 9.4%...

and adjusted net income increased 37% to $27.7 million during the quarter.

Inventory at the end of the third quarter was up 25% year-over-year...and we continue to expect to end the year with inventory growth that is higher than our sales growth given the inventory investments in RH Modern and RH Teen.

We continued to execute on several key operational initiatives.

The investments we have made in our supply chain and systems infrastructure will enable us to continue to improve our customer experience and support our long-term growth.

Early in the third quarter, we opened a new state of the art, 1.5 million square foot DC in Northern California to support our growth.

By the end of the year, we will be delivering almost 60% of our furniture through our insourced home delivery network, with plans to continue to insource additional markets over time.

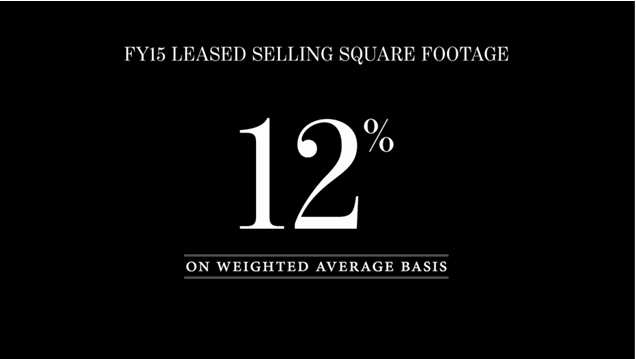

We also continue to make investments in our customer service capabilities and in our product quality infrastructure. Turning to our outlook We now expect fiscal 2015 weighted average leased selling square footage growth of approximately 12% as our next generation Design Gallery in Austin will not be opening during fiscal 2015 as planned.

Development at The Domain is still underway and although construction of our store is complete, we have chosen to delay our grand opening until construction on our neighboring stores in the mall is also substantially complete.

We now expect Austin to open in April 2016.

Based on this shift we expect to have approximately 20 new, next generation Design Gallery store months in fiscal 2015 - accelerating next year to 50 to 60 new store months as we benefit from the stores that we opened this year PLUS the addition of the 6 Galleries we expect to open in fiscal 2016.

The pipeline for 2016 and beyond continues to build nicely we currently have 13 leases signed for 2016 and beyond, and are in negotiations or have identified sites for over 25 more locations.

There are several factors that have had an impact on our business in the second half of 2015.

First, the significant reduction in our 2015 Source Book pages circulated had a more meaningful impact on our business, and especially in those categories where we cut pages.

Second is the fact that the majority of our newness came vis a vis RH Modern and RH Teen later in the year versus all in the Spring, as in years past.

Third, RH Modern is building later than anticipated as those Source Books were not in home until mid-November versus our original expectation of mid-October.

Finally, there are various external, macro factors outside our control, including deteriorating trends in regions impacted by currency and oil prices.

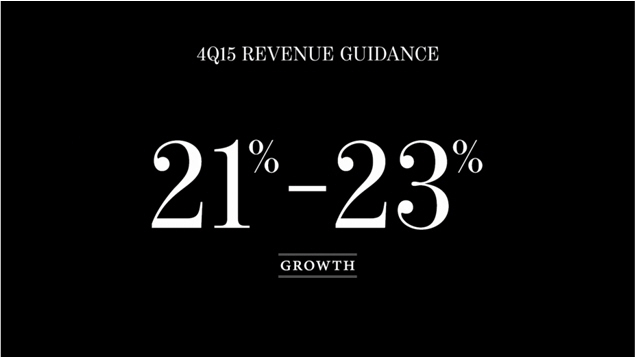

As we continue into the remainder of Q4, we feel confident in our ability to take share in this highly promotional environment and anticipate Q4 revenue growth to be in the range of 21% to 23%.

We plan to optimize and appropriately landscape our P&L to deliver adjusted diluted EPS growth in the range of 34% to 39%.

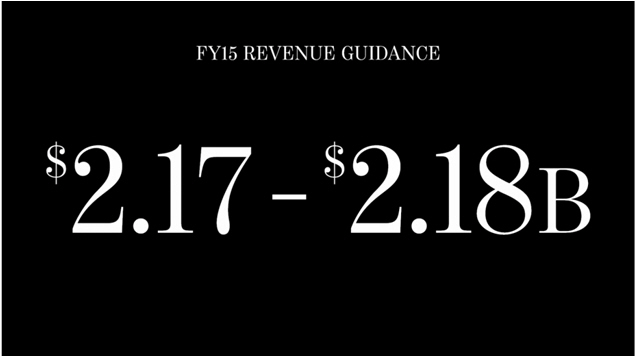

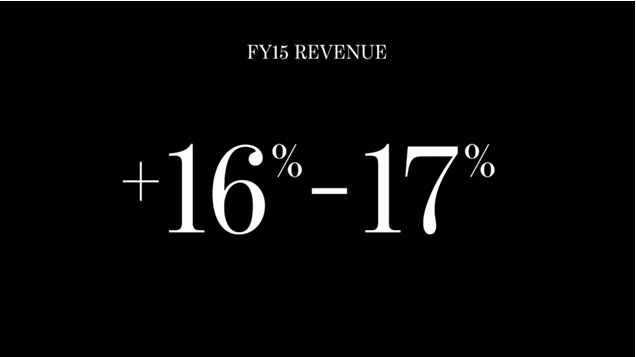

We are increasing our fiscal 2015 revenue guidance to a range of $2.17 to $2.18 billion, which represents growth in the range of 16 to 17%.

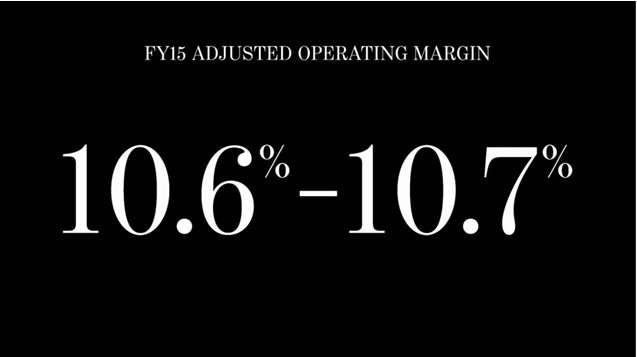

We expect adjusted operating margins to be in the range of 10.6 to 10.7%.

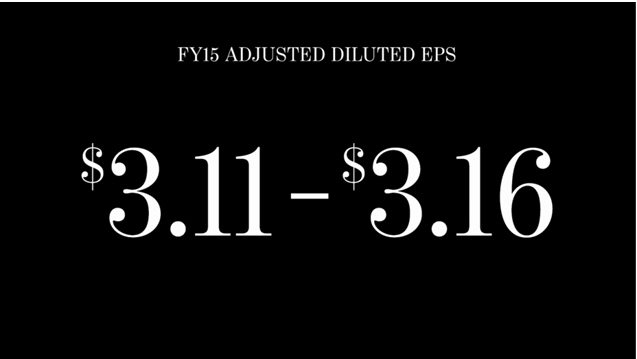

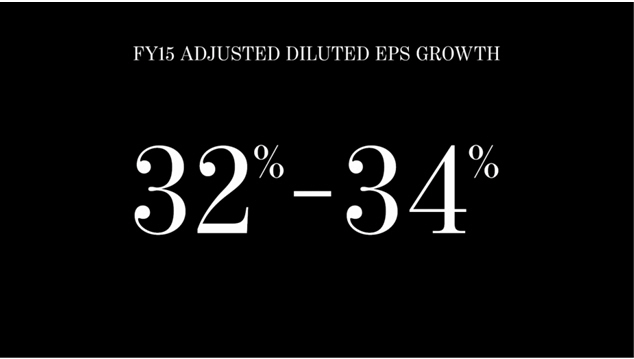

We are raising our adjusted diluted EPS guidance to a range of $3.11 to $3.16, representing growth in the range of 32% to 34% - above our long term target of earnings growth in the mid to high twenties.

We are excited about the future and the tremendous opportunity that lies ahead and are focused on delivering on our long term goals - including $4-5 billion in revenues in North America, mid-teens operating margin and significant free cash flow generation.

We have a proven ability to adapt and execute, combined with an un-matched level of innovation and a powerful multi-channel platform which will enable us to continue to deliver industry-leading results over the long-term.

And we believe our focus on being one of those very few companies in history that can deliver durable growth, significant free cash flow, and ROIC growth over the very long term will create tremendous value for our shareholders.

We wish you, our team, and all of our partners around the world a very happy holiday season.