10-K/A: Annual report pursuant to Section 13 and 15(d)

Published on May 31, 2019

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 2, 2019

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35720

(Exact name of registrant as specified in its charter)

| Delaware | 45-3052669 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

| 15 Koch Road Corte Madera, CA |

94925 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrants telephone number, including area code: (415) 924-1005

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each class) |

(Trading symbol) |

(Name of each exchange on which registered) |

||

| Common Stock, $0.0001 par value | RH | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 3, 2018, the last business day of the registrants most recently completed second quarter, the approximate market value of the registrants common stock held by non-affiliates was $2,651,665,414. Solely for purposes of this disclosure, shares of common stock held by executive officers and directors of the registrant as of such date have been excluded because such persons may be deemed to be affiliates.

As of May 23, 2019, 18,360,211 shares of registrants common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

RH

| 1 | ||||||

| PART II. | ||||||

| Item 9B. |

Other Information | 2 | ||||

| PART III. | ||||||

| Item 10. |

Directors, Executive Officers and Corporate Governance | 3 | ||||

| Item 11. |

Executive Compensation | 11 | ||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 39 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence | 41 | ||||

| Item 14. |

Principal Accounting Fees and Services | 43 | ||||

| PART IV. | ||||||

| Item 15. |

Exhibits and Financial Statement Schedules | 44 | ||||

Table of Contents

This Amendment No. 1 on Form 10-K/A (the Amendment) amends the Annual Report on Form 10-K of RH, a Delaware corporation (we, us, or the Company), for the fiscal year ended February 2, 2019, originally filed with the Securities and Exchange Commission (the SEC) on March 29, 2019 (the Original Filing). This Amendment is being filed to include the information required by Item 10Directors, Executive Officers and Corporate Governance, Item 11Executive Compensation, Item 12Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters, Item 13Certain Relationships and Related Transactions, and Director Independence and Item 14Principal Accountant Fees and Services of Part III of Form 10-K. The reference on the cover page of the Original Filing to the incorporation by reference of portions of our definitive proxy statement into Part III of the Original Filing is hereby deleted. Items 10, 11, 12, 13 and 14 of Part III of the Original Filing are amended and restated in their entirety as set forth in the Amendment. In addition, pursuant to Rule 13a-14(a) of the Securities Exchange Act of 1934, as amended (the Exchange Act), we are including with the Amendment certain currently dated certifications. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. We are not including the certifications under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Amendment.

In addition, the Amendment includes information under Item 9BOther Information with respect to amendments to our amended and restated credit agreement and second lien credit agreement entered into on May 31, 2019. Item 9B of Part II of the Original Filing is amended to add the disclosure as set forth in this Amendment.

Except as described above, no other amendments are being made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events that occurred at a date subsequent to the filing of the Original Filing other than as expressly indicated in this Amendment. Accordingly, this Amendment should be read in conjunction with the Original Filing and our other filings made with the SEC on or subsequent to March 29, 2019.

1

Table of Contents

| Item 9B. | Other Information. |

Fourth Amendment to Eleventh Amended and Restated Credit Agreement

On May 31 2019, Restoration Hardware, Inc., a wholly-owned subsidiary of RH, entered into a Fourth Amendment to the Eleventh Amended and Restated Credit Agreement, dated as of May 31, 2019 (the Fourth Amendment), which amends that certain Eleventh Amended and Restated Credit Agreement, dated as of June 28, 2017, among Restoration Hardware, Inc., as lead borrower, various other subsidiaries of RH named therein as borrowers, the guarantors party thereto, the lenders party thereto and Bank of America, N.A. as administrative agent and collateral agent (as heretofore amended or otherwise modified from time to time, the First Lien Credit Agreement). The Fourth Amendment, among other things, (a) extends the time to deliver monthly financial statements to the lenders for the fiscal months ending February 2019 and March 2019 until June 19, 2019; (b) removes the requirement to deliver monthly financial statements to the lenders for the last fiscal month of any fiscal quarter; and (c) waives any default or event of default under the First Lien Credit Agreement relating to the delivery of monthly financial statements or other information to lenders for the fiscal months ending February 2019 and March 2019. The foregoing is only a summary of the material terms of the Fourth Amendment and does not purport to be complete, and is qualified in its entirety by reference to the Fourth Amendment, a copy of which is filed as Exhibit 10.26 hereto and incorporated by reference herein.

First Amendment to Second Lien Credit Agreement

On May 31, 2019, Restoration Hardware, Inc., a wholly-owned subsidiary of RH, entered into a First Amendment to the Credit Agreement, dated as of May 31, 2019 (the First Amendment), which amends that certain Credit Agreement, dated as of April 9, 2019 and effective as of April 10, 2019, among Restoration Hardware, Inc., as lead borrower, the guarantors party thereto, the lenders party thereto, and BSP Agency, LLC as administrative agent and collateral agent (the Second Lien Credit Agreement). The First Amendment, among other things, (a) removes the requirement to deliver monthly financial statements to the lenders for the last fiscal month of any fiscal quarter; and (b) waives any default or event of default under the Second Lien Credit Agreement relating to the delivery of monthly financial statements or other information to lenders for the fiscal months ending February 2019 and March 2019. The foregoing is only a summary of the material terms of the First Amendment and does not purport to be complete, and is qualified in its entirety by reference to the First Amendment, a copy of which is filed as Exhibit 10.27 hereto and incorporated by reference herein.

2

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance. |

DIRECTORS

Below is detailed biographical information and ages, as of May 23, 2019, for each of our directors and a summary of the qualifications and skills demonstrated by each directors experience.

CLASS I DIRECTORS CONTINUING IN OFFICE UNTIL THE 2019 ANNUAL MEETING

| ERI CHAYA | ||

| Age: 45 Director since 2012 Board Committees: None |

Eri Chaya has served as a member of our board of directors since November 2012. Ms. Chaya also serves as our President, Chief Creative and Merchandising Officer. Ms. Chaya leads product curation and integration, brand development and design, and Interior Design for RH Interiors, Modern, Outdoor, Baby & Child and Teen, across the Companys physical, digital and print channels of distribution. Ms. Chaya served as RHs Co-President, Chief Creative and Merchandising Officer and Director from May 2016 to November 2017, Chief Creative Officer from April 2008 to May 2016 and Vice President of Creative from July 2006 to April 2008. Prior to RH, Ms. Chaya was a creative director at Goodby, Silverstein and Partners, an international advertising agency, and a creative director at Banana Republic.

Qualifications: Ms. Chaya was selected to our board of directors because of her extensive knowledge and experience in design, product development, brand development, marketing and advertising. |

|

| MARK DEMILIO | ||

| Age: 63 Director since 2009 Board Committees: Audit, Compensation, Nominating and Corporate Governance |

Mark Demilio has served as a member of our board of directors since September 2009 and currently serves as the boards Lead Independent Director. Since September 2015, Mr. Demilio has served as a member of the board of directors and Chairman of the audit committee of Schumacher Clinical Partners, a privately-held provider of emergency medicine and hospitalist services through physician staffing and management. Since June 2018, Mr. Demilio has served as a member of the board of directors and Chairman of the audit committee of Nurse Assist, a privately-held FDA registered manufacturer of medical device products. Mr. Demilio was a member of the board of directors of Cosi, Inc., a national restaurant chain, from April 2004 to May 2017, served on its audit committee, its compensation committee and its nominating and corporate governance committee, and served for a time as Chairman of the board of directors of Cosi and as the interim Chief Executive Officer of Cosi. From February 2014 through March 2016, Mr. Demilio served as a member of the board of directors and Chairman of the audit committee of The Paslin Company, a private company that designs, assembles and integrates robotic assembly lines for the automotive industry. From December 2000 until his retirement in October 2008, Mr. Demilio served as the Chief Financial Officer of Magellan Health Services, Inc., a Nasdaq-listed managed specialty healthcare company that managed the delivery of behavioral healthcare treatment services, specialty pharmaceuticals and radiology services. Mr. Demilio has also been the General Counsel for Magellan Health Service, the Chief Financial Officer and General Counsel of Youth Services International, Inc., an attorney specializing in corporate and securities law with the law firms of Miles & Stockbridge and Piper & Marbury, a financial analyst for CareFirst BlueCross BlueShield of Maryland and a certified public accountant with Arthur Andersen LLP.

Qualifications: Mr. Demilio was selected to our board of directors because he possesses particular knowledge and experience in accounting, finance and capital structure, strategic planning and leadership of complex organizations and board practices of other major corporations. |

|

3

Table of Contents

| LEONARD SCHLESINGER | ||

| Age: 66 Director since 2014 Board Committees: Compensation |

Leonard Schlesinger was appointed to our board of directors in April 2014. Dr. Schlesinger has served as the Baker Foundation Professor of Business Administration at Harvard Business School, a role he returned to in July 2013 after having served as the President of Babson College from July 2008 until July 2013 and having held various positions at public and private companies. From 1999 to 2007, Dr. Schlesinger held various executive positions at Limited Brands, Inc. (now L Brands, Inc.), an NYSE-listed company, including Vice Chairman of the board of directors and Chief Operating Officer. While at Limited Brands, he was responsible for the operational and financial functions across the enterprise including Express, Limited Stores, Victorias Secret Beauty, Bath and Body Works, C.O. Bigelow, Henri Bendel and the White Barn Candle Company. Dr. Schlesinger also previously served as Executive Vice President and Chief Operating Officer at Au Bon Pain Co., Inc. and as a director of numerous public and private retail, consumer products and technology companies. Dr. Schlesinger has also held leadership roles at leading MBA and executive education programs and other academic institutions, including twenty years at Harvard Business School where he served as the George Fisher Baker Jr. Professor of Business Administration. Dr. Schlesinger holds a Doctor of Business Administration from Harvard Business School, an M.B.A. from Columbia University and a Bachelor of Arts in American Civilization from Brown University.

Qualifications: Dr. Schlesingers extensive experience at numerous private and public retail companies provides the board with valuable operational, financial and business expertise. |

|

CLASS II DIRECTORS CONTINUING IN OFFICE UNTIL THE 2020 ANNUAL MEETING

| HILARY KRANE | ||

| Age: 55 Director since 2016 Board Committees: Audit |

Hilary Krane has served on our board of directors since her appointment in June 2016. She has served in executive roles at NIKE, Inc. since 2010 and currently serves as its Executive Vice President, Chief Administrative Officer and General Counsel. Prior to joining NIKE, Inc., Ms. Krane was General Counsel and Senior Vice President for Corporate Affairs at Levi Strauss & Co. from 2006 to 2010. From 1996 to 2006, she was a partner and assistant general counsel at PricewaterhouseCoopers LLP. Ms. Krane has been a director at the Federal Reserve Bank of San Francisco, Portland Branch since January 2018. Ms. Krane holds a Bachelor of Arts from Stanford University and a J.D. from the University of Chicago.

Qualifications: Ms. Krane was selected to our board of directors because of her experience contributing to the growth and development of innovative and iconic global brands. |

|

| KATIE MITIC | ||

| Age: 49 Director since 2013 Board Committees: Audit |

Katie Mitic has served on our board of directors since October 2013. Ms. Mitic was previously Founder and Chief Executive Officer of Sitch, Inc., a mobile app company from 2012 to 2017. From 2010 to 2012, Ms. Mitic served as Director of Platform & Mobile Marketing for Facebook, Inc., a social networking service. From June 2009 to July 2010, Ms. Mitic served as Senior Vice President, Product Marketing of Palm, Inc., a smartphone manufacturer. From 1994 to 2010, Ms. Mitic held leadership positions at various consumer technology companies. She also serves on the board of directors, | |

4

Table of Contents

| KATIE MITIC | ||

| compensation committee and nominating and governance committee of eBay, Inc., a global e-commerce company and on the board of directors of Headspace, a mobile health and wellness company. Ms. Mitic holds a B.A. degree in Economics from Stanford University and an M.B.A. degree from Harvard Business School.

Qualifications: Ms. Mitic was selected to our board of directors because of her extensive experience as a leader and entrepreneur obtained from her experience with major global consumer-facing technology companies. |

||

| ALI ROWGHANI | ||

| Age: 46 Director since 2015 Board Committees: |

Ali Rowghani was appointed to our board of directors on January 22, 2015. Mr. Rowghani has served in executive leadership positions at innovative growth companies, including Twitter, Inc. and Pixar Animation Studios, Inc. At Twitter, Mr. Rowghani was hired as the Companys first Chief Financial Officer in March 2010, and later served as Chief Operating Officer, with responsibility for business development, platform, media, product, and business analytics, from December 2012 to June 2014. Prior to Twitter, from June 2002 to February 2010, Mr. Rowghani served in various leadership roles at Pixar, including Chief Financial Officer and Senior Vice President, Strategic Planning, reporting to Pixar founder and President, Ed Catmull. Mr. Rowghani is currently the CEO of the YCombinator Continuity Fund, which invests in growth-stage startups. Mr. Rowghani holds a B.A. in International Relations and an M.B.A. from Stanford University.

Qualifications: Mr. Rowghanis operational and financial leadership, coupled with his expertise in scaling innovative, high-growth companies, provides the board with valuable operational and financial expertise. |

|

CLASS III DIRECTORS CONTINUING IN OFFICE UNTIL THE 2021 ANNUAL MEETING

| GARY FRIEDMAN | ||

| Age: 61 Director since 2013 Board Committees: None |

Gary Friedman has served as our Chairman and Chief Executive Officer of the Company, and Founder of the RH brand as we know it today since January 2014. Previously, Mr. Friedman served as our Co-Chief Executive Officer and Director from July 2013 to January 2014, and as Chairman and Co-Chief Executive Officer from May 2010 to October 2012. From October 2012 to July 2013, Mr. Friedman served as Chairman Emeritus, Creator and Curator on an advisory basis, and as Chief Executive Officer and a member of our Board of Directors from March 2001 to October 2012, during which time he served as our Chairman from March 2005 to June 2008. Mr. Friedman joined RH from Williams-Sonoma, Inc. where he spent 14 years serving as President and Chief Operating Officer from May 2000 to March 2001, as Chief Merchandising Officer of Williams-Sonoma, Inc. and President of Retail from 1995 to 2000, and as Executive Vice President of Williams-Sonoma, Inc. and President of the Williams-Sonoma and Pottery Barn brands from 1993 to 2000 during which time Mr. Friedman was responsible for transforming Pottery Barn from a $50 million dollar table top and accessories business, into a billion dollar plus home furnishings lifestyle brand. Mr. Friedman also developed and rolled out the revolutionary Williams-Sonoma Grande Cuisine stores, growing the brand from less than $100 million to almost $1 billion. Lastly, while at Williams-Sonoma Mr. Friedman spent several years conceptualizing and developing the West Elm brand which launched shortly after he left the company. Mr. Friedman joined Williams-Sonoma in 1988 as Senior Vice President of Stores and Operations. Mr. Friedman began his retail career in 1977 as a stock-boy at the Gap store in Santa Rosa, California. He spent eleven years with Gap, and held the positions of Store Manager, District Manager and Regional Manager overseeing 63 stores in Southern California. | |

5

Table of Contents

| GARY FRIEDMAN | ||

| Qualifications: Mr. Friedman was selected to our board of directors because of his leadership in re-conceptualizing and developing the RH brand and business into the leading luxury home brand in the North American market, his deep and unmatched expertise in developing and rapidly growing many of the leading consumer brands in the home furnishings space, and his extensive knowledge of building and leading complex multi-branded and multi-channel organizations. | ||

| CARLOS ALBERINI | ||

| Age: 63 Director since 2010 Board Committees: None |

Carlos Alberini has served on our board of directors since June 2010. Mr. Alberini currently serves as a member of the board of directors and Chief Executive Officer of Guess?, Inc., an NYSE-listed specialty retailer of apparel and accessories, since February 2019. Mr. Alberini previously served as the Chairman and Chief Executive Officer of Lucky Brand from February 2014 to February 2019. Mr. Alberini served as our Co-Chief Executive Officer from June 2010 through October 2012 and from July 2013 through January 2014, and he served as our sole Chief Executive Officer from October 2012 through July 2013. Mr. Alberini was President and Chief Operating Officer of Guess from December 2000 to June 2010. From May 2006 to July 2006, Mr. Alberini served as Interim Chief Financial Officer of Guess. Mr. Alberini served as a member of the board of directors of Guess from December 2000 to September 2011. From October 1996 to December 2000, Mr. Alberini served as Senior Vice President and Chief Financial Officer of Footstar, Inc., a retailer of footwear. From May 1995 to October 1996, Mr. Alberini served as Vice President of Finance and Acting Chief Financial Officer of the Melville Corporation, a retail holding corporation. From 1987 to 1995, Mr. Alberini was with The Bon-Ton Stores, Inc., an operator of department stores, in various capacities, including Corporate Controller, Senior Vice President, Chief Financial Officer and Treasurer. Prior to that, Mr. Alberini served in various positions at PricewaterhouseCoopers LLP, an audit firm.

Qualifications: Mr. Alberini was selected to our board of directors because he possesses particular knowledge and experience in retail and merchandising, branded consumer goods, accounting, financing and capital finance, board practices of other large retail companies and leadership of complex organizations. |

|

| KEITH BELLING | ||

| Age: 61 Director since 2016 Board Committees: None |

Keith Belling has served on our board of directors since April 2016, and previously served as an advisor to the board of directors from May 2015 to April 2016. Mr. Belling is the founder and CEO of RightRice, a next generation rice brand that launched in February 2019, in Whole Foods Markets nationwide and on Amazon. Mr. Belling is also the co-founder, Chairman and former Chief Executive Officer of popchips, inc. (popchips) a leading better-for-you snack food business that launched in 2007. He previously served as popchips Chief Executive Officer from 2007 through 2012, leading the company to sales and distribution at over 30,000 retail stores across North America and the United Kingdom and has served as the Chairman of the Board since 2007. Mr. Belling has served as an advisor to several innovative consumer, real estate and technology companies, including Modern Meadow Inc., Olly Nutrition, and LBA Realty LLC. Mr. Belling also has founded other businesses, including e-commerce company Allbusiness.com, a leading small business portal, founded in 2008, where Mr. Belling formerly served as Chief Executive Officer and which was acquired by NBCi. Mr. Belling was a real estate attorney with Morrison & Foerster LLP, where he represented a diverse clientele including developers and real estate investors.

Qualifications: Mr. Belling has been selected to our board because of his experience as a founder, leader, and entrepreneur of several innovative consumer companies, as well as his background and experience in the real estate sector. |

|

6

Table of Contents

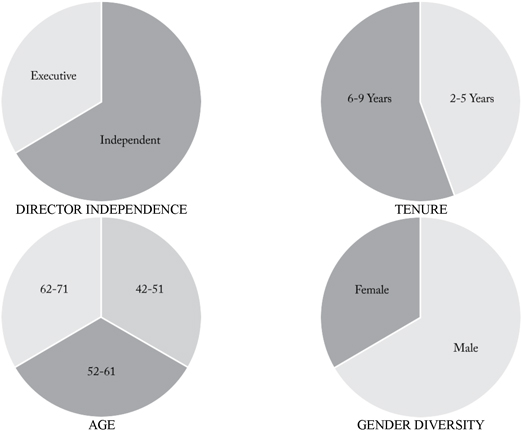

COMPOSITION AND QUALIFICATIONS OF OUR BOARD OF DIRECTORS

Our board of directors consists of nine directors, including our Chairman and Chief Executive Officer. Our certificate of incorporation provides that, subject to any rights applicable to any then-outstanding preferred stock, our board of directors shall consist of such number of directors as determined from time to time by resolution adopted by a majority of the total number of authorized directors whether or not there exist any vacancies in previously authorized directorships. Subject to any rights applicable to any then-outstanding preferred stock, any additional directorships resulting from an increase in the number of directors may only be filled by the directors then in office, unless otherwise required by law or by a resolution passed by our board of directors. The term of office for each director will be until his or her successor is elected at our annual meeting or his or her death, resignation or removal, whichever is earliest to occur.

Our board of directors is divided into three classes, with each director serving a three-year term, and one class being elected at each years annual meeting of shareholders. Our directors by class are as follows:

Class I: Eri Chaya, Mark Demilio and Leonard Schlesinger, with a term expiring at the 2019 annual meeting.

Class II: Hilary Krane, Katie Mitic and Ali Rowghani, with a term expiring at the 2020 annual meeting.

Class III: Gary Friedman, Carlos Alberini and Keith Belling, with a term expiring at the 2021 annual meeting.

We believe our board of directors should be composed of individuals with sophistication and experience in many substantive areas that impact our business. We believe experience, qualifications, or skills in the following areas are most important: retail merchandising; marketing and advertising; furniture and consumer goods; sales and distribution; accounting, finance, and capital structure; strategic planning and leadership of complex organizations; legal/regulatory and government affairs; people management; and board practices of other major corporations. We believe that all our current board members possess the professional and personal qualifications necessary for board service, and have highlighted particularly noteworthy attributes for each board member in their individual biographies above and as summarized below.

7

Table of Contents

| COMMITTEE MEMBERSHIP | ||||||||||||||||

| NAME/ CURRENT POSITION | AGE | DIRECTOR SINCE |

INDEPENDENT | AUDIT | COMP. | NOM. &CORP. GOVERNANCE |

||||||||||

| Gary Friedman RH Chairman and CEO |

61 | Jul. 2013 | ||||||||||||||

| Carlos Alberini Director and CEO of Guess? Inc. |

63 | Jun. 2010 | ◾ | |||||||||||||

| Keith Belling Founder and Chairman of popchips, inc. |

61 | Apr. 2016 | ||||||||||||||

| Eri Chaya RH President, Chief Creative and Merchandising Officer |

45 | Nov. 2012 | ||||||||||||||

| Mark Demilio Director and Chairman of the Audit Committee of Schumacher Clinical Partners and Nurse Assist |

63 | Sep. 2009 | ◾ | ☐ | ◾ | ☐ | ||||||||||

| Hilary Krane EVP, CAO and General Counsel, NIKE, Inc. |

55 | Jun. 2016 | ◾ | ◾ | ||||||||||||

| Katie Mitic Director of eBay, Inc. |

49 | Oct. 2013 | ◾ | ◾ | ||||||||||||

| Ali Rowghani CEO, YCombinator Continuity Fund |

46 | Jan. 2015 | ◾ | ◾ | ||||||||||||

| Leonard Schlesinger Professor of Business Administration, Harvard Business School |

66 | Apr. 2014 | ◾ | ☐ | ||||||||||||

| ☐ | Committee Chair |

| ◾ | Committee Member |

| EXPERIENCE | ||||||||||||||||||||||||||||

| NAME/ CURRENT POSITION | BUSINESS LEADERSHIP |

BRAND/ RETAIL |

GROWTH COMPANY |

PUBLIC CO. EXECUTIVE/ DIRECTOR |

INVESTMENT/ FINANCIAL |

LEGAL | RISK MANAGEMENT |

|||||||||||||||||||||

| Gary Friedman RH Chairman and CEO |

◾ | ◾ | ◾ | ◾ | ||||||||||||||||||||||||

| Carlos Alberini Director and CEO of Guess? Inc. |

◾ | ◾ | ◾ | ◾ | ◾ | |||||||||||||||||||||||

| Keith Belling Founder and Chairman, popchips, inc. |

◾ | ◾ | ◾ | ◾ | ||||||||||||||||||||||||

| Eri Chaya RH President, Chief Creative and Merchandising Officer |

◾ | ◾ | ||||||||||||||||||||||||||

| Mark Demilio Director and Chairman of the Audit Committee of Schumacher, Clinical Partners and Nurse Assist |

◾ | ◾ | ◾ | ◾ | ◾ | |||||||||||||||||||||||

| Hilary Krane EVP, CAO & General Counsel, NIKE, Inc. |

◾ | ◾ | ◾ | ◾ | ||||||||||||||||||||||||

| Katie Mitic Director, eBay, Inc. |

◾ | ◾ | ◾ | ◾ | ||||||||||||||||||||||||

| Ali Rowghani CEO, YCombinator Continuity Fund |

◾ | ◾ | ◾ | ◾ | ◾ | |||||||||||||||||||||||

| Leonard Schlesinger Harvard Business School Professor, Business Administration |

◾ | ◾ | ◾ | ◾ | ◾ | |||||||||||||||||||||||

| ◾ | Committee Member |

8

Table of Contents

EXECUTIVE OFFICERS

Below is a list of the names and ages, as of May 23, 2019, of our executive officers and a description of their business experience.

| NAME | AGE | POSITION | ||||

| Gary Friedman |

61 | Chairman and Chief Executive Officer |

||||

| Eri Chaya |

45 | President, Chief Creative and Merchandising Officer |

||||

| DeMonty Price |

57 | President, Chief Operating, Service and Values Officer |

||||

| David Stanchak |

60 | President, Chief Real Estate and Development Officer |

||||

| Jack Preston |

45 | Chief Financial Officer |

||||

Gary Friedman has served as our Chairman and Chief Executive Officer of the Company, and Founder of the RH brand as we know it today since January 2014. Previously, Mr. Friedman served as our Co-Chief Executive Officer and Director from July 2013 to January 2014, and as Chairman and Co-Chief Executive Officer from May 2010 to October 2012. From October 2012 to July 2013, Mr. Friedman served as Chairman Emeritus, Creator and Curator on an advisory basis, and as Chief Executive Officer and a member of our board of directors from March 2001 to October 2012, during which time he served as our Chairman from March 2005 to June 2008. Mr. Friedman joined RH from Williams-Sonoma, Inc. where he spent 14 years serving as President and Chief Operating Officer from May 2000 to March 2001, as Chief Merchandising Officer of Williams-Sonoma, Inc. and President of Retail from 1995 to 2000, and as Executive Vice President of Williams-Sonoma, Inc. and President of the Williams-Sonoma and Pottery Barn brands from 1993 to 2000 during which time Mr. Friedman was responsible for transforming Pottery Barn from a $50 million dollar table top and accessories business, into a billion dollar plus home furnishings lifestyle brand. Mr. Friedman also developed and rolled out the revolutionary Williams-Sonoma Grande Cuisine stores, growing the brand from less than $100 million to almost $1 billion. Lastly, while at Williams-Sonoma Mr. Friedman spent several years conceptualizing and developing the West Elm brand which launched shortly after he left the company. Mr. Friedman joined Williams-Sonoma in 1988 as Senior Vice President of Stores and Operations. Mr. Friedman began his retail career in 1977 as a stock-boy at the Gap store in Santa Rosa, California. He spent eleven years with Gap, and held the positions of Store Manager, District Manager and Regional Manager overseeing 63 stores in Southern California.

Eri Chaya serves as our President, Chief Creative and Merchandising Officer and Director. Ms. Chaya leads product curation and integration, brand development and design, and Interior Design for RH Interiors, Modern, Outdoor, Baby & Child and Teen, across the Companys physical, digital and print channels of distribution. Ms. Chaya served as RHs Co-President, Chief Creative and Merchandising Officer and Director from May 2016 to November 2017, Chief Creative Officer from April 2008 to May 2016 and Vice President of Creative from July 2006 to April 2008. Ms. Chaya has been a member of our board of directors since 2012. Prior to RH, Ms. Chaya was a creative director at Goodby, Silverstein and Partners, an international advertising agency, and a creative director at Banana Republic.

DeMonty Price serves as our President, Chief Operating, Service and Values Officer. Mr. Price leads service and operations across the Companys Galleries, outlets, distribution centers, care centers and home delivery network, as well as ensure a deep commitment to the Companys values and beliefs throughout the organization. Mr. Price served as Co-President, Chief Operating, Service and Values Officer from May 2016 to November 2017. Mr. Price joined RH in 2002 and served as the Companys Chief Service and Values Officer from September 2015 to May 2016, and Senior Vice President of Retail Galleries and Operations, and the Companys Chief Values Officer from June 2006 to September 2015. Prior to RH, Mr. Price was with Williams-Sonoma, Inc. for four years in various field leadership roles, as well as with Gap Inc. and Nike Inc.

David Stanchak serves as our President, Chief Real Estate and Development Officer. Mr. Stanchak leads real estate development, architecture and design for all of the Companys brands, concepts and facilities domestically and internationally. Prior to Mr. Stanchaks appointment to the Office of the President in November 2017, Mr. Stanchak served as RHs Chief Real Estate and Transformation Officer since May 2017 and Chief Real Estate and Development Officer from May 2015 to May 2017. From 2008 to 2013, Mr. Stanchak served as Senior Vice President of Dicks Sporting Goods and as President of Golf Galaxy. Mr. Stanchak has also been the President and owner of Pinpoint Real Estate Company since 1995. Over his 30-year career in the commercial real estate industry, Mr. Stanchak has worked as a senior executive, board member, consultant, investor, real estate broker and attorney in all aspects of high-growth, multi-unit retail brand development. He has had direct responsibility for opening more than 2,500 retail store locations, managing real estate portfolios and deploying in excess of $2 billion for retailers including RH, Dicks Sporting Goods, Field & Stream, Golf Galaxy, True Runner, DSW, Filenes Basement, Mike Ditkas Steakhouse, James Hardie Building Products, Blockbuster Entertainment, Einstein/Noah Bagel Corp. and Boston Market.

9

Table of Contents

Jack Preston serves as our Chief Financial Officer and leads all financial functions including strategic and financial planning, accounting, treasury, tax, internal audit and investor relations across the Companys multiple businesses and brands. Mr. Preston served as RHs Senior Vice President, Finance and Chief Strategy Officer from August 2014 to March 2019, and Senior Vice President, Finance and Strategy from April 2013 to August 2014. Prior to RH, Mr. Preston worked for Bank of America Merrill Lynch for over 12 years, where he most recently served as a director in the consumer and retail investment banking group. Mr. Preston holds a bachelor of commerce degree from the Sauder School of Business at the University of British Columbia.

CODE OF BUSINESS CONDUCT AND CODE OF ETHICS

We have adopted a code of business conduct and code of ethics applicable to our principal executive, financial and accounting officers and all persons performing similar functions. Copies of these codes are available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on Corporate Governance. The contents of our website are not incorporated by reference into this Amendment. We expect that any amendments to either code, or any waiver of the requirements of either code, will be disclosed on our website or as required by applicable law or NYSE listing requirements.

FAMILY RELATIONSHIPS

There are no family relationships between any of our directors and executive officers.

AUDIT COMMITTEE

The audit committee was established for the primary purpose of assisting the board of directors in overseeing the accounting and financial reporting processes of the Company and audits of its financial statements. The audit committee is responsible for, among other matters:

| | Appointing, retaining, compensating, evaluating, terminating and overseeing our independent registered public accounting firm; |

| | Delineating relationships between our independent registered public accounting firm and our Company consistent with the rules of the NYSE and requesting information from our independent registered public accounting firm and management to determine the presence or absence of a conflict of interest; |

| | Reviewing with our independent registered public accounting firm the scope and results of their audit; |

| | Approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| | Overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

| | Reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; |

| | Establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; and |

| | Reviewing and approving related-person transactions. |

Our audit committee currently consists of Mr. Demilio, Ms. Krane and Ms. Mitic. Rule 10A-3 of the Exchange Act, and NYSE rules require us to have at least three audit committee members, all of whom are independent. Our board of directors has affirmatively determined that each of Mr. Demilio, Ms. Krane and Ms. Mitic meets the definition of independent director for purposes of serving on our audit committee under Rule 10A-3 of the Exchange Act and NYSE rules. In addition, our board of directors has determined that Mr. Demilio qualifies as an audit committee financial expert, as such term is defined in Item 407(d)(5) of Regulation S-K.

Our board of directors has adopted a written charter for the audit committee, which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on Corporate Governance. The audit committee conducts an annual self-evaluation of its performance, as set forth in its charter.

10

Table of Contents

| Item 11. | Executive Compensation. |

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

We align our executive compensation practices to the business objectives of our Company in order to drive ongoing improvements in our financial performance. This compensation discussion and analysis (CD&A) explains the strategy, design, and decision-making processes of our compensation programs and practices in the fiscal year ended February 2, 2019 (fiscal 2018) for our named executive officers. This CD&A is intended to provide perspective on the compensation information contained in the compensation tables that follow this discussion. This CD&A also discusses how the fiscal 2018 compensation of our named executive officers aligns with the key goals of our compensation philosophy, namely, attracting and retaining the best talent and driving financial performance. We also discuss how our Company uses its compensation programs including equity programs to encourage an ownership and stakeholder perspective among our named executive officers by providing them with a long-term interest in the growth and financial performance of our Company that aligns with the interests of our shareholders.

We believe that continually analyzing and refining our compensation program enables us to achieve the key goals of our compensation philosophy and supports ongoing improvements in our financial performance.

Fiscal 2018 Business Highlights

We call your attention to the following information about the Companys 2018 financial performance along with key executive compensation actions and decisions, and our key corporate governance policies and practices. The following business highlights are only a summary. For more complete information about these topics, please review the Companys prior filings with the SEC.

RH is a curator of design, taste and style in the luxury lifestyle market. The Company offers its collections through its retail galleries across North America, the Companys multiple Source Books, and online at RH.com, RHModern.com, RHBabyandChild.com, RHTeen.com and Waterworks.com. The home furnishings market is large and fragmented and we believe we have an opportunity to be the home brand for the luxury consumer at scale, both nationally and internationally. Our growth and long-term strategy is centered on the expansion of our product assortment, developing new categories, the transformation of our real estate platform and on international expansion.

We believe that compensation paid to our executive officers should be closely aligned with the performance of the Company, on both a short-term and long-term basis. The compensation committees decision-making regarding executive compensation in any given fiscal year is informed in part by the financial performance of the Company during the prior fiscal year as well as the strategic and business initiatives pursued by the Company during the year and over time. The Company undergoes an annual process to re-assess its compensation alignment. Accordingly, the compensation committee took actions in 2018 to better align the compensation of our leadership team with the Companys performance goals and long-term business strategy as well as to retain the Companys key talent. Below we highlight the Companys strong recent performance including fiscal 2018 financial performance, fiscal 2018 key strategies and initiatives and fiscal 2018 share price performance.

| FISCAL 2018 | ||

| Financial Performance(1) | GAAP diluted earnings per share of $5.68 compared to $0.01 last year, adjusted diluted earnings per share of $8.54 compared to $3.05 last year, an increase of 180%.

GAAP net income of $150.6 million compared to $2.2 million last year, adjusted net income of $400 million compared to $89.2 million last year, an increase of 151%.

GAAP operating margin of 11.5% versus 5.4% last year, adjusted operating margin of 12.1% versus 7.0% last year.

GAAP net revenues and adjusted net revenues increased 3% to $2.51 billion.

|

|

| Key Strategies & Initiatives | We focused in fiscal 2017 and fiscal 2018 on executing our new membership business model, architecting a new operating platform and maximizing cash flow by increasing revenues and earnings while decreasing inventory and capital spending.

We believe that our record fiscal 2018 results demonstrate the strength of the RH brand, the power of our new business model, our focus on managing the business with a bias for earnings versus revenue growth, and our continued success revolutionizing physical retailing.

|

|

11

Table of Contents

| FISCAL 2018 | ||

| While most in our industry are closing or downsizing stores, we remain committed to our quest of revolutionizing physical retailing. Our progress in fiscal 2018 included the opening of RH Portland and RH Nashville in the first half of the year, and the opening of two very unique and diverse retail experiences, RH New York and RH Yountville, in September. We continue to be pleased with the performance of our new Galleries and now have six Galleries with our integrated hospitality experience.

As we did in fiscal 2017, we continued to hold ourselves back from adding new businesses in fiscal 2018 outside of ongoing investments in RH Hospitality as we remained focused on optimizing the profitability of our new operating platform.

Our efforts architecting a new operating platform, inclusive of our distribution center network redesign, the redesign of our reverse logistics and outlet business, and the reconceptualization of our home delivery and customer experience, is driving lower costs and inventory levels, and higher earnings and inventory turns. We expect this multi-year effort to result in a dramatically improved customer experience, continued margin enhancement and significant cost savings over the next several years.

As previously mentioned, our plan is to accelerate our real estate transformation, opening 5 to 7 new Galleries per year, up from 3 to 5 per year.

We have several new brand extension plans in our development pipeline. We are launching RH Beach House with a dedicated Source Book and plan to launch RH Ski House with a dedicated Source Book. Additionally, we have plans to elevate and expand our assortments in key categories with the introduction of new bespoke collections as we pivot back to growth over the next several years. Our investment in RH Interior Design continues to provide a significant revenue opportunity as we continue building our ability to provide world class interior design services in North Americain our continued move beyond creating and selling products to conceptualizing and selling spaces.

|

||

| Share Price Performance | We commenced fiscal 2018 with our common stock price trading at a price near $90 per share and ended the fiscal year with our stock having traded in the range of $120 per share to above $130 per share toward the end of our fiscal year. We believe our stock price performance was driven by our financial performance through the year as well as the success of our focus on execution, architecture and cash. In each of fiscal 2017, 2018 and 2019, the Company has deeply focused on capital allocation, optimization of free cash flow and increasing the gross margins of the business. For example, our fiscal 2017 and fiscal 2018 share repurchase programs have resulted in the repurchase of $1.25 billion of our capital stock, which the Company believes will prove to be an excellent allocation of capital in the long term interest of shareholders. Although our stock price has experienced substantial volatility from quarter to quarter including during fiscal 2018, we believe over the long term investors have and will continue to experience stock price appreciation.

As of February 1, 2019, the last trading day of fiscal 2018, the closing price of our common stock was $133.64 per share, compared to $92.04 per share, which was the closing price of our common stock as of February 2, 2018, the last trading day of fiscal 2017.

|

|

| Other Performance Metrics | In fiscal 2018 we generated record revenues in excess of $2.5 billion, record GAAP operating margin of 11.5%, record adjusted operating margins of 12.1%(1), and industry leading ROIC of 27.8%.(2)

We have included a stock performance table below to disclose a measure of total shareholder return, reflecting positive performance, growth and the effectiveness of pay for performance alignment.

|

|

| (1) | Reconciliations of GAAP to non-GAAP financial measures for adjusted net revenues, adjusted operating margin, adjusted net income and adjusted diluted earnings per share are provided in the tables included in Annex A to this Amendment. |

| (2) | We define Return on Invested Capital (or ROIC) as adjusted operating income after-tax for the most recent twelve-month period, divided by the average of beginning and ending debt and equity less cash and equivalents as well as short and long-term investments for the most recent twelve month period. ROIC is not a measure of financial performance under GAAP, and should be considered in addition to, and not as a substitute for other financial measures prepared in accordance with GAAP. Our method of determining ROIC may differ from other companies methods and therefore may not be comparable. |

12

Table of Contents

STOCK PERFORMANCE

The following table shows the total shareholder return for our common stock during the five fiscal year periods indicated below. The first row of the table indicates the cumulative return of an investor purchasing one share of RH common stock at the market close on January 31, 2014 and its value (percentage increase or decrease) at the associated fiscal year ends indicated in the table. The table then assumes a scenario where $100 was invested at the market close on January 31, 2014 in RH common stock, which is equivalent to 1.76 shares (if fractional shares were permitted), and its value (percentage increase or decrease) at the associated fiscal year ends indicated in the table.

| 2014 ( Jan. 31) |

2015 ( Jan. 30) |

2016 ( Jan. 29) |

2017 ( Jan. 27) |

2018 (Feb. 2) |

2019 (Feb. 1) |

|||||||||||||||||||

| Value of 1 share |

$ | 56.74 | $ | 87.53 | $ | 61.62 | $ | 26.09 | $ | 92.04 | $ | 133.64 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Value of a $100 Investment |

$ | 100 | $ | 154.27 | $ | 108.60 | $ | 45.98 | $ | 162.21 | $ | 235.53 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Percentage Change |

N/A | 54.27 | % | 8.60 | % | -54.02 | % | 62.21 | % | 135.53 | % | |||||||||||||

This table is supplemental to the stock performance graph presented in the Original Filing.

The following table sets forth, for fiscal 2018, our named executive officers, as defined in Item 402 of Regulation S-K promulgated under the Securities Act of 1933, as amended:

| NAME | TITLE | |

| Gary Friedman | Chairman and Chief Executive Officer | |

| Ryno Blignaut(1) | President, Chief Financial and Administrative Officer | |

| Karen Boone(2) | Former President, Chief Financial and Administrative Officer | |

| Eri Chaya | President, Chief Creative and Merchandising Officer and Director | |

| DeMonty Price | President, Chief Operating, Service and Values Officer | |

| David Stanchak | President, Chief Real Estate and Development Officer |

| (1) | Mr. Blignaut was hired on August 14, 2018. Mr. Blignaut left the Company in March 2019 due to health considerations, at which time Jack Preston assumed the role of Chief Financial Officer. |

| (2) | Ms. Boone left the Company in November 2018. |

We believe that compensation paid to our executive officers should be:

| | Closely aligned with the performance of the Company, on both a short-term and long-term basis; |

| | Linked to specific, measurable results intended to create value for shareholders; |

| | Transparent, accessible and understandable by all stakeholders to understand what drives our executives; and |

| | Tailored to achieve the key goals of our compensation program and philosophy. |

Our executive compensation programs are aligned with our shareholders interests, with performance-based compensation being tied primarily to our annual earnings before taxes and our long-term stock price performance.

The compensation committee has continued to focus on balancing the alignment of our executive compensation program with our financial performance, providing incentives for retention purposes, rewarding the continued transformation of the business in fiscal 2018 and tailoring our compensation arrangements to match changes in our executive leadership. In March 2019, the compensation committee reviewed the Companys financial results, corporate performance measures and the adjusted net income before tax metric goals that were set for fiscal 2018 with respect to its performance-based annual cash incentive awards. The committee reviewed the extent to which those established goals were achieved and determined that the related compensation earned was at the 170% achievement level based on its targeted fiscal 2018 performance objectives (see Fiscal 2018 Business Highlights above for more information regarding the Companys financial performance and key strategies and initiative for fiscal 2018). In the case of Mr. Blignaut, who was hired on August 14, 2018 and left the Company in March 2019, the compensation committee determined to provide him with a discretionary bonus for fiscal 2018 in recognition of his not being eligible for a bonus under the LIP program due to his departure from the Company as well as in consideration of his contributions to the Company during his tenure and his assistance with the transition of his roles and responsibilities to Mr. Preston, the Companys current Chief Financial Officer. In addition, the base salaries for Ms. Chaya, Mr. Price, Mr. Stanchak and Ms. Boone were increased from the fiscal 2017 base salaries, as further discussed below.

13

Table of Contents

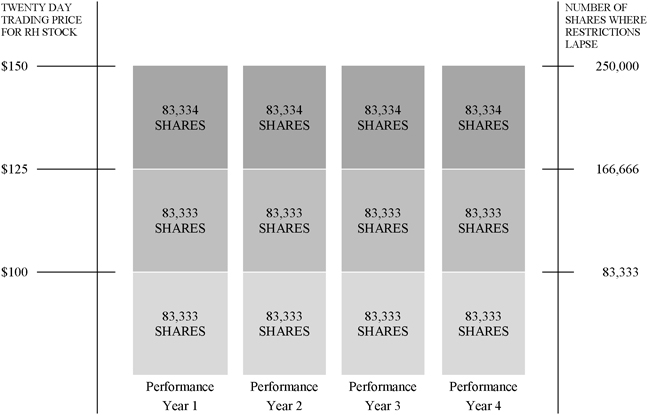

In the case of our Chairman and Chief Executive Officer, Mr. Friedman, the compensation committee has determined that no additional equity grants be made to him for fiscal 2018 and fiscal 2019 given his multi-year equity grant structure. Equity grants are the primary form of long-term incentive compensation provided to Mr. Friedman. In fiscal 2017, the compensation committee determined to grant multi-year equity awards with performance conditions tied to stock price performance to Mr. Friedman. One of our overriding goals informing our compensation philosophy is to create in our management an ownership and entrepreneurial mindset in order to align management performance with improvements in shareholder returns. The multi-year stock option award granted to Mr. Friedman during fiscal 2017 required substantial stock price appreciation from the Companys share price on the date of grant: the stock price performance targets in Mr. Friedmans equity award were set at $100, $125 and $150 per share, measured over a minimum four year time period from the date of grant and represented premiums to the grant-date stock price of 105.7%, 157.1% and 208.5%, respectively.

The fiscal 2017 equity award to Mr. Friedman was structured as a multi-year equity award with performance conditions tied to stock price performance, which the committee determined to be a transparent and accessible measure of overall value that aligns Mr. Friedmans compensation with returns experienced by investors. The multi-year structure of the 2017 award was similar to the multi-year structure of the prior equity grant to Mr. Friedman in 2013 and is designed to incentivize Mr. Friedman and align him with a long-term view in leading the Company. Mr. Friedman has not requested changes to his base salary or bonus since 2016.

In its 2018 and 2019 annual review of executive compensation, the compensation committee affirmed the effectiveness of the multi-year equity structure. Since the date of the equity award to Mr. Friedman, the financial and operational performance of RH has improved and the stock price has appreciated. As of February 2, 2018, the last trading day of fiscal 2017, the closing price of our common stock was $92.04 per share, a substantial increase over the price at the time of the equity award to Mr. Friedman in May, 2017. As of February 1, 2019, the last trading day of fiscal 2018, the closing price of our common stock had further increased to $133.64 per share. Based on the strong performance of RHs stock price since the date of the award to Mr. Friedman, each of the first two tranches have met two-thirds of the performance hurdles and the first two tranches have met the time requirement as of the date of this Amendment.

We believe this grant shows our commitment to set compensation and performance targets for our executives that align with our long-term growth strategy and our shareholders interests.

We continue to believe that our executive compensation program, including the compensation of our Chairman and Chief Executive Officer, is clearly structured to reflect the best interest of shareholders and that if we continue to drive improving operational and financial performance investors will be rewarded by stock price appreciation.

Shareholder Engagement

We actively engage with major shareholders of the Company, which has been a practice of the Company since our initial public offering in 2012. At our 2018 annual meeting of shareholders, approximately 60% of the votes cast by our shareholders supported our say-on-pay proposal. We are committed to the interests of our shareholders and the delivery of shareholder value through our focus on execution, architecture and cash, including through capital allocation, optimization of free cash flow and increasing the gross margins of the business. We believe that, as part of this commitment, it is important to maintain an ongoing dialogue with shareholders, including with respect to feedback on our executive compensation programs. In 2016, we launched a formalized annual shareholder outreach program in order to solicit additional input from shareholders with respect to corporate governance and executive compensation practices. This shareholder outreach effort continued in 2017, 2018 and 2019. Along with our annual shareholder outreach program, throughout the year, members of our leadership team, including our Chief Financial Officer and head of investor relations, engage in regular shareholder and investor communications, in which we receive feedback.

As part of our shareholder outreach efforts, we have provided explanations of our organizational and management structures and our constant efforts to continue evolving our management structure in order to refine the organizational design and improve its alignment with the evolution of the business. In particular, we have highlighted that numerous business initiatives like the membership program have resulted in simplification of some aspects of our business, while other new initiatives require on-going management focus and efforts, and that the shifts in focus and responsibilities of our business and executive officers are designed to attune the organizational and management structures to the transformation of our business. This formalized shareholder outreach program is designed to solicit feedback from the Companys shareholders with respect to a number of topics related to our executive pay practices and corporate governance policies. This effort supplements the ongoing communications between our management and shareholders. We continue to receive feedback from our investors under our shareholder outreach program throughout the year.

As part of the shareholder outreach campaign,

14

Table of Contents

| | In 2016, we solicited the views of institutional investors that we believe represented approximately 94% of our issued and outstanding shares owned by institutional investors as of December 31, 2015, and had discussions with and received feedback from investors representing approximately 61% of such outstanding shares. |

| | In 2017, we solicited the views of institutional investors that we believe represented approximately 55% of our issued and outstanding shares owned by institutional investors as of December 31, 2016, and had discussions with and received feedback from investors representing approximately 40% of such outstanding shares. |

| | In 2018, we solicited the views of institutional investors that we believe represented approximately 67% of our issued and outstanding shares owned by institutional investors as of December 31, 2017, and had discussions with and received feedback from investors representing approximately 28% of such outstanding shares. |

| | In 2019, we solicited the views of institutional investors that we believe represented approximately 69% of our issued and outstanding shares owned by institutional investors as of December 31, 2018, and had discussions with and received feedback from investors representing approximately 31% of such outstanding shares. |

In 2019, inasmuch as we had contacts with a large number of our investors in our prior annual shareholder outreach campaigns, a number of our investors that had been previously contacted indicated there was not a need to have a further round of conversations in the current annual shareholder outreach campaign as their positions on the topics discussed had not changed in any significant way from the prior year conversations.

In addition to the general feedback noted in the chart below, investors have expressed appreciation of our outreach efforts and acknowledged our quick reaction and responsiveness to the against vote recommendation last year from two proxy advisory firms on our say-on-pay proposal. The results of the shareholder outreach campaign, including concerns and feedback we received, were provided to our board of directors.

| WHAT WE HEARD | WHAT WE DID | |

| Shareholders requested that we make our proxy statement more readable and make the information presented more accessible.

|

We continue to make improvements to our proxy statements from previous years, including providing more information in tables and charts rather than within lengthy narrative form in order to make the presentation easier to read and the information more accessible. | |

| Shareholders requested increased transparency around peer group or other competitive measurements used by the Company for our pay-for-performance alignment.

|

We provided additional disclosure around our market check approach to our compensation practices to ensure performance alignment and retention of our key executives. | |

| Shareholders requested increased transparency into the decision to use adjusted net income before tax in our annual (short-term) cash bonus or Leadership Incentive Program, or LIP.

|

We provided disclosure in our compensation discussion and analysis in order to explain the reasons we chose certain compensation metrics and to show how our program is aligned with shareholder interests. | |

| Shareholders requested increased transparency into the decision to use stock price as part of the performance metric under our long-term incentive (equity) program. | Given one of our core foci is on innovation and business transformation, and our objectives to use a metric that is objectively measurable, aligned on both the Companys short-term and long-term goals, useful across the multiple industries (such as e-commerce and hospitality) in which we operate or intend to operate in the long-term, transparent, understandable and accessible to our shareholders and other key stakeholders, including our employees, we believe and have determined stock price is a useful performance metric that addresses all of the Companys strategic goals for a performance metric.

We also provided detailed information concerning the structuring of a stock option that the compensation committee approved for grant to Mr. Friedman, our Chairman and Chief Executive Officer, under the 2012 Stock Incentive Plan to purchase 1,000,000 shares of the Companys common stock with certain selling restrictions tied to stock price appreciation (the 2017 Stock Option Award).

|

15

Table of Contents

| WHAT WE HEARD | WHAT WE DID | |

| Shareholders requested information related to other performance metrics such as total shareholder return (TSR) and return on invested capital (ROIC). | We continued to refine our executive compensation program, including in 2018, to create significant pay-for-performance alignment. Although we do not use these metrics as part of our long-term incentive strategy, we have been providing indications of these measures in our Form 10-K and as well as in our earnings releases and have determined to disclose them in our proxy statement for convenience.

We have included a stock performance table above to disclose a measure of total shareholder return, reflecting positive performance, growth and the effectiveness of pay for performance alignment.

Please see sub-section entitled Fiscal 2018 Business Highlights at the beginning of the Compensation Discussion and Analysis section of this Amendment.

|

|

| Shareholders requested additional disclosure regarding certain corporate governance practices. | We added details and information regarding certain of our corporate governance practices. In particular, in 2018 we included disclosure about our newly adopted stock ownership guidelines, board and executive diversity and our corporate social responsibility programs that addresses environmental, social and governance issues relevant to the Companys business.

|

|

| Shareholders requested further disclosure about the basis for Mr. Alberinis independence as a director in response to certain policy approaches by independent governance and proxy advisory firms around the ability of former chief executive officers to serve as independent board members on the boards of companies they once served as chief executive officers.

|

We provided additional disclosures regarding the basis for the determination that Mr. Alberini is an independent director. Since his departure, Mr. Alberini served in senior management roles at other companies, and is currently a director and CEO of Guess, Inc., which is a publicly traded company. Given his other active roles, and time away from RH management, we believe Mr. Alberini provides a valuable role as an independent director to RH. In each year, the board also determined not to appoint Mr. Alberini to any of RHs committees of the board of directors that require directors be independent. | |

| Shareholders requested further disclosure about the nature of our Chairman and Chief Executive Officers multi-year awards and further explanation around the period that the award is intended to cover. | In those circumstances where we make a multi-year equity award to an executive officer, we intend to disclose details concerning the multi-year nature of the award.

We have followed a practice of making multi-year equity awards to our Chairman and Chief Executive Officer in several instances and we have provided substantial additional disclosure concerning those multi-year awards. In particular, we provided a multi-year equity award to him in the second fiscal quarter of 2013. In the second quarter of fiscal 2017, we granted our Chairman and Chief Executive Officer an additional multi-year equity award that is designed to serve for a four year period. We have included enhanced disclosure concerning these multi-year equity awards to our Chairman and Chief Executive Officer in our compensation discussion and analysis in order to explain the intent and details behind these large equity awards as well as the fact that we have not granted further equity awards to Mr. Friedman in fiscal 2018 or fiscal 2019.

The multi-year structure arose out of a purposefully driven conversation and discussion between the compensation committee and Mr. Friedman and is believed to incentivize Mr. Friedman and align him with a long-term view in leading the Company.

|

16

Table of Contents

| WHAT WE HEARD | WHAT WE DID | |

| Shareholders also expressed a preference that equity awards granted to the executive officers of RH in particular be tied to performance metrics rather than simple time based metrics based on continued service. | Our compensation program relies on equity and equity upside as a key incentive that aligns incentives between the management team and our investors. For example, we consider stock option awards, which only have value if the stock goes higher, a key component of our compensation program.

Based on discussions and compensation reviews in 2016 and 2017, we structured the 2017 Stock Option Award to Mr. Friedman to require substantial stock price appreciation from the price of our common stock on the date of grant in order for restrictions on the shares underlying the award to lapse. We also required a four year service period for the Chief Executive Officer in order to assure that these price objectives would be measured on a sustained basis rather than at a single moment in time.

We believe the four year structure of the award aligns and incentivizes Mr. Friedman to take a multi-year and long-term approach in leading the Company.

|

|

| Shareholders requested additional disclosure around the new leadership team and the recent changes to our organizational design. | As a result of the ongoing evolution of our business, we continuously adjust the structure and operation of our executive leadership team to meet the needs of our business and optimize the outcome of our initiatives. We frequently implement changes to our organizational design in order to more closely align our management structure with the changing needs of the business. We have launched numerous initiatives that have become integral to the ongoing development of our business including, among others: (i) our membership program; (ii) the introduction of RH Hospitality in many of our new Gallery locations; (iii) the transformation of our real estate both through the introduction of new Galleries and changes in the real estate development model; (iv) ongoing restructuring and improvements to our distribution centers, transportation network and supply chain; (v) the introduction and expansion of design services as part of our Gallery operations; (vi) improvements in our home delivery and outlet model including the introduction of reverse logistics; (vii) improvements in our product assortment including the introduction of new categories such as RH Modern; and (viii) expansion of our business into international markets. While some of these initiatives such as the ongoing development of RH Hospitality have required us to add incremental management positions, others have simplified our business.

Our efforts architecting a new operating platform, inclusive of our distribution center network redesign, the redesign of our reverse logistics and outlet business, and the reconceptualization of our home delivery and customer experience, are driving lower costs and reductions in inventory levels. Likewise, the adoption of a membership model has resulted in simplification in our business and corresponding reduction in certain management personnel. Many of the efforts to improve our organizational design have resulted in changes in our home office operations and increased responsibilities for our executive leadership team.

Over the last several years, we have eliminated a large number of middle management positions as part of the organizational redesign and we have increased the scope of responsibility for our named executive officers including Ms. Chaya, Mr. Price and Mr. Stanchak, each of whom works closely with our CEO. Ms. Chaya, our President, Chief Creative and Merchandising Officer oversees our product assortment and merchandising as well as related parts of our business including our Source Books and web presence. Mr. Price, our President, Chief Operating, Service and Values Officer, oversees our Gallery operations, Human Resources, distribution centers and supply chain, outlet and call center operations. Mr. Stanchak, our President, Chief Real Estate and Development Officer oversees our real estate transformation. The compensation committee determined to increase the base salaries for these named executive officers, as discussed below, in order to incentivize such named executive officers to continue to drive operational performance through these initiatives.

|

17

Table of Contents

OVERVIEW OF COMPENSATION PROGRAM AND PHILOSOPHY

Our compensation program is designed to do the following:

| Attract and retain | We focus on attracting and retaining top-caliber, knowledgeable and experienced senior executives | |

| Encourage an ownership and entrepreneurial mindset | Our programs create in our management an ownership and entrepreneurial mindset in order to align the annual and long-term strategic goals of our executives with those of our Company and our shareholders, including improvements in shareholder returns | |

| Motivate | Our programs motivate our executives to achieve superior results for our Company and our shareholders | |

| Reward performance | We pay for performance that is achieved through creativity, the capitalization of unique strategic opportunities and business initiatives, and results in shareholder-aligned financial successes, including improvements in our stock price | |

| Encourage appropriate risk taking | Our programs focus our executives to analyze business initiatives where we seek return on investment that exceeds downside risks | |

| Provide transparent reward systems | Our reward systems are easily understood by our managers and shareholders | |

| Reinforce the succession planning process | Our programs help management to focus on identifying, and help us reward, retain and promote from within, the next generation of senior leadership to achieve the Companys growth, profitability and other objectives through increased responsibilities and compensation | |

This compensation philosophy guides the compensation committee in assessing the compensation to be paid to our executives, including our named executive officers. The compensation committee endeavors to ensure that the total compensation paid to the named executive officers is fair, competitive and consistent with our compensation philosophy. This compensation philosophy also guides the compensation committee as to the proper allocation among current cash compensation (in the form of annual base salary), short-term compensation (in the form of performance-based, annual cash incentives), and long-term compensation (in the form of equity incentive compensation). We evaluate both the performance and compensation of our named executive officers annually to ensure that the executive compensation program we implement achieves these goals.

One of our overriding goals informing our compensation philosophy is to create in our management an ownership and entrepreneurial mindset in order to align management performance with improvements in shareholder returns. Our compensation programs aim to improve upon this interest alignment through various methods, including the use of stock options for equity grants, the use of long-term price performance targets in the award granted to our Chief Executive Officer and various profit metrics in the bonus plan.

We have implemented executive compensation policies and practices that reinforce our compensation philosophy and align with those commonly-viewed best practices and sound governance principles that we believe are appropriate for us. The following chart summarizes these policies and practices:

PRACTICES WE FOLLOW

| | 100% independent directors on our compensation committee |

| | Annual review and approval of our compensation strategy |

| | Independent compensation consultant engaged by our compensation committee |

| | Performance-based cash incentives |

| | Significant portion of executive compensation is either tied to corporate performance directly or indirectly through stock price performance because of the equity component of compensation |

| | We have continued to shift our vesting practices to incentivize retention and a long-term leadership approach by using either five-year or seven-year vesting periods, with vesting weighted more heavily in the back years |

| | For most equity awards, we have shifted our vesting practices to use five-year vesting periods |

18

Table of Contents

| | Generally, we use five-year vesting upon hiring, as well as for subsequent grants |

| | Depending on the circumstances, awards may vest 20% per year on a straight-line basis or in a back-end loaded schedule where larger amounts vest in later years |

| | We have been more frequently using the back-end loaded vesting structure and shifting from awards that vest on a straight-line basis in order to create longer term incentives for performance |

| | Five-year vesting structures that are not straight-line vesting may vest in several different ways including, by way of example: |

| | 15% in year one; 15% in year two; 20% in year three; 25% in year four; and 25% in year five; or |

| | 10% in year one; 10% in year two; 20% in year three; 30% in year four; and 30% in year five |

| | Prohibition on short sales, hedging of stock ownership positions and transactions involving derivatives of our common stock |

| | In May 2018, the board adopted stock ownership guidelines applicable to all directors and executive officers of the Company in order to further align the financial interest of our directors and executive officers with the interest of our investors |

| | Our Chairman and Chief Executive Officer, Mr. Friedman, has consistently maintained a significant equity ownership interest in the Company and, as of May 23, 2019, beneficially owns approximately 31.0% of the Companys common stock which, based on the average closing price for RH stock for fiscal 2018, was valued at approximately 468.5 times his annual base salary for fiscal 2018(1), far above the multiple of six times salary minimum ownership requirement |

| | Broad-based company-sponsored health and retirement benefits programs |

PRACTICES WE AVOID

| | No single trigger change of control benefits |

| | No post-termination retirement- or pension-type non-cash benefits or perquisites for our executive officers that are not available to our employees generally |