DEF 14A: Definitive proxy statements

Published on December 28, 2022

UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO

SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

☒ Filed by the Registrant ☐ Filed by a Party other than the Registrant

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Name of Registrant as Specified in Its Charter

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

February 7, 2023 10:30 a.m. Pacific Time

RH, 15 Koch Road, Corte Madera, CA 94925

Important notice regarding the Special Shareholder Meeting to be held on February 7, 2023 (the “Special Meeting”): The Company’s Notice of Special Meeting of Shareholders, Proxy Statement and its proxy card are available for review online at www.proxyvote.com

RH SHAREHOLDER,

We are holding the Special Meeting for the following purpose, which is more fully described in the proxy statement:

| 1. | To approve the RH 2023 Stock Incentive Plan. |

Only shareholders of record as of the close of business on December 21, 2022, are entitled to notice and to vote at the Special Meeting or any postponement or adjournment thereof. A list of shareholders entitled to vote will be available for inspection at our offices for ten days prior to the Special Meeting. If you would like to view this shareholder list, please contact the Corporate Secretary at (415) 945-4998.

We intend to hold our Special Meeting in person. However, in the event we determine it is not possible or advisable to hold our Special Meeting in person due to health or other considerations related to COVID-19 or other reasons, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. If we take this step, we will announce the decision to do so via a press release and details about how to participate will be posted on our website and filed with the U.S. Securities and Exchange Commission as additional proxy materials. Please monitor our website at ir.rh.com for updated information. As always, we encourage you to vote your shares prior to the Special Meeting.

Each share of common stock that you own represents one vote, and your vote as a shareholder of RH is very important. For questions regarding your stock ownership, you may contact the Corporate Secretary at (415) 945-4998 or, if you are a registered holder, our transfer agent, Computershare Investor Services, by email through their website at www.computershare.com/contactus or by phone at (800) 962-4284 (within the U.S. and Canada) or (781) 575-3120 (outside the U.S. and Canada).

The Board of Directors has approved the proposal described in the accompanying proxy statement and recommends that you vote “FOR” the approval of the RH 2023 Stock Incentive Plan.

By order of the Board of Directors,

Gary Friedman

Chairman & Chief Executive Officer

Your Vote Is Important. Instructions for submitting your proxy are provided in the proxy statement and your proxy card. It is important that your shares be represented and voted at the Special Meeting. Please submit your proxy through the Internet, by telephone, or by completing the enclosed proxy card and returning it in the enclosed envelope. You may revoke your proxy at any time prior to its exercise at the Special Meeting.

SPECIAL MEETING OF SHAREHOLDERS

PROXY STATEMENT SUMMARY

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the Board of Directors of RH (the “Company”) for use at the Company’s Special Meeting of Shareholders (the “Special Meeting”) to be held at the Company’s headquarters located at 15 Koch Road, Corte Madera, CA 94925 on February 7, 2023, at 10:30 a.m. (Pacific Time), and any adjournment or postponement thereof.

We will commence mailing our proxy materials to shareholders on or about December 27, 2022. Our proxy materials are first being made available online on or about December 27, 2022.

ABOUT THE SPECIAL MEETING

What is the purpose of the Special Meeting?

At our Special Meeting, shareholders will vote upon the proposal described in this proxy statement.

What proposal is scheduled to be voted on at the Special Meeting?

Approval of the RH 2023 Stock Incentive Plan (the “2023 Plan”).

What is the recommendation of the Board of Directors on the proposal scheduled to be voted on at the Special Meeting?

The Board of Directors recommends that you vote “FOR” the approval of the 2023 Plan (the “Proposal”).

Could other matters be decided at the Special Meeting?

No. Pursuant to our Bylaws, the business to be conducted at the Special Meeting is limited to the purpose or purposes stated in the notice of the special meeting. Accordingly, the Proposal is the only matter that will be brought before the Special Meeting.

Who can vote at the Special Meeting?

Shareholders as of the record date for the Special Meeting, the close of business on December 21, 2022 (the “Record Date”), are entitled to vote at the Special Meeting. At the close of business on the Record Date, there were 23,951,191 shares of the Company’s common stock outstanding and entitled to vote.

Shareholder of Record: Shares Registered in Your Name

If, as of the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Investor Services, then you are considered the shareholder of record with respect to those shares.

As a shareholder of record, you may vote at the Special Meeting or vote by proxy. Whether or not you plan to attend the Special Meeting, we urge you to vote over the Internet or by telephone, or, if you request paper proxy materials, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee

If, as of the close of business on the Record Date, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the shareholder of record for purposes of voting at the Special Meeting. Because you are not the shareholder of record, you may not vote your shares at the Special Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Special Meeting.

SPECIAL MEETING OF SHAREHOLDERS |

2022 PROXY STATEMENT | 3 |

|

How do I vote?

If you are a shareholder of record, you may:

VOTE IN PERSON—we will provide a ballot to shareholders who attend the Special Meeting and wish to vote in person;

VOTE BY MAIL—if you request a paper proxy card, simply complete, sign and date the enclosed proxy card, then follow the instructions on the card; or

VOTE VIA THE INTERNET or VIA TELEPHONE—follow the instructions on the proxy card and have the proxy card available when you access the Internet website or place your telephone call.

Votes submitted via the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on February 6, 2023. Submitting your proxy, whether via the Internet, by telephone or by mail (if you requested a paper proxy card), will not affect your right to vote at the Special Meeting should you decide to attend the meeting.

If you are not a shareholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares.

Your vote is important. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure that your vote is counted. You may still attend the Special Meeting if you have already voted by proxy.

What if I return my proxy card directly to the Company, but do not provide voting instructions?

If a signed proxy card is returned to us without any indication of how your shares should be voted on the Proposal, your shares will be voted in accordance with the recommendations of our Board of Directors stated above. Accordingly, if you return a signed proxy card with no indication of your vote on the Proposal, your vote will be cast “FOR” the approval of the 2023 Plan.

Because the Proposal is a non-routine matter (as described below), if you hold your shares in street name and do not vote, your broker does not have discretionary power to vote your shares. As a result, your shares will not be counted in determining the number of shares necessary for approval of the Proposal. Voting results will be tabulated and certified by the inspector of elections appointed for the Special Meeting.

What is the quorum requirement for the Special Meeting?

A majority of our outstanding shares as of the Record Date must be present at the Special Meeting in order to hold the meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the meeting if you are present and vote in person at the meeting or if you have properly submitted a proxy.

How are abstentions treated?

Abstentions (i.e., shares present at the meeting and voted “abstain”) are counted for purposes of determining whether a quorum is present. In determining whether the Proposal received the requisite number of affirmative votes, abstentions are not considered votes cast and will have no effect on the Proposal.

Note that if you are a beneficial holder and do not provide specific voting instructions to your broker, the broker that holds your shares will not be authorized to vote on the Proposal, as it is a non-discretionary item.

Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Special Meeting.

4 | 2022 PROXY STATEMENT |

SPECIAL MEETING OF SHAREHOLDERS |

|

What is the vote required for the Proposal?

The affirmative vote of a majority of votes cast, whether in person or by proxy, is required to approve the Proposal. Because the vote for the Proposal is considered to be a non-routine matter under the rules of the NYSE, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for the Proposal, brokers will not be permitted to exercise their voting authority with respect to the Proposal. Abstentions are not considered votes cast and will have no effect on the Proposal.

How can I get electronic access to the proxy materials?

The Company’s proxy materials are available at ir.rh.com. This website address is included for reference only. The information contained on the Company’s website is not incorporated by reference into this proxy statement.

Who is paying for this proxy solicitation?

The Company is paying the costs of the solicitation of proxies. Proxies may be solicited on behalf of the Company by our directors, officers, associates (we refer to our employees as “associates”) or agents in person or by telephone, facsimile or other electronic means. We will also reimburse brokerage firms and other custodians, nominees and fiduciaries, upon request, for their reasonable expenses incurred in sending proxies and proxy materials to beneficial owners of our common stock. We have retained the services of Alliance Advisors LLC (“Alliance”) to assist in the solicitation of proxies for a fee of approximately $26,000 plus reasonable out-of-pocket expenses. We may engage Alliance for additional solicitation work and incur fees greater than $26,000 depending on a variety of factors, including preliminary voting results and recommendations from Institutional Shareholder Services. As part of its engagement agreement, the Company has also agreed to certain indemnification provisions with Alliance.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

How can I change my vote after submitting my proxy?

A shareholder who has given a proxy may revoke it at any time before it is exercised at the meeting by:

Delivering to the Corporate Secretary of the Company (by any means, including facsimile) a written notice stating that the proxy is revoked;

Signing and delivering a proxy bearing a later date;

Voting again over the Internet or by telephone; or

Attending and voting at the Special Meeting (although attendance at the meeting will not, by itself, revoke a proxy).

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Where can I find the voting results?

The final voting results will be tallied by the inspector of elections and filed with the SEC in a Current Report on Form 8-K within four business days of the Special Meeting.

SPECIAL MEETING OF SHAREHOLDERS |

2022 PROXY STATEMENT | 5 |

|

6 | 2022 PROXY STATEMENT |

ANNUAL MEETING OF SHAREHOLDERS |

|

APPROVAL OF THE RH 2023 STOCK INCENTIVE PLAN

We are asking shareholders to approve the 2023 Plan.

We have previously awarded equity compensation under the Restoration Hardware Holdings, Inc. 2012 Stock Incentive Plan (the “2012 Plan”), which expired on November 1, 2022. The last day on which grants could be made under the 2012 Plan was October 31, 2022. On December 14, 2022, our Board of Directors, at the recommendation of the compensation committee, approved the 2023 Plan, subject to approval by our shareholders at the Special Meeting. If shareholders approve the 2023 Plan, it will become effective on the date of the Special Meeting. Outstanding awards under the 2012 Plan will remain outstanding and subject to the terms of the 2012 Plan and the respective award agreements, until the vesting, expiration or lapse of such awards in accordance with their terms.

Approval of the 2023 Plan is intended to enable us to continue granting stock-based incentive awards, which our Board of Directors believes is a critical element of our compensation program and vital to our continued ability to attract and retain skilled people in our competitive industry. We use stock-based awards to align the financial interests of award recipients with those of the Company’s shareholders. We believe that providing an equity stake in the future success of our business encourages and motivates award recipients to strive to achieve our business goals and to increase shareholder value.

Accordingly, we believe approving the 2023 Plan is in the best interest of our shareholders.

Given that the 2012 Plan expired on November 1, 2022, if the Proposal is not approved by our shareholders, we generally will not be able to continue to issue stock-based incentive compensation to our directors, employees, consultants and other service providers subject to certain exceptional circumstances such as inducement awards for new hires. As a result, we would lose an important compensation tool that enables us to compete for, incentivize and retain employees, directors, consultants and other service providers. Without a stock incentive plan, we would be forced to consider cash replacement alternatives to provide a market-competitive total compensation package necessary to retain and motivate talent critical to our future successes. These cash replacement alternatives could, among other things, reduce the cash available for growth and development and reduce the incentive opportunities of employees, consultants and other service providers. In short, if the Proposal is not approved by our shareholders, we believe our ability to attract and retain key talent in the competitive market for human capital would be significantly and negatively impacted, and this could affect our long-term success.

Accordingly, in this Proposal, shareholders are being asked to approve the 2023 Plan.

As of December 21, 2022, the closing price of our common stock was $264.47, as reported by the NYSE.

PROPOSAL |

2022 PROXY STATEMENT | 7 |

|

CERTAIN COMPENSATION AND GOVERNANCE PRACTICES CONCERNING EQUITY AWARDS

The Company has instituted a number of investor friendly practices in connection with its use of stock-based incentive awards.

Certain Equity Award Practices

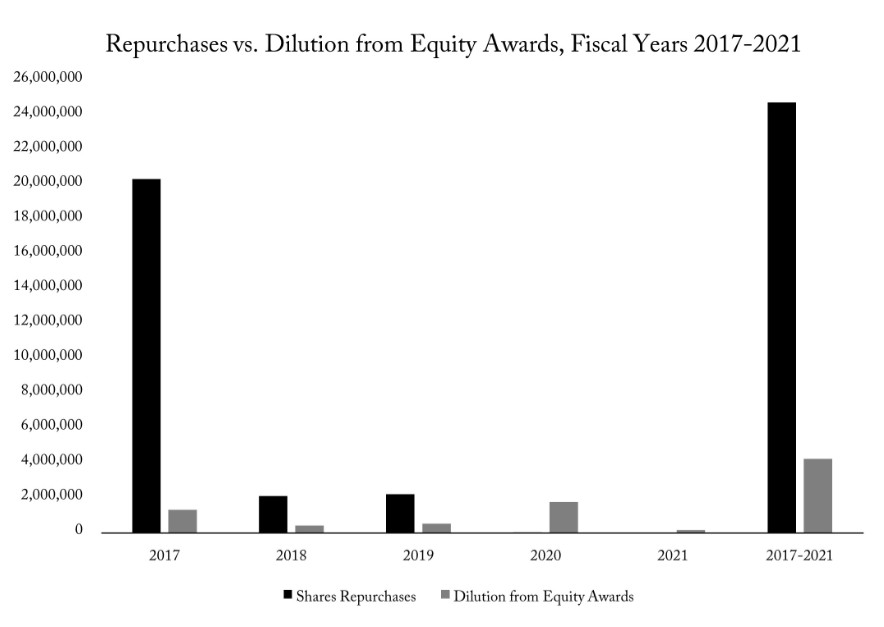

The Company recognizes the dilutive impact of stock-based incentive awards on our shareholders. We strive to balance the impact of dilution with our need to attract and retain talent. In addition, we rely on a number of other measures to address the dilutive effects of equity awards including: (i) use of longer term vesting with respect to many equity awards, a large number of which have a seven year vesting measurement period, (ii) avoiding mechanistic or formulaic grant practices that may create expectations around annual refresh grants that are not linked to market and business conditions, and (iii) repurchase of shares under our share repurchase programs as an offsetting mechanism to reduce dilution from equity awards.

Equity “Burn” Rate. The aggregate equity burn rate is a measurement of how quickly the Company is granting stock-based incentive awards in relation to shares outstanding and is calculated based on the number of awards granted during the year, divided by the weighted average shares of common stock outstanding. This formulation of burn rate is on a “gross” basis and does not factor in the return of shares to the pool available for grant in connection with associate departures. The Company’s gross burn rate in 2021 was 0.8%, and the average three-year gross burn rate (from 2019 to 2021) was 4.23%, which is far below the applicable 5.34% burn rate used by Institutional Shareholder Services (ISS) with respect to certain companies deemed by ISS to be in a comparable category.

Certain Plan Terms and Conditions. The 2023 Plan includes a number of features that will further align the interests of award recipients and the Company’s shareholders, including terms and conditions that we believe reflect sound compensation and corporate governance practices. These provisions include the following:

Shareholder Approval Required for Additional Shares. Unlike the 2012 Plan, the 2023 Plan does not contain an annual “evergreen” provision that provides for automatic increases of shares of our common stock authorized for issuance under the plan. The 2023 Plan authorizes a fixed share reserve. Therefore, we would have to obtain shareholder approval to increase the 2023 Plan’s share reserve.

No Discount Stock Options or Stock Appreciation Rights. All stock options and stock appreciation rights (“SAR”) will be granted with an exercise price equal to or greater than the fair market value of our common stock on the date the stock option or SAR is granted.

No Repricing of Stock Options or Stock Appreciation Rights. Unlike the 2012 Plan, the 2023 Plan prohibits, without shareholder approval, actions to reprice, replace, or repurchase options or SARs when the exercise price per share of an option or SAR exceeds the fair market value of the underlying shares.

Transferability. The 2023 Plan will allow for the transfer of awards under the 2023 Plan only (i) by will, (ii) by the laws of descent and distribution and (iii) for awards other than incentive stock options, to the extent authorized by the administrator.

8 | 2022 PROXY STATEMENT |

PROPOSAL |

|

In recent years, we have maintained active share repurchase programs as a means of creating shareholder value for our investors.

Share Repurchase Programs Offset Dilution. Share repurchases are an important component of our overall capital allocation strategy. We have attempted to be good stewards of capital and we strive to allocate capital in a manner that is in the long-term interest of our investors. We believe that our share repurchase programs have been a key component of our overall shareholder returns including the substantial increases in our share price from $24 per share at the time of our initial public offering and we expect that the ongoing use of share repurchases will be an important element of our ongoing strategy. Share repurchases also have the effect of offsetting dilution related to stock-based incentive awards. We are conscious that equity awards can be an important incentive for our leadership team in their efforts to drive shareholder returns while at the same time being mindful that share repurchases can be a means of offsetting dilution related to equity grants.

Five Year Share Repurchase Program Impact on Dilution. Our share repurchase programs have more than compensated for the impact of stock option and restricted stock unit issuances and dilution related to the 2012 Plan. We have maintained a robust share repurchase program over the past five years and have been opportunistic buyers of a significant number of shares of our common stock. Our shareholders understand the power of share repurchase programs as a valuable tool to drive shareholder returns and mitigate dilution. Our share repurchases have supported not only a return of capital to shareholders but also a complete offset to any shareholder dilution related to our equity awards over this time period. As shown below, over the past five years we completed substantial share repurchases which more than offset the dilutive effect of our equity awards granted during that time.

In 2022, the Company has continued to repurchase shares pursuant to its share repurchase program and has once again repurchased substantially more shares than it awarded through equity grants during the year.

PROPOSAL |

2022 PROXY STATEMENT | 9 |

|

SUMMARY OF THE 2023 PLAN

We have established the 2023 Plan terms and conditions in order to provide equity incentive awards to our associates as part of the operation of our business.

Background

Equity is an important element of compensation. We operate in a highly competitive market for talent. Our corporate headquarters is located in the San Francisco Bay Area, and we compete for executive talent with many other companies that offer equity incentives as a key element of their compensation programs.

As a result, we believe that having a sufficient number of shares available for grant to our associates as part of our equity compensation is a critical element of our overall compensation approach.

We have sized the 2023 Plan in terms of share availability with the objective that it should be sufficient for our needs for the next three to five years of equity awards and possibly longer. The 4,000,000 shares authorized under the 2023 Plan takes into account that upon expiration of the 2012 Plan there were approximately 1.6 million shares that lapsed under the plan. Accordingly, we carried over such unused share balance into the 2023 Plan together with approximately 2.4 million incremental shares resulting in a 2023 Plan size of 4,000,000 authorized shares.

We have determined the size of the 2023 Plan taking into account a range of factors including our historical equity grant practices as well as anticipated future needs of our business. The exact rate at which we use shares under the 2023 Plan will depend upon a range of variables including the rate of our growth in expanding the business internationally as well as other factors such as the degree to which we acquire other businesses. We recently have acquired several other businesses and may in the future add additional complementary businesses that fit within our overall strategic direction as we continue to climb the luxury mountain. In addition, we have not made refresh equity awards to most of our personnel since April 2020 and so we anticipate some level of catch up award activity in light of the cadence of our recent grants.

Certain Plan Terms and Conditions

The following summary of the 2023 Plan provided herein sets forth the principal features of the 2023 Plan. This summary does not purport to be a complete description of all of the provisions of the 2023 Plan. It is qualified in its entirety by reference to the full text of the 2023 Plan, a copy of which is attached as Annex A to this proxy statement.

General. The 2023 Plan permits the Company to issue stock options (incentive and/or non-qualified), SARs, restricted stock, restricted stock units and other equity and cash awards.

Eligibility. Employees, non-employee directors and consultants of the Company and its subsidiaries would be eligible to receive awards under the 2023 Plan. As of December 21, 2022, we had approximately 5,500 employees, 7 non-employee directors and approximately 2,301 consultants who would have been eligible to be selected to receive awards under the 2023 Plan. Such persons are eligible to participate in the 2023 Plan on the basis that such participation provides an incentive, through ownership of our common stock, to continue in service to us and any parent and subsidiary corporations, and to help us compete effectively with other enterprises for the services of qualified persons.

10 | 2022 PROXY STATEMENT |

PROPOSAL |

|

Share Reserve. The maximum number of shares of common stock that may be issued pursuant to the 2023 Plan is (i) 4,000,000, plus (ii) any shares of our common stock covered by any outstanding award granted under the 2012 Plan (or a portion of such award) that will be added to the 2023 Plan’s authorized share limit if such award (or a portion of such award) is forfeited, is canceled or expires (whether voluntarily or involuntarily) without the issuance of shares of our common stock or if the shares underlying such award (or a portion of such award) that are surrendered or withheld in payment of the award’s exercise or purchase price or in satisfaction of tax withholding obligations with respect to an award would be deemed not to have been issued for purposes of determining the maximum number of shares of our common stock that may be issued under the 2023 Plan had such award been an award granted under the 2023 Plan. We determined the 4,000,000 share number by considering the number of available but unused shares under the 2012 Plan at the 2012 Plan’s expiration (which 1,607,508 shares were no longer available for grant under the 2012 Plan upon its expiration) and our expected use of the 2023 Plan in connection with the growth of our business. As of November 1, 2022, when the 2012 Plan expired, there were (i) options to purchase approximately 4,472,856 shares of our common stock outstanding under the 2012 Plan, (ii) no SARs covering any shares outstanding under the 2012 Plan, (iii) awards other than options and SARs covering an aggregate of 24,390 shares outstanding under the 2012 Plan, and (iv) approximately 1,607,508 shares that remained available for future awards under the 2012 Plan. The weighted average exercise price of all options outstanding as of November 1, 2022 was approximately $157.54 and the weighted average remaining term of such options was approximately 4.82 years.

In addition, if an award under the 2023 Plan pursuant to which shares are issuable is forfeited, expires or terminates, then the shares underlying such award will be available for future issuance under the 2023 Plan.

To the extent not prohibited by applicable laws, any shares covered by an award that are surrendered or withheld in payment of the award’s exercise or purchase price, or in satisfaction of tax withholding obligations with respect to an award, will be deemed not to have been issued for purposes of determining the maximum number of shares that may be issued under the 2023 Plan, unless otherwise determined by the plan administrator. SARs payable in shares will reduce the maximum aggregate number of shares which may be issued under the 2012 Plan only by the net number of actual shares issued to the award recipient upon exercise of the SAR.

As described below under the heading “Certain Adjustments,” the plan administrator will adjust the share limit if it determines that a dividend, recapitalization, stock split, merger, consolidation or other similar corporate transaction or event equitably requires an adjustment. The plan administrator may issue awards in settlement or assumption of, or in substitution for, outstanding awards in connection with the Company or its subsidiary acquiring another entity, an interest in another entity or an additional interest in connection with a merger, stock purchase, asset purchase or other form of transaction, and the shares underlying such awards will not be counted against the share limit. Additionally, available shares under a shareholder approved plan of an acquired company, as appropriately adjusted to reflect such acquisition, may be used for awards under the 2023 Plan and will not be counted against the share limit, except as required by the rules of any applicable stock exchange.

Administration. Our Board of Directors, or a committee of our Board of Directors, will administer the 2023 Plan. To the extent permitted by applicable law, our Board of Directors or a committee of our Board of Directors may also authorize one or more officers or other employees to administer the 2023 Plan with respect to awards to employees or consultants who are neither directors nor officers. The administrator may determine and interpret the terms and conditions of the awards, including the employees, directors and consultants who will receive awards, the exercise price, the number of shares subject to each such award, the vesting schedule and exercisability of the awards, the restrictions on transferability of awards and the form of consideration payable upon exercise.

PROPOSAL |

2022 PROXY STATEMENT | 11 |

|

Except in connection with equity restructurings and other situations in which share adjustments are specifically authorized, the 2023 Plan will prohibit repricing of any outstanding stock option or SAR awards without the prior approval of our shareholders. Specifically, without prior affirmative approval of Company’s shareholders, the Company may not (a) reduce the per share exercise price of an option or base amount of a SAR previously awarded to any Grantee, (b) cancel, surrender, replace or otherwise exchange any outstanding option or SAR where the fair market value of a share of our common stock underlying such option or SAR is less than its per share exercise price or base amount for a new stock option or SAR, another award, cash, shares or other securities or (c) take any other action that is considered a “repricing” for purposes of the shareholder approval rules of the applicable securities exchange or inter-dealer quotation system on which the our shares of common stock are listed or quoted.

Stock Options. The 2023 Plan will allow for the grant of incentive stock options that qualify under Section 422 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”) only to our employees and employees of any parent or subsidiary of ours. Non-qualified stock options may be granted to our employees, directors and consultants and those of any parent or subsidiary of ours. The exercise price of all options granted under the 2023 Plan must at least be equal to the fair market value of our common stock on the date of grant. The term of an incentive stock option may not exceed ten years, except that with respect to any employee who owns more than 10% of the voting power of all classes of our outstanding stock or any parent or subsidiary corporation as of the grant date, the term must not exceed five years, and the exercise price must equal at least 110% of the fair market value on the grant date. After the continuous service of an employee, director or consultant terminates, he or she may exercise his or her option, to the extent vested, for the period of time specified in the option agreement. However, an option may not be exercised later than the expiration of its term.

Stock Appreciation Rights. The 2023 Plan will allow for the grant of SARs. SARs allow the recipient to receive the appreciation in the fair market value of our common stock between the date of grant and the exercise date. The administrator will determine the terms of SARs, including when such rights become exercisable and whether to pay the increased appreciation in cash or with shares of our common stock, or a combination thereof, except that the base appreciation amount for the cash or shares to be issued pursuant to the exercise of a SAR will be no less than 100% of the fair market value per share on the date of grant. After the continuous service of an employee, director or consultant terminates, he or she may exercise his or her SAR, to the extent vested, only to the extent provided in the SAR agreement.

Restricted Stock Awards. The 2023 Plan will allow for the grant of restricted stock. Restricted stock awards are shares of our common stock that vest in accordance with terms and conditions established by the administrator. The administrator will determine the number of shares of restricted stock granted to any employee, director or consultant. The administrator may impose whatever conditions on vesting it determines to be appropriate. For example, the administrator may set restrictions based on the achievement of specific performance goals. Shares of restricted stock that do not vest are subject to our right of repurchase or forfeiture.

Restricted Stock Units. The 2023 Plan will allow for the grant of restricted stock units. Restricted stock units are awards that will result in payment to a recipient at the end of a specified period only if the vesting criteria established by the administrator are achieved or the award otherwise vests. The administrator may impose whatever conditions to vesting, or restrictions and conditions to payment that it determines to be appropriate. The administrator may set restrictions based on the achievement of specific performance goals or on the continuation of service or employment. Payments of earned restricted stock units may be made, in the administrator’s discretion, in cash, with shares of our common stock or other securities, or a combination thereof.

12 | 2022 PROXY STATEMENT |

PROPOSAL |

|

Terms of Awards. Subject to the terms of the 2023 Plan, the administrator will determine the provisions, terms, and conditions of each award including, but not limited to, the award vesting schedule, repurchase provisions, rights of first refusal, forfeiture provisions, form of payment (cash, shares, or other consideration) upon settlement of the award, payment contingencies, and satisfaction of any performance criteria.

Transferability of Awards. Incentive stock options may not be sold, pledged, assigned, hypothecated, transferred or disposed of in any manner other than by will or by the laws of descent or distribution and may be exercised, during the lifetime of the award recipient, only by the award recipient. Awards other than incentive stock options will be allowed to be transferred (i) by will or by the laws of descent and distribution, (ii) during the lifetime of the award recipient, to the extent and in the manner authorized by the administrator, but only to the extent such transfers are made in accordance with applicable laws to family members, to family trusts, to family controlled entities, to charitable organizations, and pursuant to domestic relations orders or agreements, in all cases without payment for such transfers to the award recipient and (iii) as otherwise expressly permitted by the administrator and in accordance with applicable laws.

Certain Adjustments. Subject to any required action by the Company’s shareholders, applicable laws and the change in control provisions as discussed below, (i) the number and kind of shares or other securities or property covered by any outstanding award, (ii) the number and kind of shares that have been authorized for issuance under the 2023 Plan, (iii) the exercise price, base amount or purchase price of any outstanding award and (iv) any other terms that the administrator determines require adjustment, will be proportionately adjusted for: (A) any increase or decrease in the number of issued shares of our common stock resulting from a stock split, reverse stock split, stock dividend, recapitalization, combination or reclassification, or similar transaction affecting the shares; (B) any other increase or decrease in the number of issued shares of our common stock effected without receipt of consideration by the Company; or (C) any other transaction with respect to the shares of our common stock, including any distribution of cash, securities or other property to shareholders (other than a normal cash dividend), a corporate merger, consolidation, acquisition of property or stock, separation (including a spin-off or other distribution of stock or property), reorganization, liquidation (whether partial or complete), a “corporate transaction” as defined in Section 424 of the Code or any similar transaction. Such adjustments to outstanding awards will be effected in a manner that is intended to preclude the enlargement or diminution of rights and benefits under such awards. Except as the administrator determines, no issuance by the Company of shares of any class, or securities convertible into shares of any class, will affect, and no adjustment will be made with respect to, the number or price of shares of our common stock subject to an award.

PROPOSAL |

2022 PROXY STATEMENT | 13 |

|

Changes in Control. The 2023 Plan provides that in the event of a change in control, as such term is defined in the 2023 Plan, all outstanding awards will be treated in the manner described in the definitive transaction agreement (or, if there is no such agreement, in the manner determined by the administrator). The treatment specified in the definitive transaction agreement or as determined by the administrator may include one or more of the following: (i) cancellation of the awards for no consideration; (ii) assumption or substitution of the awards with adjustments as to the number or kind of shares or other securities or property and applicable exercise price, base amount, or purchase price; (iii) acceleration of vesting of the awards; (iv) the cancellation of the vested awards, together with a payment to the grantees holding such vested awards so canceled of an amount based upon the consideration being paid per share in connection with such change in control in cash or, in the sole discretion of the Administrator, in the form of such other consideration necessary for a grantee to receive property, cash or securities (or a combination thereof) as the grantee would have been entitled to receive upon such change in control, if the grantee had been, immediately prior to such change in control, the holder of the number of shares covered by the award at such time, less any applicable exercise price or base amount; provided, however, that holders of vested options and vested SARs shall be entitled to such consideration only if the per-share consideration exceeds the applicable exercise price or base amount, and to the extent that the per-share consideration is less than or equal to the applicable exercise price or base amount, such vested options and vested SARs shall be cancelled for no consideration; or (v) the replacement of the awards with a cash incentive program that preserves the value of the awards so replaced (determined as of such change in control).

Plan Amendments and Termination. The 2023 Plan will automatically terminate ten years following the date it becomes effective, unless we terminate it sooner. In addition, our Board of Directors has the authority to amend, suspend or terminate the 2023 Plan, subject to shareholder approval in the event such approval is required by law. No amendment, suspension or termination of the 2023 Plan or any award shall materially adversely affect the rights under any outstanding award without the holder’s written consent. However, an amendment that may cause an incentive stock option to become a non-qualified stock option or the administrator considers necessary or advisable to comply with applicable laws will not be treated as materially adversely affecting the rights under any outstanding award.

Certain Interests of Directors and Officers. In considering the recommendation of the Board of Directors with respect to the approval of the 2023 Plan, shareholders should be aware that, as discussed above, directors and officers are eligible to receive awards under the 2023 Plan. The Board of Directors recognizes that approval of this proposal may benefit our directors and their successors.

CERTAIN U.S. FEDERAL TAX CONSEQUENCES

The following summary of U.S. federal taxes applicable to awards that may be provided under the 2023 Plan and the disposition of shares acquired pursuant to the exercise or settlement of such awards, based on provisions of the Code and the regulations thereunder in effect on the date of this proxy statement. This summary is not intended to be a complete statement of applicable law, nor does it address foreign, state, local, and payroll tax considerations. This summary assumes that all awards described in the summary are exempt from, or comply with, the requirement of Section 409A of the Code. Moreover, the U.S. federal income tax consequences to any particular participant may differ from those described herein by reason of, among other things, the particular circumstances of such participant.

14 | 2022 PROXY STATEMENT |

PROPOSAL |

|

Non-Qualified Stock Options. The grant of a non-qualified stock option under the 2023 Plan generally will not result in any U.S. Federal income tax consequences to the award recipient or to the Company. Upon exercise of a non-qualified stock option, the award recipient is generally subject to income taxes at the rate applicable to ordinary compensation income on the difference between the option exercise price and the fair market value of the shares on the date of exercise. This income is generally subject to withholding for U.S. Federal income and employment tax purposes. The Company is entitled to an income tax deduction in the amount of the income recognized by the award recipient, subject to possible limitations imposed by Section 162(m) or Section 280G of the Code. Any gain or loss on the award recipient’s subsequent disposition of the shares of the Company’s common stock will receive long or short-term capital gain or loss treatment, depending on whether the shares are held for more than one year following exercise. The Company does not receive a tax deduction for any such gain.

Incentive Stock Options. The grant of an incentive stock option under the 2023 Plan will not result in any U.S. Federal income tax consequences to the award recipient or to the Company. An award recipient recognizes no U.S. Federal taxable income upon exercising an incentive stock option (subject to the alternative minimum tax rules discussed below), and the Company receives no deduction at the time of exercise. In the event of a disposition of stock acquired upon exercise of an incentive stock option, the tax consequences depend upon how long the award recipient has held the shares of the Company’s common stock. If the award recipient does not dispose of the shares within two years after the incentive stock option was granted, nor within one year after the incentive stock option was exercised, the award recipient will recognize a long-term capital gain (or loss) equal to the difference between the sale price of the shares and the exercise price. The Company is not entitled to any deduction under these circumstances.

If the award recipient fails to satisfy either of the foregoing holding periods, the award recipient must recognize ordinary income in the year of the disposition, which is referred to as a “disqualifying disposition.” The amount of such ordinary income generally is the lesser of (i) the difference between the amount realized on the disposition and the exercise price or (ii) the difference between the fair market value of the stock on the exercise date and the exercise price. Any gain in excess of the amount taxed as ordinary income will be treated as a long or short-term capital gain, depending on whether the stock was held for more than one year. The Company, in the year of the disqualifying disposition, is entitled to a deduction equal to the amount of ordinary income recognized by the award recipient, subject to possible limitations imposed by Section 162(m) and Section 280G of the Code.

The “spread” under an incentive stock option—i.e., the difference between the fair market value of the shares at exercise and the exercise price—is classified as an item of adjustment in the year of exercise for purposes of the alternative minimum tax. If an award recipient’s alternative minimum tax liability exceeds such award recipient’s regular income tax liability, the award recipient will owe the larger amount of taxes. In order to avoid the application of alternative minimum tax with respect to incentive stock options, the award recipient must sell the shares within the same calendar year in which the incentive stock options are exercised. However, such a sale of shares within the same year of exercise will constitute a disqualifying disposition, as described above.

Restricted Stock. The grant of restricted stock will generally subject the recipient to ordinary compensation income on the difference between the amount paid for such stock and the fair market value of the shares on the date that the restrictions lapse. This income is generally subject to withholding for U.S. Federal income and employment tax purposes. The Company is entitled to an income tax deduction in the amount of the ordinary income recognized by the recipient, subject to possible limitations imposed by Section 162(m) and Section 280G of the Code. Any gain or loss on the recipient’s subsequent disposition of the shares will receive long or short-term capital gain or loss treatment depending on how long the stock has been held since the restrictions lapsed. The Company does not receive a tax deduction for any such gain.

PROPOSAL |

2022 PROXY STATEMENT | 15 |

|

Recipients of restricted stock may make an election under Section 83(b) of the Code (a “Section 83(b) Election”) to recognize as ordinary compensation income in the year that such restricted stock is granted, the amount equal to the spread between the amount paid for such stock (if any) and the fair market value on the date of the issuance of the stock. If such an election is made, the recipient recognizes no further amounts of compensation income upon the lapse of any restrictions and any gain or loss on subsequent disposition will be long or short-term capital gain to the recipient. The Section 83(b) Election must be made within thirty days from the time the restricted stock is issued.

Stock Appreciation Rights. Recipients of SARs generally should not recognize income until such rights are exercised, assuming there is no ceiling on the value of the right and Section 409A of the Code does not apply. Upon exercise, the award recipient will normally recognize taxable ordinary income for U.S. Federal income tax purposes equal to the amount of cash and fair market value the shares, if any, received upon such exercise. Award recipients who are employees will be subject to withholding for U.S. Federal income and employment tax purposes with respect to income recognized upon exercise of a SAR. Award recipients will recognize gain upon the disposition of any shares received on exercise of a SAR equal to the excess of (i) the amount realized on such disposition over (ii) the ordinary income recognized with respect to such shares under the principles set forth above. That gain will be taxable as long or short-term capital gain depending on whether the shares were held for more than one year.

The Company will be entitled to a tax deduction to the extent and in the year that ordinary income is recognized by the award recipient, subject to possible limitations imposed by Section 162(m) and Section 280G of the Code.

Restricted Stock Units. Recipients of restricted stock units generally should not recognize income until such units are converted into cash or shares of stock unless Section 409A of the Code applies. Upon conversion, the award recipient will normally recognize taxable ordinary income for federal income tax purposes equal to the amount of cash and fair market value the shares, if any, received upon such conversion. Award recipients who are employees will be subject to withholding for federal income and employment tax purposes with respect to income recognized upon conversion of the restricted stock units. Award recipients will recognize gain upon the disposition of any shares received upon conversion of the restricted stock units equal to the excess of (i) the amount realized on such disposition over (ii) the ordinary income recognized with respect to such shares under the principles set forth above. That gain will be taxable as long or short-term capital gain depending on whether the shares were held for more than one year.

The Company will be entitled to a tax deduction to the extent and in the year that ordinary income is recognized by the award recipient, subject to possible limitations imposed by Section 162(m) and Section 280G of the Code.

Dividends and Dividend Equivalents. Recipients of stock-based awards that earn dividends or dividend equivalents will recognize taxable ordinary income on any dividend payments received with respect to unvested shares subject to such awards, which income is generally subject to withholding for U.S. Federal income and employment tax purposes. The Company is entitled to an income tax deduction in the amount of the income recognized by an award recipient, subject to possible limitations imposed by Section 162(m) and Section 280G of the Code.

Compliance with Section 409A of the Code. To the extent applicable, it is intended that the 2023 Plan and any grants made under the 2023 Plan will comply with or be exempt from the provisions of Section 409A of the Code, so that the income inclusion provisions of Section 409A(a)(1) of the Code do not apply to the participants. The 2023 Plan and any grants made under the 2023 Plan will be administered and interpreted in a manner consistent with this intent.

16 | 2022 PROXY STATEMENT |

PROPOSAL |

|

The foregoing is only a summary of the U.S. Federal income tax consequences of 2023 Plan transactions, and is based upon U.S. Federal income tax laws in effect on the date of this proxy statement. Reference should be made to the applicable provisions of the Code. This summary does not purport to be complete, and does not discuss the tax consequences of an award recipient’s death or the tax laws of any municipality, state or foreign country to which the award recipient may be subject.

NEW PLAN BENEFITS

Awards under the 2023 Plan, if approved by shareholders, would be discretionary and no specific determination has been made as to the grant or allocation of awards under the 2023 Plan. Therefore, at this time the benefits that may be received by the Company’s employees, directors, consultants or other service providers under the 2023 Plan are not presently determinable.

EQUITY COMPENSATION PLAN INFORMATION

For information regarding awards made under our existing equity compensation plans, including the 2012 Plan, outstanding as of January 29, 2022, the last day of our 2021 fiscal year, see “Executive and Director Compensation—Equity Compensation Plan Information” below.

REQUIRED VOTE FOR THIS PROPOSAL

The affirmative vote of a majority of votes cast, whether in person or by proxy, is required to approve the Proposal. Abstentions are not considered votes cast and will have no effect on the Proposal.

THE BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE RH 2023 STOCK INCENTIVE PLAN.

PROPOSAL |

2022 PROXY STATEMENT | 17 |

|

18 | 2022 PROXY STATEMENT |

EXECUTIVE & DIRECTOR COMPENSATION |

|

EXECUTIVE COMPENSATION

Due to the fact that the Proposal relates to a compensation plan in which executive officers and directors of the Company will participate, the Company is required under applicable disclosure rules to furnish certain executive and director compensation information related to our last completed fiscal year. As such, this section is based on the Compensation Discussion and Analysis information and related compensation tables that were included in our definitive Proxy Statement, dated May 19, 2022, for the fiscal year ended January 29, 2022.

COMPENSATION DISCUSSION & ANALYSIS

Executive Summary

We believe that continually analyzing and refining our compensation program enables us to achieve the key goals of our compensation philosophy and supports ongoing improvements in our financial performance. We align our executive compensation practices to the business objectives of our Company in order to drive ongoing improvements in our financial performance. This compensation discussion and analysis (“CD&A”) explains the strategy, design, and decision-making processes of our compensation programs and practices in fiscal 2021 for our named executive officers. This CD&A is intended to provide perspective on the compensation information contained in the compensation tables that follow this discussion. This CD&A also discusses how the fiscal 2021 compensation of our named executive officers aligns with the key goals of our compensation philosophy, namely, attracting and retaining the best talent and driving financial performance. We also discuss how we use our compensation programs, including equity programs, to encourage an ownership and stakeholder perspective among our named executive officers by providing them with a long-term interest in the growth and financial performance of our Company that aligns with the interests of our shareholders.

The following table sets forth, for fiscal 2021, our named executive officers, as defined in Item 402 of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”):

| (1) | Mr. Price retired and left the Company on January 29, 2022. |

| (2) | Mr. Stanchak retired and left the Company on May 16, 2021. |

We believe that compensation paid to our executive officers should be:

Closely aligned with the performance of the Company, on both a short-term and long-term basis;

Linked to specific, measurable results intended to create value for shareholders;

Transparent, accessible and understandable by all stakeholders to understand what drives our executives; and

Tailored to achieve the key goals of our compensation program and philosophy.

Our executive compensation programs are aligned with our shareholders’ interests, with performance-based compensation being tied primarily to our annual earnings before taxes and our long-term stock price performance.

EXECUTIVE & DIRECTOR COMPENSATION |

2022 PROXY STATEMENT | 19 |

|

In the case of our Chairman and Chief Executive Officer, we have structured his equity grants in reliance on multi-year stock option awards. His grants for both 2017 and 2020 were designed to require substantial stock price appreciation from the Company’s share price on the date of grant, as described further below. Mr. Friedman’s base salary has remained unchanged since it was last increased in June 2013 when he returned to the Company, at the time, as our Chairman and Co-Chief Executive Officer. Mr. Friedman’s bonus opportunity was not changed for fiscal 2019, fiscal 2020 or fiscal 2021. We have made these compensation decisions with respect to our Chairman and Chief Executive Officer to place the highest priority in his compensation incentives on performance using the measure of stock price appreciation, which we believe is the single best overall measure of performance that aligns the executive’s compensation with shareholder returns over time.

The compensation committee has also continued to focus on balancing the alignment of our executive compensation program with our financial performance, providing incentives for retention purposes, rewarding the continued transformation of the business in fiscal 2021, and tailoring our compensation arrangements to match changes in our executive leadership. In March 2022, the compensation committee reviewed, as described further below, the Company’s financial results related to the Leadership Incentive Program (“LIP”) targets set in the prior year and determined that the Company had exceeded the 200% achievement level with respect to the Company’s financial objectives. As a result, the compensation committee determined that the amount of the payout under the LIP would be set at the maximum level of 200%. In addition, in fiscal 2021 we increased the base salaries for certain named executives, as discussed further below.

Multi-Year Stock Option Awards to Chairman and Chief Executive Officer

Our last two stock options awards to Mr. Friedman were granted on a multi-year basis in May, 2017 (the “2017 Stock Option Award”) and in October, 2020 (the “2020 Stock Option Award”), in reliance on certain selling restrictions tied to stock price appreciation that are measured over a four year initial performance period and have been designed to reward Mr. Friedman for long-term stock price appreciation.

The 2020 Stock Option Award contains the same overall structure as the 2017 Stock Option Award by utilizing both time-based service period requirements and performance-based metrics. The 2017 Stock Option Award was granted for 1 million shares at an exercise price of $50 per share with stock price performance targets of $100, $125 and $150 per share, which performance hurdles each represented a substantial premium above the prevailing RH common stock price at the time of the grant. The 2020 Stock Option Award was granted for 700,000 shares at an exercise price of $385.30 per share with stock price performance targets of $500, $650 and $800 per share, which performance hurdles each represented a substantial premium above the prevailing RH common stock price at the time of the grant.

The compensation committee determined to grant Mr. Friedman the 2020 Stock Option Award to cover the successive four-year period upon the expiration of the time-based service requirements of the 2017 Stock Option Award in order to provide a continuation of the stock price performance methodology of the 2017 award for four successive performance years commencing in May 2021 through May 2025 at enhanced price levels.

Selling restrictions attached to the shares with respect to these multi-year awards only lapse upon the achievement of both certain time-based service period requirements and certain stock price-based performance objectives. The compensation committee believes that the combination of time-based restrictions and performance-based restrictions tied to stock price appreciation creates a strong alignment between Mr. Friedman and the objectives of the Company’s shareholders.

The RH stock price has substantially exceeded the performance hurdles under the 2017 award granted to Mr. Friedman such that all of the selling restrictions associated with that award have lapsed. The Board of Directors and the compensation committee concluded that the 2017 award was a successful incentive structure for the Chief Executive Officer using a combination of both time-based restrictions and performance-based restrictions to create strong alignment between the Chief Executive Officer and the Company’s shareholders.

20 | 2022 PROXY STATEMENT |

EXECUTIVE & DIRECTOR COMPENSATION |

|

Selling Restrictions Lapsed During First Performance Period for 2020 Stock Option Award

The following table quantifies the stock price appreciation from the date of grant that were required as of the date of the initial grant in order to achieve each performance target under the 2020 Stock Option Award:

|

|

PRICE TARGET ($) |

|

PREMIUM TO GRANT |

|

|||

Exercise Price |

|

$ |

385 |

|

|

0.0% |

|

|

Performance Target |

|

$ |

500 |

|

|

29.8% |

|

|

Performance Target |

|

$ |

650 |

|

|

68.7% |

|

|

Performance Target |

|

$ |

800 |

|

|

107.6% |

|

|

A portion of the time-based service period requirements and stock price-based performance hurdles for the 2020 Stock Option Award have been achieved during the first year of performance measurement under the 2020 Stock Option Award from May 2021 through May 2022 as follows:

58,333 shares with stock price performance hurdle of $500 per share

58,333 shares with a stock price performance hurdle of $650 per share

The selling restrictions under the 2020 Stock Option Award with respect to the remaining 583,334 shares have not yet been achieved. The compensation committee believes that the stock price appreciation and stock option exercise metrics of the 2020 Stock Option Award provide substantial incentive for Mr. Friedman to help to achieve stock price appreciation in the years ahead, which the compensation committee believes create a high degree of alignment with successful outcomes for the Company’s investors.

If Mr. Friedman’s employment with RH is terminated (i) by RH without cause, (iii) by Mr. Friedman for good reason (as such terms are defined in the option award agreement), or (iii) for death or disability (as such terms are defined in the option award agreement), then any share selling restrictions on shares subject to the 2020 Stock Option Award that would have been eligible to lapse at any time during the twelve-month period following such termination had such termination not occurred will be eligible to lapse based solely upon the achievement of the stated stock price performance levels at any point during such twelve-month period. For further details regarding the option award agreement with respect to the 2020 Stock Option Award, refer to the Company’s Current Report on Form 8-K filed on October 21, 2020.

We continue to believe that our executive compensation program, including the compensation of our Chairman and Chief Executive Officer, is clearly structured to reflect the best interests of shareholders and that if we continue to drive improving operational and financial performance investors will be rewarded by stock price appreciation.

EXECUTIVE & DIRECTOR COMPENSATION |

2022 PROXY STATEMENT | 21 |

|

OVERVIEW OF COMPENSATION PROGRAM & PHILOSOPHY

|

||

Attract and retain |

|

We focus on attracting and retaining top-caliber, knowledgeable and experienced senior executives |

|

|

|

|

||

|

Encourage an ownership and entrepreneurial mindset |

|

Our programs create in our leadership an ownership and entrepreneurial mindset in order to align the annual and long-term strategic goals of our executives with those of our Company and our shareholders, including improvements in shareholder returns |

|

|

|

|

||

Motivate |

|

Our programs motivate our executives to achieve superior results for our Company and our shareholders |

|

|

|

|

||

Reward performance |

|

We pay for performance that is achieved through creativity, the capitalization of unique strategic opportunities and business initiatives, and results in shareholder-aligned financial successes, including improvements in our stock price |

|

||

|

|

|

Encourage appropriate risk taking |

|

Our programs focus our executives to analyze business initiatives where we seek return on investment that exceeds downside risks |

|

||

|

|

|

Provide transparent reward systems |

|

Our reward systems are easily understood by our leaders and shareholders |

|

||

|

|

|

|

Reinforce the succession planning process |

|

Our programs help leadership to focus on identifying, and help us reward, retain and promote from within, the next generation of senior leadership to achieve the Company’s growth, profitability and other objectives through increased responsibilities and compensation |

|

|

|

This compensation philosophy guides the compensation committee in assessing the compensation to be paid to our executives, including our named executive officers. The compensation committee endeavors to ensure that the total compensation paid to the named executive officers is fair, competitive and consistent with our compensation philosophy. This compensation philosophy also guides the compensation committee as to the proper allocation among current cash compensation (in the form of annual base salary), short-term compensation (in the form of performance-based, annual cash incentives), and long-term compensation (in the form of equity incentive compensation). We evaluate both the performance and compensation of our named executive officers annually to ensure that the executive compensation program we implement achieves these goals.

One of our overriding goals informing our compensation philosophy is to create in our leadership an ownership and entrepreneurial mindset in order to align leadership performance with improvements in shareholder returns. Our compensation programs aim to improve upon this interest alignment through various methods, including the use of stock options for equity grants, the use of long-term price performance targets in the award granted to our Chief Executive Officer and various profit metrics in the bonus plan.

22 | 2022 PROXY STATEMENT |

EXECUTIVE & DIRECTOR COMPENSATION |

|

We have implemented executive compensation policies and practices that reinforce our compensation philosophy and align with those commonly-viewed best practices and sound governance principles that we believe are appropriate for us. The following chart summarizes these policies and practices:

100% independent directors on our compensation committee

Annual review and approval of our compensation strategy

Independent compensation consultant engaged by our compensation committee

Performance-based cash incentives

Significant portion of executive compensation is either tied to corporate performance directly or indirectly through stock price performance because of the equity component of compensation

We use five year vesting schedules for some of our equity grants (frequently with 20% vesting in each year). In more recent years, we have shifted our vesting practices to use back-end loaded vesting periods with respect to many of our equity awards, which we believe motivates our associates and leaders in favor of creating long-term shareholder value on a sustained basis. With regard to back-end loaded vesting, we often use schedules along these lines:

Our seven-year award structure would generally vest 10% in years one, two and three; 15% in years four and five; and 20% in years six and seven

Our five-year award structure would generally vest either (i) 15% in years one and two; 20% in year three; and 25% in years four and five, or (ii) 10% in years one and two; 20% in year three; and 30% in years four and five

In May 2018, the board adopted stock ownership guidelines applicable to all directors and executive officers of the Company in order to further align the financial interest of our directors and executive officers with the interest of our investors

Our Chairman and Chief Executive Officer, Mr. Friedman, has consistently maintained a significant equity ownership interest in the Company and, as of December 21, 2022, beneficially owned approximately 19.5% of the Company’s common stock which, based on the average closing price for RH stock for fiscal 2021, was valued at approximately 2,185.7 times his annual base salary for fiscal 2021(1), far above the multiple of six times salary minimum ownership requirement.

Broad-based company-sponsored health and retirement benefits programs

| (1) | Based on shares owned directly, shares owned indirectly and reported as beneficially owned for Section 16 reporting purposes, and the “in the money” value of stock options, restricted stock and restricted stock units that are no longer subject to vesting or selling restrictions. |

EXECUTIVE & DIRECTOR COMPENSATION |

2022 PROXY STATEMENT | 23 |

|

No “single trigger” change of control benefits

No post-termination retirement- or pension-type non-cash benefits or perquisites for our executive officers that are not available to our associates generally

No short sales with respect to our common stock or hedging or derivative transactions involving our securities by directors, officers, associates or other insiders

We have not repriced or bought out underwater stock options, which will be prohibited in absence of approval by our shareholders for grants under the 2023 Plan if the Proposal is approved by our shareholders

No acceleration of share vesting generally—instead, we have simple customary levels of severance protection commensurate with a senior position

No tax gross-ups for change of control benefits

No defined value pensions or long term cash incentives like supplemental retirement plans or other forms of long-term deferred compensation

No equity awards for leadership with short-term restrictions or vesting, such as one-, two- or three-year vesting

24 | 2022 PROXY STATEMENT |

EXECUTIVE & DIRECTOR COMPENSATION |

|

COMPENSATION COMMITTEE REVIEW OF COMPENSATION

Our Board of Directors has established a compensation committee that is generally responsible for the oversight, implementation and administration of our executive compensation plans and programs. The compensation committee engages in the following, either together with the Board of Directors as a whole or as a committee, making recommendations to the Board of Directors regarding approval, as necessary:

Annually review and approve the Company’s corporate goals and objectives relevant to compensation of the Chief Executive Officer;

Evaluate the Chief Executive Officer’s performance in light of such goals and objectives; and

Determine and approve the Chief Executive Officer’s compensation level based on this evaluation.

In addition, the compensation committee annually reviews the following:

Annual base salary levels;

Annual incentive compensation levels;

Long-term incentive compensation levels; and

Any supplemental or special benefits.

And, the committee ensures that appropriate overall corporate performance measures and goals are set and determine the extent to which the established goals have been achieved and any related compensation earned;

Determines the appropriateness of, and in some cases retain, a compensation consultant to offer advice for the consideration of the compensation committee and consider the independence of such consultant in accordance with applicable SEC and NYSE rules; and

Performs other necessary tasks related to the implementation and administration of executive compensation plans and programs.

The compensation committee’s annual review of executive compensation generally occurs within the timeframe of April to June of each year.

EXECUTIVE & DIRECTOR COMPENSATION |

2022 PROXY STATEMENT | 25 |

|

COMPENSATION LEVEL SETTING PROCESS

Our compensation committee reviews the following, among other factors, when determining compensation:

The individual’s performance and contributions to financial objectives;

Equity awards previously granted to the executive, which includes amounts of such awards that remain unvested or are under selling restrictions and therefore continue to incentivize future performance;

Individual leadership, expectations, expertise, skill, and knowledge;

Overall compensation, including base salary and bonus opportunity, as a whole;

Analyses of competitive market compensation practices and labor market conditions;

Alignment with the long-term business strategy of the Company;

Retention and succession planning;

Input from senior leadership, including our Chairman and Chief Executive Officer; and

Input from an independent compensation consultant.

As we are headquartered in the San Francisco Bay Area, which is a highly dynamic and competitive market for talent, we seek to provide competitive compensation practices for our executive leadership in order to attract and retain the best available talent.

To set a competitive, reasonable and appropriate level of compensation, the Board of Directors and the compensation committee take a holistic approach and consider all relevant factors to the compensation decision being made in any given year. The Board of Directors’ and the compensation committee’s approach to evaluating these factors is subjective, not formulaic, and may place more or less weight on a particular factor when determining a particular executive officer’s compensation.

ROLE OF LEADERSHIP IN DETERMINING EXECUTIVE COMPENSATION

In determining the total compensation for each executive officer, the Board of Directors and the compensation committee consider the specific recommendations of our Chairman and Chief Executive Officer (other than with respect to his own compensation) and may consider input from other senior members of leadership.

Our Chairman and Chief Executive Officer plays a significant role in the compensation setting process for the other named executive officers by:

Evaluating their performance;

Discussing the role and responsibilities of the relevant executive officer within the Company and the expected future contributions of the executive officer;

Considering retention and succession planning;

Recommending business performance targets and establishing objectives; and

Recommending salary levels, bonuses and equity awards.

Our Chairman and Chief Executive Officer annually reviews the compensation paid to other named executive officers over the fiscal year through presentations to the compensation committee, either as a committee or together with the Board of Directors as a whole, and provides his recommendations regarding the compensation to be paid to such persons during the next year. Following a review of such recommendations, the Board of Directors or the compensation committee, after reviewing the other factors and input as discussed above, takes action regarding such compensation recommendations as it deems appropriate. The Board of Directors and the compensation committee also consider input from our Chairman and Chief Executive Officer, as well as our Chief Financial Officer and certain of our Presidents, when setting financial objectives for our performance-based incentive program.

26 | 2022 PROXY STATEMENT |

EXECUTIVE & DIRECTOR COMPENSATION |

|

Our executive compensation program is designed to reward successful annual performance while encouraging long-term value creation for our shareholders. Short- and long-term incentive compensation is subject to rigorous, objective, at-risk performance hurdles across our performance metrics and performance periods, which the compensation committee intends to be an incentive to leadership to drive Company performance and encourage prudent risk management consistent with the Company’s financial and strategic goals.

ROLE OF COMPENSATION CONSULTANTS

The compensation committee has periodically engaged compensation consultants to assist the committee in assessing compensation market conditions.

Commencing in January 2017, Mercer was engaged by the compensation committee to provide evaluations and recommendations concerning our executive and board compensation programs and to advise the compensation committee with respect to structuring our compensation plans to achieve our business objectives. Mercer has continued to provide evaluations and recommendations concerning our executive and board compensation programs and to advise the compensation committee with respect to structuring our compensation plans to achieve our business objectives for fiscal 2017 through fiscal 2021. Mercer provided support to the compensation committee in connection with equity awards and compensation for our leadership and in particular in connection with the structuring and details of the multi-year equity award granted in fiscal 2020 to our Chairman and Chief Executive Officer.

The compensation committee has considered the independence of Mercer in accordance with applicable SEC and NYSE rules. Although Mercer worked with leadership to develop plans that support our business objectives while carrying out its duties for the compensation committee, Mercer was retained by and reports directly to the compensation committee and does not provide any other services to the Company other than those approved by the compensation committee that would not constitute a conflict of interest or that would not otherwise compromise their independence.

ANALYSES OF COMPETITIVE MARKET PRACTICES