DEF 14A: Definitive proxy statements

Published on May 17, 2024

UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

INFORMATION

PROXY STATEMENT PURSUANT TO

SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

☒ Filed by the Registrant ☐ Filed by a Party other than the Registrant

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Name of Registrant as Specified in Its Charter

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

June 27, 2024 10:30 a.m. Pacific Time

RH, 15 Koch Road, Corte Madera, CA 94925

Important Notice Regarding the Availability of Proxy Materials for the Annual Shareholder Meeting to be Held on June 27, 2024 (the “Annual Meeting”): The Company’s 2024 Notice and Proxy Statement, its fiscal 2023 Annual Report on Form 10-K and its proxy card are available for review online at www.proxyvote.com

RH SHAREHOLDER,

We are holding the Annual Meeting for the following purposes, which are more fully described in the proxy statement:

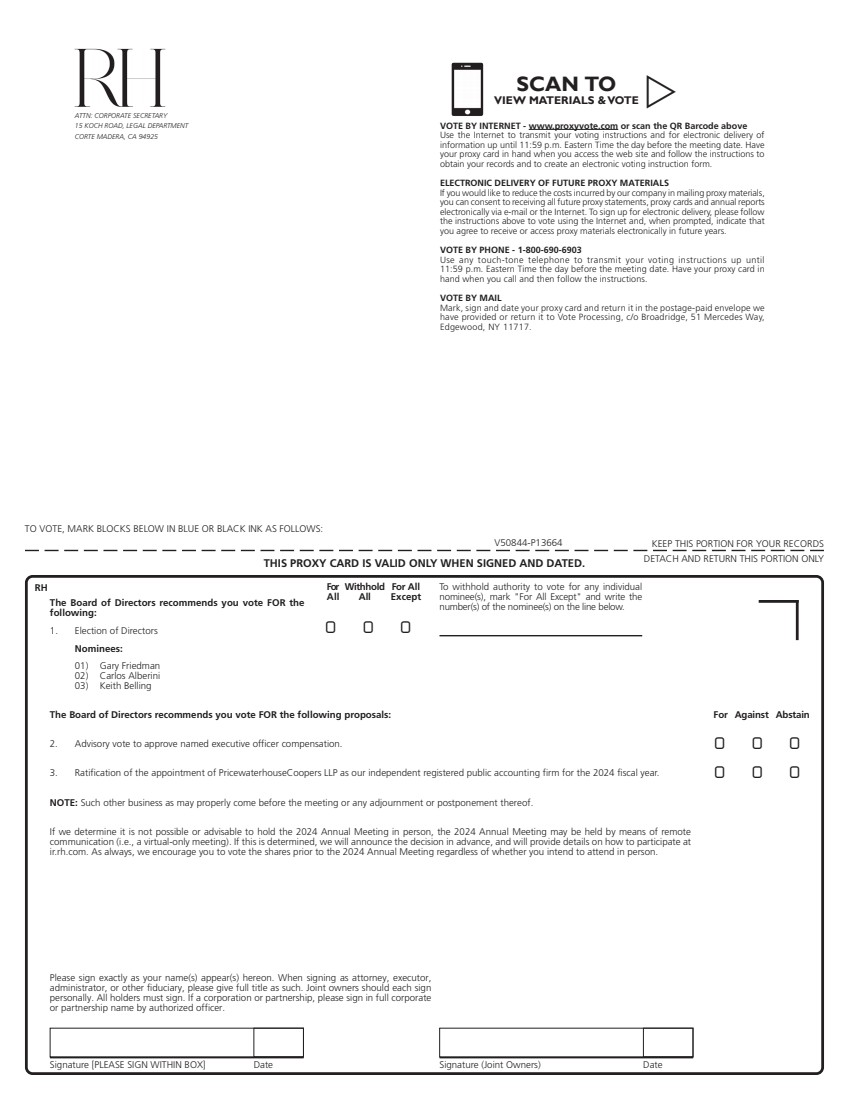

| 1. | To elect the three nominees named in the proxy statement to our Board of Directors; |

| 2. | To vote, on an advisory basis, on our named executive officer compensation; |

| 3. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending February 1, 2025; and |

| 4. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Only shareholders of record as of the close of business on May 3, 2024 are entitled to notice and to vote at the Annual Meeting or any postponement or adjournment thereof. A list of shareholders entitled to vote will be available for inspection at our offices for ten days prior to the Annual Meeting. If you would like to view this shareholder list, please contact the Corporate Secretary at (415) 945-4998.

We intend to hold our Annual Meeting in person. However, in the event we determine it is not possible or advisable to hold our Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. If we take this step, we will announce the decision to do so via a press release and details about how to participate will be posted on our website and filed with the U.S. Securities and Exchange Commission as additional proxy materials. Please monitor our website at ir.rh.com for updated information.

As always, we encourage you to vote your shares prior to the Annual Meeting. Each share of stock that you own represents one vote, and your vote as a shareholder of RH is very important. For questions regarding your stock ownership, you may contact the Corporate Secretary at (415) 945-4998 or, if you are a registered holder, our transfer agent, Computershare Investor Services, by email through their website at www.computershare.com/contactus or by phone at (800) 962-4284 (within the U.S. and Canada) or (781) 575-3120 (outside the U.S. and Canada).

The Board of Directors has approved the proposals described in the accompanying proxy statement and recommends that you vote “FOR” the election of all nominees for director (Proposal 1), “FOR” the non-binding advisory vote to approve the compensation of our named executive officers (Proposal 2), and “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP (Proposal 3).

By order of the Board of Directors,

Gary Friedman

Chairman & Chief Executive Officer

Your Vote Is Important. Instructions for submitting your proxy are provided in the Notice of Internet Availability of Proxy Materials, the proxy statement and your proxy card. It is important that your shares be represented and voted at the Annual Meeting. Please submit your proxy through the Internet, by telephone, or by completing the enclosed proxy card and returning it in the enclosed envelope. You may revoke your proxy at any time prior to its exercise at the Annual Meeting.

2024 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT SUMMARY

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the Board of Directors of RH (the “Company”) for use at the Company’s 2024 Annual Meeting of Shareholders (the “Annual Meeting”) to be held at the Company’s headquarters located at 15 Koch Road, Corte Madera, CA 94925 on June 27, 2024, at 10:30 a.m. (Pacific Time), and any adjournment or postponement thereof.

On or about May 17, 2024, we will mail to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our 2024 Notice and Proxy Statement and our fiscal 2023 Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 28, 2024 (the “Annual Report”) via the Internet and how to vote online. The Notice also contains instructions on how you can receive a paper copy of the proxy materials. Our Annual Report, the Notice and our proxy card are first being made available online on or about May 17, 2024.

ABOUT THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At our Annual Meeting, shareholders will vote upon the three proposals described in this proxy statement.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules and regulations adopted by the SEC, instead of mailing a printed copy of our proxy materials to all shareholders entitled to vote at the Annual Meeting, we are furnishing the proxy materials to our shareholders over the Internet. Accordingly, on or about May 17, 2024, the Company will mail the Notice to the Company’s shareholders, other than those who previously requested electronic or paper delivery. If you received the Notice by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice will instruct you as to how you may access and review the proxy materials and submit your vote on the Internet or by telephone. If you received the Notice by mail and would like to receive a printed copy of the proxy materials, please follow the instructions for requesting such materials included in the Notice. On the date of mailing of the Notice, all shareholders will have the ability to access all of our proxy materials on a website referred to in the Notice. These proxy materials will be available free of charge. We encourage shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the cost of the physical printing and mailing of materials.

What proposals are scheduled to be voted on at the Annual Meeting?

Shareholders will be asked to vote on the following three proposals:

| 1. | The election to our Board of Directors of the three nominees named in this proxy statement; |

| 2. | The approval, on a non-binding advisory basis, of our named executive officer compensation; and |

| 3. | The ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the fiscal year ending February 1, 2025 (“fiscal 2024”). |

What is the recommendation of the Board of Directors on each of the proposals scheduled to be voted on at the Annual Meeting?

The Board of Directors recommends that you vote:

FOR each of the nominees to the Board of Directors (Proposal 1);

FOR the approval, on a non-binding advisory basis, of our named executive officer compensation (Proposal 2); and

FOR the ratification of the appointment of PwC as our independent registered public accounting firm for fiscal 2024 (Proposal 3).

Could other matters be decided at the Annual Meeting?

Our bylaws require that we receive advance notice of any proposal to be brought before the Annual Meeting by shareholders of the Company. As of the date of this proxy statement, there are no other matters that the Board of Directors intends to present for action at the Annual Meeting other than those referred to in this proxy statement.

Who can vote at the Annual Meeting?

Shareholders as of the record date for the Annual Meeting, the close of business on May 3, 2024 (the “Record Date”), are entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 18,342,797 shares of the Company’s common stock outstanding and entitled to vote.

Shareholder of Record: Shares Registered in Your Name

If, as of the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Investor Services, then you are considered the shareholder of record with respect to those shares.

As a shareholder of record, you may vote at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting in person, we urge you to vote over the Internet or by telephone, or by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee

If, as of the close of business on the Record Date, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the shareholder of record for purposes of voting at the Annual Meeting. Because you are not the shareholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

How do I vote?

If you are a shareholder of record, you may:

VOTE IN PERSON—we will provide a ballot to shareholders who attend the Annual Meeting and wish to vote in person;

VOTE BY MAIL—simply complete, sign and date the enclosed proxy card, then follow the instructions on the card; or

VOTE VIA THE INTERNET or VIA TELEPHONE—follow the instructions on the Notice or proxy card and have the Notice or proxy card available when you access the Internet or place your telephone call.

Votes submitted via the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on June 26, 2024. Submitting your proxy, whether via the Internet, by telephone or by mail, will not affect your right to vote at the Annual Meeting should you decide to attend the meeting.

If you are not a shareholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted. You may still attend the Annual Meeting if you have already voted by proxy.

What if I return my proxy card directly to the Company, but do not provide voting instructions?

If a signed proxy card is returned to us without any indication of how your shares should be voted on a particular proposal at the meeting, your shares will be voted in accordance with the recommendations of our Board of Directors stated above. For example, if you return a signed proxy card with no indication of your vote on any of the proposals, your votes will be cast “FOR” the election of the three director nominees named in this proxy statement, “FOR” the approval, on a non-binding advisory basis, of the compensation of our named executive officers, and “FOR” the ratification of the appointment of PwC as our independent registered public accounting firm for fiscal 2024.

If you hold your shares in street name and do not vote, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described below) and may not be counted in determining the number of shares necessary for approval of a proposal. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting. Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting.

What is the quorum requirement for the Annual Meeting?

A majority of our outstanding shares as of the Record Date must be present at the Annual Meeting in order to hold the meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the meeting if you are present and vote in person at the meeting or if you have properly submitted a proxy. Additionally, abstentions, broker non-votes and “WITHHOLD” votes (as described below) will also be counted towards the quorum requirement. If there is no quorum, the chair of the Annual Meeting may adjourn the meeting until a later date.

How are abstentions, broker non-votes and “WITHHOLD” votes treated?

Abstentions (i.e., shares present at the meeting and voted “abstain”) are counted for purposes of determining whether a quorum is present. In determining whether a proposal received the requisite number of affirmative votes, abstentions are not considered votes cast and will have no effect on the proposal. As a result, abstentions will have no impact on the non-binding advisory vote on our named executive officer compensation (Proposal 2), or the ratification of appointment of our independent registered public accounting firm (Proposal 3).

Broker non-votes are counted for purposes of determining whether a quorum is present. In determining whether a proposal received the requisite number of affirmative votes, broker non-votes are not considered votes cast and will have no effect on the proposal. Broker non-votes occur when shares held by a broker for a beneficial owner are not voted because (i) the broker did not receive voting instructions from the beneficial owner, and (ii) the broker lacked discretionary authority to vote the shares. Brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf with respect to “non-routine” proposals but may vote their clients’ shares on “routine” proposals. As a result, broker non-votes will have no impact on “non-routine” proposals, including the approval of the election of directors (Proposal 1), and the non-binding advisory vote on our named executive officer compensation (Proposal 2).

Note that if you are a beneficial holder and do not provide specific voting instructions to your broker, the broker that holds your shares will not be authorized to vote on “non-routine” items, including the election of directors (Proposal 1), or the approval, on a non-binding advisory basis, or of our named executive officer compensation (Proposal 2). Ratification of the appointment of our independent registered public accounting firm for fiscal 2024 (Proposal 3) is considered to be a “routine” matter and, accordingly, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 3, brokers will be permitted to exercise their discretionary authority to vote for the ratification of the appointment of the independent registered public accounting firm. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Annual Meeting.

“WITHHOLD” votes will also be counted towards the quorum requirement and will have no effect on the outcome of the election of directors (Proposal 1) because the election of directors is based on the votes actually cast.

What is the vote required for each proposal?

The votes required to approve each proposal are as follows:

Proposal 1. Shareholders’ choices for Proposal 1 (Election of Directors) are limited to “FOR” and “WITHHOLD.” A plurality of the votes cast, whether in person or by proxy, is required to elect each of the three nominees for director described under Proposal 1. Under plurality voting, the three nominees receiving the largest number of votes cast (votes “FOR”) will be elected. You may vote for all the director nominees, withhold authority to vote your shares for all the director nominees or withhold authority to vote your shares with respect to any one or more of the director nominees. Withholding authority to vote your shares with respect to one or more director nominees will have no effect on the election of those nominees. Because the election of directors under Proposal 1 is considered to be a non-routine matter under the rules of the New York Stock Exchange (“NYSE”), if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 1, brokers will not be permitted to exercise their voting authority and uninstructed shares may constitute broker non-votes. “WITHHOLD” votes and broker non-votes will have no effect on the outcome of Proposal 1 because the election of directors is based on the votes actually cast.

Proposal 2. Proposal 2 is a non-binding advisory vote. Therefore, our Board of Directors will consider our named executive officer compensation described under Proposal 2 (Advisory Vote to Approve Executive Compensation) to be approved if the proposal receives the affirmative vote of a majority of votes cast, whether in person or by proxy. Because the advisory vote under Proposal 2 is considered to be a non-routine matter under the rules of the NYSE, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 2, brokers will not be permitted to exercise their voting authority and uninstructed shares may constitute broker non-votes. Abstentions and broker non-votes will have no effect on the outcome of Proposal 2 because the advisory vote is based on the votes actually cast.

Proposal 3. The affirmative vote of a majority of votes cast, whether in person or by proxy, is required to ratify the appointment of the independent registered public accounting firm for fiscal 2024 described under Proposal 3 (Ratification of Appointment of Registered Independent Public Accounting Firm). Proposal 3 is considered to be a “routine” matter under the rules of the NYSE and, accordingly, if you do not instruct your broker, bank or other nominee on how to vote the shares in your account for Proposal 3, brokers will be permitted to exercise their discretionary authority to vote for the ratification of the appointment of the independent registered public accounting firm. Abstentions and broker non-votes will have no effect on the outcome of Proposal 3 because the ratification of the appointment of the independent registered public accounting firm is based on the votes actually cast.

6 | 2024 PROXY STATEMENT |

ANNUAL MEETING OF SHAREHOLDERS |

|

How can I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to use the Internet to:

View the Company’s proxy materials for the Annual Meeting; and

Instruct the Company to send future proxy materials to you by email.

The Company’s proxy materials are available at ir.rh.com. This website address is included for reference only. The information contained on the Company’s website is not incorporated by reference into this proxy statement.

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

Who is paying for this proxy solicitation?

The Company is paying the costs of the solicitation of proxies. Proxies may be solicited on behalf of the Company by our directors, officers, team members (we refer to our employees as “team members”) or agents in person or by telephone, facsimile or other electronic means. We will also reimburse brokerage firms and other custodians, nominees and fiduciaries, upon request, for their reasonable expenses incurred in sending proxies and proxy materials to beneficial owners of our common stock. We have retained the services of Alliance Advisors LLC (“Alliance”) to assist in the solicitation of proxies for a fee of approximately $28,000 plus reasonable out-of-pocket expenses. We may engage Alliance for additional solicitation work and incur fees greater than $28,000 depending on a variety of factors, including preliminary voting results and recommendations from Institutional Shareholder Services. As part of its engagement agreement, the Company has also agreed to certain indemnification provisions with Alliance.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

How can I change my vote after submitting my proxy?

A shareholder who has given a proxy may revoke it at any time before it is exercised at the meeting by:

Delivering to the Corporate Secretary of the Company (by any means, including facsimile) a written notice stating that the proxy is revoked;

Signing and delivering a proxy bearing a later date;

Voting again over the Internet or by telephone; or

Attending and voting at the Annual Meeting (although attendance at the meeting will not, by itself, revoke a proxy).

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Where can I find the voting results?

The final voting results will be tallied by the inspector of elections and filed with the SEC in a Current Report on Form 8-K within four business days of the Annual Meeting.

ANNUAL MEETING OF SHAREHOLDERS |

2024 PROXY STATEMENT | 7 |

|

SECURITY OWNERSHIP OF TOP

SHAREHOLDERS & LEADERSHIP

The following table sets forth information as of the close of business on May 3, 2024, regarding the beneficial ownership of our common stock by: each person or group who is known by us to beneficially own more than 5% of our outstanding shares of our common stock; each of our named executive officers; each of our current directors; and all of our current executive officers and directors as a group.

Beneficial ownership for the purposes of the following table is determined in accordance with the rules and regulations of the SEC. Percentage of beneficial ownership is based on 18,342,797 shares of common stock outstanding as of May 3, 2024. Except as disclosed in the footnotes to this table and subject to applicable community property laws, we believe that each shareholder identified in the table possesses sole voting and investment power over all shares of common stock shown as beneficially owned by the shareholder. Unless otherwise indicated in the table or footnotes below, the address for each beneficial owner is c/o RH, 15 Koch Road, Corte Madera, CA 94925.

NAME(1) |

|

NUMBER |

|

PERCENT |

|

Gary Friedman(2) |

5,005,063 |

25.0% |

|||

FMR LLC(3) 245 Summer Street, Boston, MA 02210 |

2,201,543 |

12.0% |

|||

Vanguard Group Inc.(4) 100 Vanguard Blvd., Malvern, PA 19355 |

1,403,447 |

7.7% |

|||

BlackRock Inc.(5) 55 East 52nd Street, New York, NY 10055 |

1,303,092 |

7.1% |

|||

Carlos Alberini(6) |

21,916 |

* |

|||

Keith Belling(6) |

5,423 |

* |

|||

Eri Chaya(7) |

329,643 |

1.8% |

|||

Mark Demilio(8) |

79,839 |

* |

|||

Stefan Duban(9) |

30,613 |

* |

|||

Hilary Krane(6) |

6,538 |

* |

|||

Edward Lee(10) |

3,100 |

* |

|||

Katie Mitic(6) |

10,839 |

* |

|||

Jack Preston(11) |

54,251 |

* |

|||

Ali Rowghani(12) |

9,525 |

* |

|||

Leonard Schlesinger(6) |

14,074 |

* |

|||

All current executive officers and directors as a group (12 persons)(13) |

5,570,824 |

28.1% |

*Represents beneficial ownership of less than 1% of our outstanding common stock.

| (1) | Under the rules of the SEC, our named executive officers include our principal executive officer, principal financial officer and the next three most highly compensated executive officers. |

| (2) | Includes 1,700,000 shares of common stock issuable upon the exercise of options that are exercisable within 60 days of May 3, 2024. As of May 3, 2024, 583,334 of these options are subject to selling restrictions. |

| (3) | Based on the Form 13F-HR filed by FMR LLC with the SEC on May 13, 2024, in which it reported that it has the sole voting power over 2,033,576 shares of common stock. |

| (4) | Based on the Form 13F-HR filed by Vanguard Group Inc. with the SEC on May 10, 2024, in which it reported having shared voting power over 5,651 shares of common stock. |

| (5) | Based on the Form 13F-HR filed by BlackRock Inc. with the SEC on May 10, 2024, in which it reported that it has the sole voting power over 1,299,024 shares of common stock. |

| (6) | Includes 423 restricted stock awards that vest on June 29, 2024. |

| (7) | Includes 23,643 shares of common stock held by the Chaya-Smith Revocable Trust and 306,000 shares of common stock issuable upon the exercise of options that are exercisable within 60 days of May 3, 2024. |

| (8) | Includes 31,416 shares of common stock held by various family trusts established by Mr. Demilio, 44,000 shares of common stock issuable upon the exercise of options that are exercisable within 60 days of May 3, 2024, 4,000 restricted stock awards vesting in eight quarterly increments through April 11, 2026, and 423 restricted stock awards that vest on June 29, 2024. |

| (9) | Includes 30,535 shares of common stock issuable upon the exercise of options that are exercisable within 60 days of May 3, 2024. |

| (10) | Includes 3,100 shares of common stock issuable upon the exercise of options that are exercisable within 60 days of May 3, 2024. |

| (11) | Includes 54,250 shares of common stock issuable upon the exercise of options that are exercisable within 60 days of May 3, 2024. |

| (12) | Includes 6,953 shares of common stock held by the Rowghani Keshavarz Living Trust and 423 restricted stock awards that vest on June 29, 2024. |

| (13) | Includes 2,137,885 shares of common stock our executive officers and directors have a right to acquire upon the exercise of options that are exercisable within 60 days of May 3, 2024, 4,000 restricted stock awards vesting in eight quarterly increments through April 11, 2026, and 2,961 restricted stock awards that vest on June 29, 2024. |

INTENTIONALLY LEFT BLANK

SECURITY OWNERSHIP OF TOP SHAREHOLDERS & LEADERSHIP |

2024 PROXY STATEMENT | 11 |

|

DIRECTORS

|

Chairman and Chief Age: 66 Director since 2013 Board Committees: None Class III Director: Continuing in office until |

Gary Friedman has served as our Chairman and Chief Executive Officer of the Company, and Founder of the RH brand as we know it today, since January 2014. Mr. Friedman joined RH in April of 2001 when the business was known as Restoration Hardware, a $350 million mall-based retail business on the verge of bankruptcy, selling mostly nostalgic discovery items and some Mission-style furniture. He has spent the past 23 years transforming every aspect of the business and building RH into the leading luxury interior design brand in the world today with revenues in excess of $3 billion. While many in the retail industry have been shrinking or closing stores, Mr. Friedman and his team have developed some of the largest and most inspiring retail experiences in the world, many in historically significant buildings with integrated interior design studios, restaurants, and wine, and barista bars. Some examples being RH San Francisco, The Gallery in the Historic Bethlehem Steel Building, RH Chicago, The Gallery in the Historic Three Arts Club, and RH England, a 17th Century, 73 acre estate with three restaurants and one of the most meticulously curated Architecture and Design Libraries, including the first modern printing in 1492 of De Archtectura, The Ten Books on Architecture by Vitruvius. Mr. Friedman is continuing to elevate and evolve the RH brand with the introduction of RH Guesthouses, a new hospitality concept for travelers seeking privacy and luxury, the first of which opened in New York City, and the second under construction in Aspen, inclusive of the first RH Bath House & Spa, and where the Company will also be introducing RH Residences, fully furnished luxury homes with integrated services that deliver taste and time value to discerning time starved consumers. Prior to RH, Mr Friedman spent 14 years in various positions at Williams-Sonoma Inc. lastly serving as President and Chief Operating Officer, and President of the Williams-Sonoma, Pottery Barn, and West Elm brands. Mr. Friedman was responsible for transforming Pottery Barn from a $50 million table top and accessories business into a billion dollar plus home lifestyle brand. Mr Friedman also developed the revolutionary Williams-Sonoma Grande Cuisine stores, and conceptualizing and developing the West Elm brand. Mr. Friedman began his career as a stock boy at the Gap store in Santa Rosa California. He spent eleven years with the Gap, and held the positions of Store Manager, District Manager, and Regional Manager overseeing 63 stores in Southern California. |

|

Qualifications: |

Mr. Friedman was selected to our Board of Directors because of his leadership in re-conceptualizing and developing the RH brand and business into the leading luxury home brand in the North American market, his deep and unmatched expertise in developing and rapidly growing many of the leading consumer brands in the home furnishings space, and his extensive knowledge of building and leading complex multi-branded and multi-channel organizations.

|

|

|

Lead Independent Director Age: 68 Director since 2009 Board Committees: Audit, Compensation, Class I Director: Continuing in office until the 2025 annual meeting |

Mark Demilio has served as a member of our Board of Directors since September 2009 and currently serves as the board’s Lead Independent Director. Mr. Demilio currently serves as a member of the Board of Directors and Chairman of the audit committee of SCP Health, a privately-held provider of emergency medicine and hospitalist services through physician staffing and management since September 2015. Since January 2021, Mr. Demilio has been serving as a consultant to Spinnaker Medical, a privately held special purpose acquisition company. Mr. Demilio served as a member of the Board of Directors of Cosi, Inc., a national restaurant chain, from April 2004 to May 2017, served on its audit committee, its compensation committee and its nominating and corporate governance committee, and served for a time as Chairman of the Board of Directors of Cosi and as the interim Chief Executive Officer of Cosi. From June 2018 through December 2020, Mr. Demilio was a member of the Board of Directors and Chairman of the audit committee of Nurse Assist, a medical device manufacturer and distributer. From February 2014 through March 2016, Mr. Demilio served as a member of the Board of Directors and Chairman of the audit committee of The Paslin Company, a private company that designs, assembles and integrates robotic assembly lines for the automotive industry. From December 2000 until his retirement in October 2008, Mr. Demilio served as the Chief Financial Officer of Magellan Health Services, Inc., a Nasdaq-listed managed specialty healthcare company that managed the delivery of behavioral healthcare treatment services, specialty pharmaceuticals and radiology services. Mr. Demilio has also been the General Counsel for Magellan Health Services, the Chief Financial Officer and General Counsel of Youth Services International, Inc., an attorney specializing in corporate and securities law with the law firms of Miles & Stockbridge and Piper & Marbury, a financial analyst for CareFirst BlueCross BlueShield of Maryland and a certified public accountant with Arthur Andersen LLP. |

|

Qualifications: |

Mr. Demilio was selected to our Board of Directors because he possesses particular knowledge and experience in accounting, finance and capital structure, strategic planning and leadership of complex organizations and board practices of other major corporations. |

|

|

Age: 71 Director since 2014 Board Committees: Compensation Class I Director: Continuing in office until |

Leonard Schlesinger was appointed to our Board of Directors in April 2014. Dr. Schlesinger has served as Baker Foundation Professor of Business Administration at Harvard Business School, a role he returned to in July 2013 after serving as the President of Babson College from July 2008 until July 2013 and having held various positions at public and private companies. He also serves as a Director and Chair of the Audit Committee of DataPoint Capital Acquisition Corporation and a Director of View Point Holdings. From 1999 to 2007, Dr. Schlesinger held various executive positions at Limited Brands, Inc. (L Brands, Inc.), a formerly listed NYSE company, including Vice Chairman of the Board of Directors and Chief Operating Officer. While at Limited Brands, he was responsible for the operational and financial functions across the enterprise, including Express, Limited Stores, Victoria’s Secret Beauty, Bath and Body Works, C.O. Bigelow, Henri Bendel, and White Barn Candle Company. Dr. Schlesinger also served as Executive Vice President and Chief Operating Officer at Au Bon Pain Co., Inc. and as a director of numerous public and private retail, consumer products, and technology companies. Dr. Schlesinger has also held leadership roles at leading MBA and executive education programs and other academic institutions, including twenty years at Harvard Business School, where he served as the George Fisher Baker Jr. Professor of Business Administration. Dr. Schlesinger holds a Doctor of Business Administration from Harvard Business School, an MBA from Columbia University, and a Bachelor of Arts in American Civilization from Brown University. |

|

Qualifications: |

Dr. Schlesinger was selected for our Board of Directors because he possesses extensive leadership, operational, financial, and business expertise from his significant and broad experience with numerous private and public retail companies. |

|

|

Age: 68 Director since 2010 Board Committees: None Class III Director: Continuing in office until |

Carlos Alberini has served on our Board of Directors since June 2010. Mr. Alberini currently serves as a member of the Board of Directors and Chief Executive Officer of Guess?, Inc., a NYSE-listed specialty retailer of apparel and accessories, since February 2019. Mr. Alberini previously served as the Chairman and Chief Executive Officer of Lucky Brand from February 2014 to February 2019. Mr. Alberini served as our Co-Chief Executive Officer from June 2010 through October 2012 and from July 2013 through January 2014, and he served as our sole Chief Executive Officer from October 2012 through July 2013. Mr. Alberini was President and Chief Operating Officer of Guess from December 2000 to June 2010. From May 2006 to July 2006, Mr. Alberini served as Interim Chief Financial Officer of Guess. Mr. Alberini served as a member of the Board of Directors of Guess from December 2000 to September 2011. Prior to Guess, Mr. Alberini served as Senior Vice President and Chief Financial Officer of Footstar, Inc., a retailer of footwear from October 1996 to December 2000. From May 1995 to October 1996, Mr. Alberini served as Vice President of Finance and Acting Chief Financial Officer of the Melville Corporation, a retail holding corporation. From 1987 to 1995, Mr. Alberini was with The Bon-Ton Stores, Inc., an operator of department stores, in various capacities, including Corporate Controller, Senior Vice President, Chief Financial Officer and Treasurer. Prior to that, Mr. Alberini served in various positions at PricewaterhouseCoopers LLP. |

|

Qualifications: |

Mr. Alberini was selected to our Board of Directors because he possesses particular knowledge and experience in retail and merchandising, branded consumer goods, accounting, financing and capital finance, board practices of other large retail companies and leadership of complex organizations. |

COMPANY LEADERSHIP, DIRECTORS & OFFICERS |

2024 PROXY STATEMENT | 15 |

|

|

Age: 66 Director since 2016 Board Committees: None Class III Director: Continuing in office until |

Keith Belling has served on our Board of Directors since April 2016, and previously served as an advisor to the Board of Directors from May 2015 to April 2016. Mr. Belling is the co-founder and former Chairman and Chief Executive Officer of popchips, Inc. (“popchips”), a leading better-for-you snack food business that launched in 2007. He previously served as popchips’ Chief Executive Officer from 2007 through 2012, leading the company to sales and distribution at over 30,000 retail stores across North America and the United Kingdom and served as the Chairman of the Board from 2007 through 2019. Mr. Belling is also the founder and former Chief Executive Officer of RightRice, a next generation rice brand that launched in February 2019, in Whole Foods Markets nationwide and on Amazon. Mr. Belling has served as an advisor to several innovative consumer, real estate and technology companies, including Modern Meadow Inc., Olly Nutrition, and LBA Realty LLC. Mr. Belling also has founded other businesses, including e-commerce company AllBusiness.com, a leading small business portal, founded in 1998, where Mr. Belling formerly served as Chief Executive Officer and which was acquired by NBCi. Mr. Belling was a real estate attorney with Morrison & Foerster LLP, where he represented a diverse clientele including developers and real estate investors. |

|

Qualifications: |

Mr. Belling was selected to our board because of his experience as a founder, leader, and entrepreneur of several innovative consumer companies, as well as his background and experience in the real estate sector. |

|

|

Age: 50 Director since 2012 Board Committees: None Class I Director: Continuing in office until |

Eri Chaya has served on our Board of Directors since 2012, and has served as our President, Chief Creative and Merchandising Officer since November 2017. Ms. Chaya leads product curation and integration, brand creative and business development for RH Interiors, Contemporary, Modern, Beach House, Ski House, Outdoor, Baby & Child and TEEN, across the Company’s physical, digital and print channels of distribution. Ms. Chaya previously served as RH’s Co-President, Chief Creative and Merchandising Officer and Director from May 2016 to November 2017, Chief Creative Officer from April 2008 to May 2016 and Vice President of Creative from July 2006 to April 2008. Prior to RH, Ms. Chaya was a creative director at Goodby, Silverstein and Partners, an international advertising agency, and a creative director at Banana Republic. |

|

Qualifications: |

Ms. Chaya was selected to our Board of Directors because of her extensive knowledge and experience in design, product development, brand development, marketing and advertising. |

|

16 | 2024 PROXY STATEMENT |

COMPANY LEADERSHIP, DIRECTORS & OFFICERS |

|

|

Age: 60 Director since 2016 Board Committees: Audit Class II Director: Continuing in office until |

Hilary Krane has served on our Board of Directors since her appointment in June 2016. Ms. Krane is currently the Chief Legal Officer for Creative Artists Agency. Up until February 2022, Ms. Krane served in various executive roles at Nike since 2010, including most recently as Executive Vice President, Chief Administrative Officer and General Counsel for NIKE, Inc. Prior to joining NIKE, Inc., Ms. Krane was General Counsel and Senior Vice President for Corporate Affairs at Levi Strauss & Co. from 2006 to 2010. From 1996 to 2006, she was a partner and assistant general counsel at PricewaterhouseCoopers LLP. Ms. Krane has been a director at the Federal Reserve Bank of San Francisco, Portland Branch since January 2018. Ms. Krane holds a Bachelor of Arts from Stanford University and a J.D. from the University of Chicago. |

|

Qualifications: |

Ms. Krane was selected to our Board of Directors because of her extensive operational, compliance and business experience contributing to the growth and development of innovative and iconic global brands. |

|

|

Age: 54 Director since 2013 Board Committees: Audit Class II Director: Continuing in office until |

Katie Mitic is currently Chief Executive Officer and Co-founder of SomethingElse, Inc., a direct-to-consumer beverage company that launched in 2019. From 2012 to 2017, Ms. Mitic was the Chief Executive Officer and Co-founder of Sitch, Inc., a startup building innovative mobile consumer products. Prior to Sitch, Ms. Mitic served in executive leadership positions at innovative growth companies, including Facebook, Inc. and Palm, Inc. As Director of Platform & Mobile Marketing at Facebook, she grew developer products and partnerships globally. As Senior Vice President, Product Marketing at Palm, she expanded the company’s product lines and international footprint up until its acquisition by Hewlett-Packard. Earlier in her career, Ms. Mitic worked at NetDynamics (acquired by Sun Microsystems), where she launched the industry’s first application server, at Four11, where she built the industry leading email service RocketMail (now Yahoo! Mail) and at Yahoo!, where she served as Vice President and General Manager. She currently serves on the Boards of Directors of private and non-profit organizations, including DVx Ventures and LeanIn.Org. Ms. Mitic received her B.A. from Stanford University and her M.B.A. from Harvard Business School. |

|

Qualifications: |

Ms. Mitic was selected to our Board of Directors because of her extensive leadership, operational and entrepreneurial experience with innovative growth companies and global consumer technology companies.

|

|

COMPANY LEADERSHIP, DIRECTORS & OFFICERS |

2024 PROXY STATEMENT | 17 |

|

|

Age: 51 Director since 2015 Board Committees: Nominating and Corporate Governance Class II Director Continuing in office until |

Ali Rowghani was appointed to our Board of Directors on January 22, 2015. Mr. Rowghani has served in executive leadership positions at innovative growth companies, including Twitter, Inc. and Pixar Animation Studios, Inc. At Twitter, Mr. Rowghani was hired as the Company’s first Chief Financial Officer in March 2010, and later served as Chief Operating Officer, with responsibility for business development, platform, media, product, and business analytics, from December 2012 to June 2014. Most recently, Mr. Rowghani was the Managing Director of the YCombinator Continuity Fund, which invests in growth-stage startups and which Mr. Rowghani helped launch in 2015. Prior to Twitter, from June 2002 to February 2010, Mr. Rowghani served in various leadership roles at Pixar, including Chief Financial Officer and Senior Vice President, Strategic Planning, reporting to Pixar founder and President, Ed Catmull. Mr. Rowghani holds a B.A. in International Relations and an M.B.A. from Stanford University. |

|

Qualifications: |

Mr. Rowghani was selected to our Board of Directors because he possesses extensive operational, financial and leadership experience, and because of his expertise in scaling innovative and high-growth companies. |

18 | 2024 PROXY STATEMENT |

COMPANY LEADERSHIP, DIRECTORS & OFFICERS |

|

EXECUTIVE OFFICERS

Below is a list of the names and ages, as of May 3, 2024, of our executive officers and a description of their business experience.

|

Chairman and Age: 66 |

Gary Friedman has served as our Chairman and Chief Executive Officer of the Company, and Founder of the RH brand as we know it today, since January 2014. Previously, Mr. Friedman served as our Co-Chief Executive Officer and Director from July 2013 to January 2014, and as Chairman and Co-Chief Executive Officer from May 2010 to October 2012. From October 2012 to July 2013, Mr. Friedman served as Chairman Emeritus, Creator and Curator on an advisory basis, and as Chief Executive Officer and a member of our Board of Directors from March 2001 to October 2012, during which time he served as our Chairman from March 2005 to June 2008. Mr. Friedman joined RH from Williams-Sonoma, Inc. where he spent 14 years serving as President and Chief Operating Officer from May 2000 to March 2001, as Chief Merchandising Officer of Williams-Sonoma, Inc. and President of Retail from 1995 to 2000, and as Executive Vice President of Williams-Sonoma, Inc. and President of the Williams-Sonoma and Pottery Barn brands from 1993 to 2000 during which time Mr. Friedman was responsible for transforming Pottery Barn from a $50 million dollar table top and accessories business into a billion dollar plus home furnishings lifestyle brand. Mr. Friedman also developed and rolled out the revolutionary Williams-Sonoma Grande Cuisine stores, growing the brand from less than $100 million to almost $1 billion. Lastly, while at Williams-Sonoma Mr. Friedman spent several years conceptualizing and developing the West Elm brand, which launched shortly after he left the company. Mr. Friedman joined Williams-Sonoma in 1988 as Senior Vice President of Stores and Operations. Mr. Friedman began his retail career in 1977 as a stock-boy at the Gap store in Santa Rosa, California. He spent eleven years with Gap, and held the positions of Store Manager, District Manager and Regional Manager overseeing 63 stores in Southern California. |

|

|

President, Chief Merchandising Age: 50 |

Eri Chaya has served as our President, Chief Creative and Merchandising Officer since November 2017 and on our Board of Directors since 2012. Ms. Chaya leads product curation and integration, brand creative and business development for RH Interiors, Contemporary, Modern, Beach House, Ski House, Outdoor, Baby & Child and TEEN, across the Company’s physical, digital and print channels of distribution. Ms. Chaya previously served as RH’s Co-President, Chief Creative and Merchandising Officer and Director from May 2016 to November 2017, Chief Creative Officer from April 2008 to May 2016 and Vice President of Creative from July 2006 to April 2008. Prior to RH, Ms. Chaya was a creative director at Goodby, Silverstein and Partners, an international advertising agency, and a creative director at Banana Republic. |

|

COMPANY LEADERSHIP, DIRECTORS & OFFICERS |

2024 PROXY STATEMENT | 19 |

|

|

Chief Financial Age: 49 |

Jack Preston has served as our Chief Financial Officer since March 2019 and leads all financial functions, including strategic and financial planning, accounting, treasury, tax, internal audit, investor relations, as well as our legal, compliance and technology teams, across the Company’s multiple businesses and brands. Mr. Preston served as RH’s Senior Vice President, Finance and Chief Strategy Officer from August 2014 to March 2019, and Senior Vice President, Finance and Strategy from April 2013 to August 2014. Prior to RH, Mr. Preston worked for Bank of America Merrill Lynch for over 12 years, where he served as a Director in the consumer and retail investment banking group. Mr. Preston holds a bachelor of commerce degree from the Sauder School of Business at the University of British Columbia. |

|

|

Chief Legal & Age: 52 |

Edward Lee has served as our Chief Legal & Compliance Officer since March 2019. Mr. Lee joined RH in October 2012 as Deputy General Counsel and was promoted to Chief Legal Officer in August 2015. Mr. Lee is also a member of the Disclosure Committee. Prior to RH, Mr. Lee was Vice President & Deputy General Counsel, Assistant Corporate Secretary at MGM Resorts International from January 2008 to October 2012. Mr. Lee holds a law degree from the University of California, Berkeley School of Law; an M.P.P. from Harvard University, The Kennedy School of Government; and a BA cum laude in Government/Public Policy from Pomona College. |

|

|

Chief Gallery & Age: 41 |

Stefan Duban has served as our Chief Gallery & Customer Officer since 2021 and is responsible for the global operations of the Company’s Galleries, Interior Design, Hospitality, Trade, Contract, Outlet and the Gallery Optimization Teams. Mr. Duban is in his 24th year at RH and began his career as a part-time sales associate in our Thousand Oaks, CA Gallery. He has held the positions of Gallery Leader, Vice President of Home Delivery, Vice President and Regional Field Leader, and most recently, Chief Gallery Officer of RH. |

20 | 2024 PROXY STATEMENT |

COMPANY LEADERSHIP, DIRECTORS & OFFICERS |

|

INTENTIONALLY LEFT BLANK

CORPORATE GOVERNANCE & DIRECTOR INDEPENDENCE

We have a number of policies and practices related to corporate governance and oversight of our business. A number of the more important policies and procedures are described in this section of the proxy statement.

CORPORATE GOVERNANCE GUIDELINES

Our Corporate Governance Guidelines specify the distribution of rights and responsibilities of our Board of Directors and detail the rules and procedures for making decisions on corporate affairs. In general, the shareholders elect our Board of Directors, which is responsible for overall governance of our Company, including selection and oversight of key leadership, and leadership is responsible for running our day-to-day operations.

Our Corporate Governance Guidelines are available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on “Governance.” The contents of our website are not incorporated by reference into this proxy statement and are not soliciting materials.

CODE OF ETHICS & CODE OF BUSINESS CONDUCT

We have adopted a code of ethics for our chief executive officer and senior financial officers. We have also adopted a code of business conduct applicable to our team members, officers and directors. Copies of these codes are available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on “Governance.” We expect that any amendment to, or waiver of, the requirements of the code of ethics for our chief executive officer and senior financial officers will be disclosed on our website and any waiver of the requirements of the code of business conduct relating to our executive officers and directors will be promptly disclosed to shareholders, in each case as required by applicable law or NYSE listing requirements.

INCENTIVE COMPENSATION RECOUPMENT POLICY

Effective October 2, 2023, our Board of Directors adopted an incentive compensation recoupment policy (the “Clawback Policy”) as required by Rule 10D-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the corresponding NYSE listing standards. In the event the Company is required to prepare an accounting restatement to correct material noncompliance with any financial reporting requirement under U.S. federal securities laws, the Clawback Policy requires the Company to recover erroneously awarded compensation that is granted, earned or vested based in whole or in part upon the attainment of a financial reporting measure and that is received by our current and former executive officers (as defined in Rule 10D-1) during the three fiscal years preceding the date that the Company is required to prepare the accounting restatement. The amount recoverable is the compensation paid or payable in excess of the amount that would have been paid or payable based on the restated financial results.

In addition, as a public company subject to Section 304 of the Sarbanes-Oxley Act of 2002, if we are required to restate our financial results due to our material noncompliance, as a result of misconduct, with any financial reporting requirements under the federal securities laws, our Chief Executive Officer and Chief Financial Officer may be legally required to reimburse us for any bonus or incentive-based or equity-based compensation they receive.

COMPENSATION COMMITTEE INTERLOCKS & INSIDER PARTICIPATION

No member of the compensation committee of our Board of Directors has served as one of our officers or been employed as one of our team members at any time. None of our executive officers serves as a member of the compensation committee of any other company that has an executive officer serving as a member of our Board of Directors. None of our executive officers serves as a member of the Board of Directors of any other company that has an executive officer serving as a member of our compensation committee. None of our directors or executive officers are members of the same family.

COMPOSITION & QUALIFICATIONS OF OUR BOARD OF DIRECTORS

Our Board of Directors consists of nine directors, including our Chairman and Chief Executive Officer. Our certificate of incorporation provides that, subject to any rights applicable to any then-outstanding preferred stock, our Board of Directors shall consist of such number of directors as determined from time to time by resolution adopted by a majority of the total number of authorized directors whether or not there exist any vacancies in previously authorized directorships. Subject to any rights applicable to any then-outstanding preferred stock, any additional directorships resulting from an increase in the number of directors may only be filled by the directors then in office, unless otherwise required by law or by a resolution passed by our Board of Directors. The term of office for each director will be until his or her successor is elected at the applicable annual meeting of shareholders or his or her death, resignation or removal, whichever is earliest to occur.

Our Board of Directors is divided into three classes, with each director serving a three-year term, and one class being elected at each year’s annual meeting of shareholders. Our directors by class are as follows:

Class I: Eri Chaya, Mark Demilio and Leonard Schlesinger, with a term expiring at the 2025 annual meeting.

Class II: Hilary Krane, Katie Mitic and Ali Rowghani, with a term expiring at the 2026 annual meeting.

Class III: Gary Friedman, Carlos Alberini and Keith Belling, with a term expiring at the Annual Meeting.

NAME/ CURRENT POSITION |

|

AGE |

|

DIRECTOR |

|

INDEPENDENT |

|

AUDIT |

|

COMP. |

|

NOM. |

Gary Friedman |

66 |

Jul. 2013 |

||||||||||

Carlos Alberini |

68 |

Jun. 2010 |

● |

|||||||||

Keith Belling |

66 |

Apr. 2016 |

||||||||||

Eri Chaya |

50 |

Nov. 2012 |

||||||||||

Mark Demilio |

68 |

Sep. 2009 |

● |

☐ |

∎ |

☐ |

||||||

Hilary Krane |

60 |

Jun. 2016 |

● |

∎ |

||||||||

Katie Mitic |

54 |

Oct. 2013 |

● |

∎ |

||||||||

Ali Rowghani |

51 |

Jan. 2015 |

● |

∎ |

||||||||

Leonard Schlesinger |

71 |

Apr. 2014 |

● |

☐ |

||||||||

☐ |

Committee Chair |

∎ |

Committee Member |

CORPORATE GOVERNANCE |

2024 PROXY STATEMENT | 25 |

|

NAME/ CURRENT POSITION |

|

BUSINESS |

|

BRAND/ |

|

GROWTH |

|

PUBLIC CO. |

|

INVESTMENT/ |

|

LEGAL |

|

RISK & |

Gary Friedman |

● |

● |

● |

● |

||||||||||

Carlos Alberini |

● |

● |

● |

● |

● |

|||||||||

|

Keith Belling Founder and Former CEO of RightRice |

● |

● |

● |

● |

||||||||||

Eri Chaya |

● |

● |

||||||||||||

Mark Demilio |

● |

● |

● |

● |

● |

|||||||||

Hilary Krane |

● |

● |

● |

● |

||||||||||

Katie Mitic |

● |

● |

● |

● |

● |

|||||||||

Ali Rowghani |

● |

● |

● |

● |

● |

|||||||||

Leonard Schlesinger |

● |

● |

● |

● |

● |

|||||||||

We believe our Board of Directors should be composed of individuals with sophistication and experience in many substantive areas that impact our business. We believe experience, qualifications, or skills in the following areas are most important: (i) business expertise in general and specific familiarity with high growth business models; (ii) experience building high value and luxury brands; (iii) industry knowledge of retail and consumer; and (iv) domain expertise in specialized areas such as merchandising and advertising; sales and distribution; accounting, finance, and capital structure; strategic planning and leadership of complex organizations; legal/regulatory and government affairs; people leadership; and board practices of other major corporations. We believe that all our current board members possess the professional and personal qualifications necessary for board service, and have highlighted selected noteworthy attributes for each board member in their individual biographies and as otherwise summarized above.

26 | 2024 PROXY STATEMENT |

CORPORATE GOVERNANCE |

|

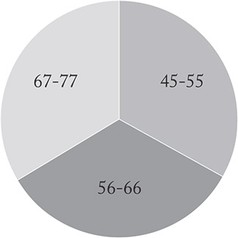

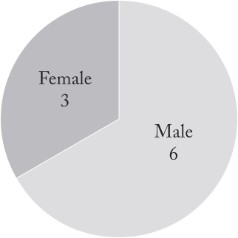

BOARD ASSESSMENT & DIVERSITY

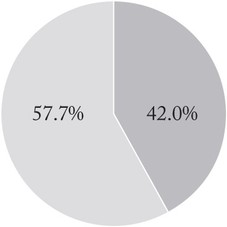

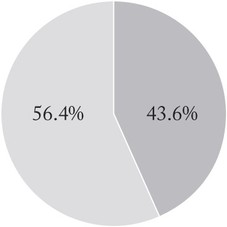

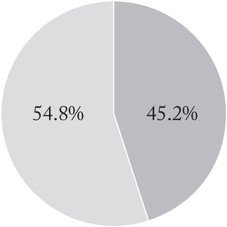

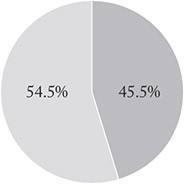

INDEPENDENCE |

TENURE |

|

|

AGE |

DIVERSITY |

|

|

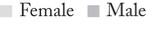

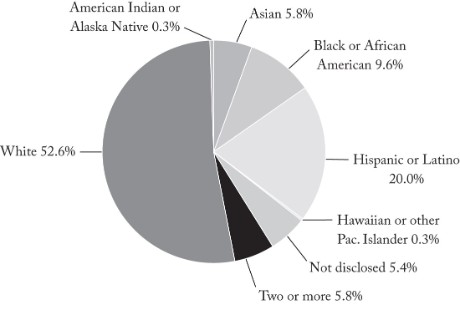

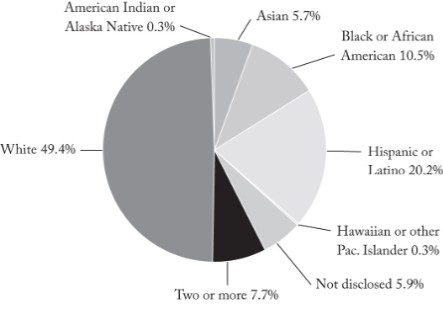

Our Board of Directors strongly believes its effectiveness is enhanced by being comprised of individuals with diverse backgrounds, skills and experience that are relevant to the role of the Board of Directors and the needs of the business. Accordingly, our Board of Directors regularly reviews the changing needs of the business and the skills and experience resident in its members, with the intention that the board will be periodically “renewed” as certain directors rotate off and new directors are recruited. The Board of Directors commitment to diversity and “renewal” will be tempered by the need to balance change with continuity and experience.

Our current board composition is highly diverse in the areas of gender, age, ethnicity and business experience. We believe that our commitment to diversity is demonstrated by the current composition of our Board of Directors.

We believe that our approach to board qualifications and selection criteria is effective in identifying strong candidates to meet the needs of the Company and its constituencies and has resulted in a diverse Board of Directors.

CORPORATE GOVERNANCE |

2024 PROXY STATEMENT | 27 |

|

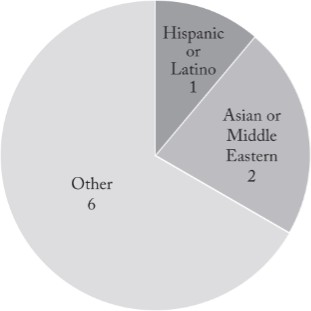

Board Members Self-Identifying from Underrepresented Communities

Three of our directors have indicated that they are from underrepresented groups. We believe that representation of such groups on our Board of Directors further demonstrates our commitment to diversity and inclusion.

One director self-identifies as Hispanic and/or Latino.

Two directors self-identify as either being of Asian and/or Middle Eastern heritage.

See the graphic under “—Composition & Qualifications of our Board of Directors” above for further information regarding the composition and experience of our current Board of Directors.

BOARD LEADERSHIP STRUCTURE; LEAD INDEPENDENT DIRECTOR

Our Corporate Governance Guidelines provide that the roles of Chairman of our Board of Directors and Chief Executive Officer may be either separate or combined, and our Board of Directors exercises its discretion in combining or separating these positions as it deems appropriate. Our Board of Directors believes that the combination or separation of these positions should continue to be considered as part of our succession planning process. Currently, the roles are combined, with Mr. Friedman serving as Chairman of our Board of Directors and Chief Executive Officer.

In July 2013, the Board of Directors created the position of Lead Independent Director and adopted a Lead Independent Director Charter, which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on “Governance.” The Lead Independent Director Charter provides that the Lead Independent Director shall serve in a lead capacity to coordinate the activities of the other non-employee directors, to help facilitate communication between the Board of Directors and leadership, and perform such other duties and functions as directed by the board from time to time. The Lead Independent Director presides over executive sessions of non-management directors.

Mr. Demilio currently serves as our Lead Independent Director. We believe the appointment of Mr. Demilio as our Lead Independent Director is beneficial to the Company due to Mr. Demilio’s breadth of experience and ability to facilitate communication between leadership and the Board of Directors and devote significant time to the Company. Our Board of Directors has determined that the Lead Independent Director provides an important governance construct for the Board of Directors to enhance regular communication with the Company’s leadership team and in particular the Chairman and Chief Executive Officer.

Our Corporate Governance Guidelines provide the flexibility for our Board of Directors to modify our leadership structure in the future as appropriate. We believe that our Company is well served by this flexible leadership structure.

28 | 2024 PROXY STATEMENT |

CORPORATE GOVERNANCE |

|

BOARD INDEPENDENCE

In accordance with our Corporate Governance Guidelines, the Board of Directors affirmatively determines that each independent director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and meets the standards for independence as defined by applicable law and the rules of the NYSE.

Our Board of Directors undertook its annual review of the independence of our directors and considered whether any director has a material relationship with us that could compromise that director’s ability to exercise independent judgment in carrying out that director’s responsibilities. Our Board of Directors affirmatively determined that each of Mr. Alberini, Mr. Demilio, Ms. Krane, Ms. Mitic, Mr. Rowghani and Dr. Schlesinger is an “independent director,” as defined under the applicable rules of the NYSE and the SEC, and that the other members of the board are not independent. The board’s independence determination was based on information provided by our current directors. In particular, in making its determination that Mr. Alberini is an independent director, the Board of Directors considered that under the rules of the NYSE and the SEC, Mr. Alberini could be deemed independent for membership on the Board of Directors after February 2017 given that his prior service as the Company’s Co-Chief Executive Officer and Chief Executive Officer had occurred more than three years prior to such date. In addition, as of February 2019, Mr. Alberini also meets the enhanced independence standard for a director who has not served as an employee of the Company for more than five years. In reaching its conclusions regarding the independence of Mr. Alberini, the Board of Directors further considered Mr. Alberini’s time away from the management of RH, the fact that he had served as the chief executive officer of Lucky Brands, and the fact that he subsequently left Lucky Brands and is now serving as the chief executive officer of Guess?, Inc., a publicly traded company, listed on the NYSE, along with other prior and existing relationships between the Company and Mr. Alberini.

Further, the Board of Directors determined that each member of the Board of Directors’ audit committee, compensation committee, and nominating and corporate governance committee satisfies independence standards applicable to each committee, on which he or she serves. Although the Board of Directors determined that Mr. Alberini is an independent director under the applicable rules of the NYSE and the SEC, the Board of Directors has elected not to appoint Mr. Alberini to any of the committees of the Company that are required under applicable rules of the NYSE or SEC to be composed entirely of independent directors.

BOARD MEETINGS

During fiscal 2023, our Board of Directors held a total of three meetings. Additionally, our independent directors met in a number of executive sessions presided over by our Lead Independent Director. During fiscal 2023, all of our director nominees and all of our incumbent directors attended at least 75% of the total meetings such directors were eligible to attend during the period in terms of the board, the committees of the board on which they served and independent or non-executive board meetings.

Agendas and topics for board and committee meetings are developed through discussions among leadership and members of our Board of Directors and its committees. Information and data that are important to the issues to be considered are distributed in advance of each meeting. Board meetings and background materials focus on key strategic, operational, financial, governance and compliance matters applicable to us.

CORPORATE GOVERNANCE |

2024 PROXY STATEMENT | 29 |

|

COMMITTEE COMPOSITION & MEETINGS

In fiscal 2023, our Board of Directors had the following standing committees: an audit committee; a compensation committee; and a nominating and corporate governance committee. All board committees are composed of independent directors. Committee membership and the number of meetings each committee held in fiscal 2023 are as follows:

DIRECTORS |

AUDIT(3) |

COMPENSATION(3) |

NOM. & CORP. |

|||

Mark Demilio(1)(2) |

Chair |

Member |

Chair |

|||

Hilary Krane |

Member |

|||||

Katie Mitic |

Member |

|||||

Ali Rowghani |

Member |

|||||

Leonard Schlesinger |

Chair |

|||||

Number of meetings in fiscal 2023 |

8 |

6 |

2 |

|||

| (1) | Designated by the board as an “audit committee financial expert.” |

| (2) | Currently the board’s Lead Independent Director. |

| (3) | Committee members had various informal meetings in fiscal 2023. |

Our Board of Directors has delegated various responsibilities and authorities to its three different committees, as described below and in the committee charters. The board committees regularly report on their activities and actions to the full Board of Directors as they deem appropriate and as the Board of Directors may request. Each member of the audit committee, the compensation committee, and the nominating and corporate governance committee was appointed by our Board of Directors, which reviews committee composition from time to time.

Audit Committee

The audit committee was established for the primary purpose of assisting the Board of Directors in overseeing the accounting and financial reporting processes of the Company and audits of its financial statements. The audit committee is responsible for, among other matters:

Appointing, retaining, compensating, evaluating, terminating and overseeing our independent registered public accounting firm;

Delineating relationships between our independent registered public accounting firm and our Company consistent with the rules of the NYSE and requesting information from our independent registered public accounting firm and leadership to determine the presence or absence of a conflict of interest;

Reviewing with our independent registered public accounting firm the scope and results of their audit;

Approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

Overseeing the financial reporting process and discussing with leadership and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC;

Reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements;

Establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; and

Reviewing and approving related-person transactions.

30 | 2024 PROXY STATEMENT |

CORPORATE GOVERNANCE |

|

Our audit committee currently consists of Mr. Demilio, Ms. Krane and Ms. Mitic. Rule 10A-3 of the Exchange Act, and NYSE rules require us to have at least three audit committee members, all of whom are independent. Our Board of Directors has affirmatively determined that each of Mr. Demilio, Ms. Krane and Ms. Mitic meets the definition of “independent director” for purposes of serving on our audit committee under Rule 10A-3 of the Exchange Act and NYSE rules. In addition, our Board of Directors has determined that Mr. Demilio qualifies as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K.

Our Board of Directors has adopted a written charter for the audit committee, which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on “Governance.” The audit committee conducts an annual self-evaluation of its performance, as set forth in its charter.

Compensation Committee

The compensation committee was established for the primary purpose of assisting the Board of Directors in discharging its responsibilities relating to the compensation of the Company’s directors and executive officers, as further described in “Executive Compensation—Compensation Discussion & Analysis—Compensation Committee Review of Compensation.” The compensation committee is responsible for, among other matters:

Reviewing key team member compensation goals, policies, plans and programs;

Reviewing and approving the compensation of our Chief Executive Officer and other executive officers;

Reviewing and approving or recommending the compensation of our directors;

Reviewing employment agreements and other similar arrangements between us and our executive officers; and

Appointing and overseeing any independent compensation consultants.

Our compensation committee currently consists of Mr. Demilio and Dr. Schlesinger. Our Board of Directors has affirmatively determined that each member of the compensation committee meets applicable independence requirements for membership on a compensation committee in accordance with applicable rules of the NYSE.

Our Board of Directors adopted a written charter for the compensation committee, which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on “Governance.” The compensation committee conducts an annual self-evaluation of its performance, as set forth in its charter.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee was established for the primary purpose of assisting the Board of Directors in discharging its responsibilities relating to the election of directors. The nominating and corporate governance committee is responsible for, among other matters:

Identifying individuals qualified to become members of our Board of Directors, consistent with criteria approved by our Board of Directors;

Overseeing the organization of our Board of Directors to discharge the board’s duties and responsibilities properly and efficiently; and

Developing and recommending to our Board of Directors a set of corporate governance guidelines and principles.

CORPORATE GOVERNANCE |

2024 PROXY STATEMENT | 31 |

|

Our nominating and corporate governance committee currently consists of Messrs. Demilio and Rowghani. Our Board of Directors has affirmatively determined that each member of the nominating and corporate governance committee meets applicable independence requirements for membership on a nominating and corporate governance committee in accordance with applicable rules of the NYSE.

Our Board of Directors adopted a written charter for the nominating and corporate governance committee, which is available on the Investor Relations section of our website, which is located at ir.rh.com, by clicking on “Governance.” The nominating and corporate governance committee conducts an annual self-evaluation of its performance, as set forth in its charter.

DIRECTOR NOMINATIONS; COMMUNICATION WITH DIRECTORS

Criteria for Nomination to the Board

In accordance with its charter, the nominating and corporate governance committee will consider candidates submitted by the Company’s shareholders, as well as candidates recommended by directors and leadership, for nomination to our Board of Directors. The nominating and corporate governance committee considers qualifications for the Board of Directors’ membership, which may include:

The highest personal and professional integrity;

Demonstrated exceptional ability and judgment;

Broad experience in business, finance or administration;

Familiarity with the Company’s industry;

Ability to serve the long-term interests of the Company’s shareholders;

Sufficient time available to devote to the affairs of the Company;

Ability to provide continuing service to promote stability and continuity in the boardroom and provide the benefit of familiarity and insight into the Company’s affairs that directors would accumulate during their tenure;

Ability to help the Board of Directors work as a collective body; and

Experience, areas of expertise, as well as other factors relative to the overall composition of the Board of Directors.

The nominating and corporate governance committee also considers such other factors as it deems appropriate, including diversity, the interplay of the candidate’s experience with the experience of other directors, and the extent to which the candidate would be a desirable addition to the Board of Directors and any committees of the Board of Directors. The nominating and corporate governance committee does not assign specific weights to particular criteria and no particular criteria is necessarily applicable to all nominees. The composition of our current Board of Directors includes diversity in the areas of gender, age, ethnicity and business experience.

The nominating and corporate governance committee further reviews and assesses the activities and associations of each candidate to address legal impediments, conflicts of interest, or other considerations that might hinder or prevent service on our Board of Directors. In making its selection, the nominating and corporate governance committee bears in mind that the foremost responsibility of a director of a company is to represent the interests of the shareholders as a whole.

Each director’s individual biography set forth above includes the key individual attributes, experience and skills of each director that led to the conclusion that each director should continue to serve as a member of our Board of Directors at this time, as reflected in the summary above. We believe the range of tenures of our directors creates a synergy between institutional knowledge and new perspectives.

32 | 2024 PROXY STATEMENT |

CORPORATE GOVERNANCE |

|

Shareholder Proposals for Nominees

In accordance with its charter, the nominating and corporate governance committee will consider potential nominees properly submitted by shareholders. Shareholders seeking to do so should provide the information set forth in the nominating and corporate governance committee’s charter regarding director nominations. The nominating and corporate governance committee will apply the same criteria for candidates proposed by shareholders as it does for candidates proposed by leadership or other directors.

To be considered for nomination by the nominating and corporate governance committee at next year’s annual meeting of shareholders, submissions by shareholders must be submitted in writing and must be received by the Corporate Secretary by the deadlines set forth in this proxy statement under “Proposals—Additional Information—Shareholder Proposals for the 2025 Annual Meeting” to ensure adequate time for meaningful consideration by the nominating and corporate governance committee. Each submission must include the following information:

The candidate’s name, age, business address and residence address;

The candidate’s biographical information, including educational information, principal occupation or employment, past work experience (including all positions held during the past five years), personal references, and service on boards of directors or other material positions that the candidate currently holds or has held during the prior three years;

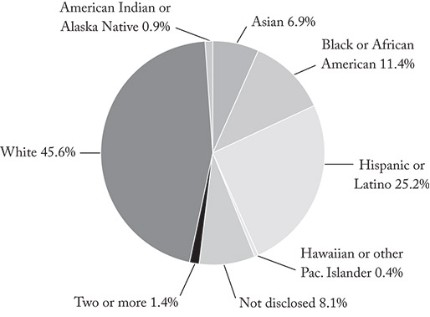

The class and number of shares of the Company which are beneficially owned by the candidate;